Why Expense Ratio Matters (A Lot)

Post on: 9 Июль, 2015 No Comment

At last count there are about 23,000 mutual funds and exchange traded funds (ETFs) available to investors in the U.S. Picking from among them for your portfolio can seem daunting. Do you pay attention to past performance? fund management? or something else to find a suitable growth vehicle for your money?

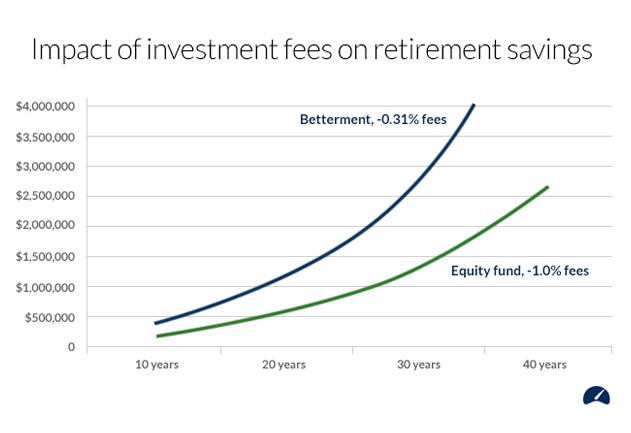

When picking funds, all else being equal (i.e. youve already decided on an asset class and investment account), the most important factor for actual returns is expense ratio. This is the annual fund operating expenses fee charged as a percentage of invested amounts in the fund.

Lets look at how this affects your portfolio in detail.

Tale of Two Expense Ratios

Consider two funds, one with an expense ratio of 0.82% and another 1.44% [1]. Its easy to be lulled into thinking that theres not much difference between these funds. After all, whats 0.6%? But theres a bit of insidious math going on here. Keep in mind that funds take a percentage of all your money invested regardless of performance. So if you invested $10k but the fund is down 10% after one year, theyll still take their chunk of the balance.

Its one of those rare places in business where you can do badly and still get paid. Moreover, because they take this portion from your portfolio every year, it limits potential growth of your money over time. Lets show how this (negative) compounding ruins your portfolios growth. Consider the growth of $10,000 invested in these two funds, with expense ratios 0.82% and 1.44%, at 9.8% with all other factors remaining the same [2].

0.62% = $22,000

As you can see, in 30 years, the less expensive fund values at an extra $22,000, which is more than two times the principal!

According to the ICI Factbook. asset-weighted expense ratios across the mutual fund industry are about 1%. We also know from the US Federal Reserve Survey of Consumer Finances that the median U.S. family had about $95,000 of investable assets. That means on average, the median American family pays almost $1000 in fund fees a year. If the median family had instead invested mostly in index funds with the lowest expense ratios, how much would they have saved?

I used VTSMX (expense ratio 0.18%) and SPY (expense ratio 0.09%) as two options for cheap index funds. In these cases, the investor would have saved $771 and $856 respectively per year. If you find yourself asking but what about performance?, a quick note: Morningstar found that the best predictor of future performance is you guessed it, low fees. Read more about it here .

I started by saying that expense ratio fees are important when youve already decided on a particular asset class or have an idea of how you want to tax-optimize your investments across your taxable and tax-sheltered accounts (e.g. Roth IRAs and 401ks). Clearly, asset allocation and tax-efficiency are key parts of building a portfolio that matches your situation and investment time horizon. Well save these subjects, and other fee factors like turnover and load, to tackle another day.

Citations:

[1] 0.82% is the 10th percentile expense ratio and 1.44% is the median expense ratio for equity funds. Figure 5.5, 2010 ICI Fact Book.

[2] 9.8% growth based on historical data from Ibbotson Associates, Stocks, Bonds, Bills, and Inflation 2010 Year-book (Chicago: Ibbotson Associates, 2009)

This is a guest post by Jon Xu, who is co-founder at FutureAdvisor. a web service that provides unbiased analysis & recommendations to save money on your investment portfolio. Jon last wrote about the importance of rebalancing your portfolio and they recently rolled out a new tool to help you search for low-fee funds .