Why I Trade ETF Options

Post on: 9 Май, 2015 No Comment

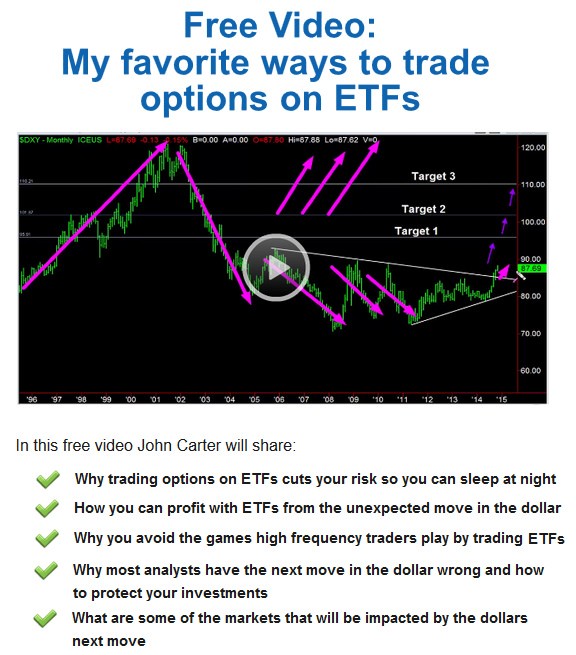

In many of my trades and examples, I’ve chosen to trade ETF options rather than stock or index options. Why?

I have three basic reasons why I prefer them. I’ll get into that in a little bit. Before I do, I want to provide some basic background on ETFs, what they are and how they compare to stocks.

What is an ETF?

First the basics. ETFs, short for Exchange Traded Funds can be thought of as a kind of mutual fund that is traded on a regular stock exchange — just like a stock. On the outside, they seem pretty straightforward but behind the scenes, there is a little bit of complexity that goes into creating and managing an ETF.

An ETF is usually made up of representative stocks held in a trust and managed by large institutions like Merrill Lynch, Vanguard, Barclays, State Street and so on. Like mutual funds, ETFs may represent a bundle of stocks in a given index, sector or asset class. They are often subject to a small management fee similar to mutual funds but usually much smaller.

Unlike mutual funds, ETFs trade like a stock. That means any brokerage where you can trade stocks, you can also trade ETFs. Also, unlike mutual funds, you are not subject to hidden capital gains taxes. Capital gains are calculated based on when you bought the ETF and when you sold it. period.

Here’s the nice part. Like stocks, many ETFs have options. That means I can trade options on the broad market much like trading index options. ETF options usually trade like stock options, which means they are ‘American style’ options that can be assigned at any time, stop trading the third Friday of the month and expire at noon the next day.

So, enough chit chat about the ETFs themselves. To find out more about the details of ETFs and ETF options, check out the following sites.

Three reasons I trade ETF Options

As promised, here are some reasons why I like to trade ETF options. Given time, I could probably think of some more but when I explain to people why I trade them, I usually end up with these three key reasons.

1. ETF options are more diverse than individual stock options

As I mention on my index option page. I have become more of a fan of trading the broad market. While there may be stronger up and down moves on individual stocks, there are less surprises with the indices and ETFs. On the index option page, I’ve also mentioned some of the disadvantages of trading index options, which naturally makes ETF options a great alternative. With ETFs I practically have the ability to trade anything as if it were a stock.

Just to bring it down to earth, let me give some examples. Let’s say I wanted to trade something really broad and diverse. I simply choose to trade the SPY, an ETF representing the S&P 500. Another good broad index is the Russell 2000 — that’s 2000 small cap stocks in this index. I trade the IWM, the ETF that represents the Russell 2000.

What about a sector? Let’s say I want to trade the financial sector. XLF represents stocks in the financial sector. Home builders? That would be the XHB.

What about a commodity like gold, silver or oil? That would be GLD, SLV or USO.

How about emerging markets? Or, what about a specific emerging country? EEM represents a basket of stocks for all emerging markets. EWZ (an ETF who’s options I’ve traded) represents just a basket of Brazilian stocks.

There are new ETFs being created practically every day. It isn’t difficult to find one to represent an asset class I’m interested trading. The trick is finding one that meets my criteria for trading options on it. More on this later.

2. Many ETFs and their options trade large volumes

Many, but not all ETFs trade in high volumes. This is particularly true of the ETFs that represent broad market indices. More and more institutions, as well as retail traders are becoming interested in trading them. As a result, many ETFs trade at volumes equal to and greater that some of the most popular stocks.

Given that the ETF itself trades high volumes, the options are often traded in large volumes as well. This can be determined by looking at the open interest for any given strike in a given month. Large open interest translates to highly liquid, which means really tight bid/ask spreads and good fills.

What I mean by good fills is that when I set an order price right between the bid and the ask, I often get filled fairly quickly. When large numbers of options are traded at any given time, market makers are often motivated to take my offer simply to get my order out of the way so they can take larger orders — a good reason to make sure my order size is a very small percentage of the open interest.

3. ETF options often trade in $1 strike increments

One of my favorite features of trading ETF options is that they often trade in $1 wide strike increments, regardless of the price of the underlying.

I didn’t notice this as much when I was trading stock options more regularly. However a friend and I were recently considering a spread trade on AAPL. If you’ve been following my trade of the week tutorials or read the vertical spread strategy pages, you know I like to sell the short strike with a probability of success between 60% and 70%, which means I need to find a strike with a probability of expiring in the money of 30%-40%. And I typically prefer 30%-35% if I can get it.

What I found looking at the option chain for AAPL is that with $5 strike increments, it was difficult to find a strike I wanted. One was too high of a probability and the next one was too low. It made me realize I hadn’t really had that problem with ETF options because most of the ones I trade are $1 increments. It’s pretty easy to find just the one I want.

Risks of trading ETFs

As with any trading vehicle, ETFs and ETF options pose some risks and it’s important to be aware of and manage them.

One risk is the the same as trading any mutual fund, index or even a stock. The market can turn and I can loose money. The nice thing about ETFs is that, just like a stock, I can set stops and limits and be out immediately. The same goes for options on the ETF.

The main risk I think about when considering ETFs is that I don’t know the exact mechanics of that ETF in terms of how it is valued and how it behaves relative to the basket of assets it represents. This can affect the results of an option trade based on that particular ETF.

Another thing to be aware of is that some of the reverse ETFs and leveraged ETFs can behave unexpectedly. The combination of leverage on the ETF plus leverage on the options can drain your trading account.

The main way to overcome or manage these risks is to be well educated on the ETF you are trading. Every ETF has a prospectus, much like a mutual fund so it’s pretty easy to research the ETF to determine if it is one worth trading. Additionally, it is a good idea to spend some time following the ETF and perhaps paper trading with it before going ‘live’.

Finding an ETF to trade

I have my favorite ETFs that I like to trade and I use them over and over again, regardless of the direction they are moving. If you are just starting out, you may be wondering where to find ETFs that make good option trading candidates. Here are some basic steps to take.

- Research — use the websites I’ll list at the end of this page to locate good ETFs. In addition, you may find your broker provides some good research tools as well. Make sure to know things like what comprises the ETF, what management costs are, and how it is valued

- Eliminate ETFs that trade lower volumes — By lower volume, I’d say anything that trades less than about 1 million shares/day (average) is too low.

- Eliminate ETFs where the front month option open interest is low — By too low, I mean that the open interest should be large enough that an your order makes up only a small percentage

- Monitor broad index trends as well as sector trends — know what sectors are relatively weak and which are relatively strong

- Begin trading just a few — Start with broad index ETF options like SPY, DIA and QQQQ, get to know them and slowly add to the list a few at a time. You don’t need too many — just a few you know really well

Finally, here are a list of good websites that can be used to research ETFs. Remember to make sure you not only know what index, sector or asset class it represents but how it behaves.