Why Dollar Cost Averaging is Popular

Post on: 16 Март, 2015 No Comment

Why Dollar Cost Averaging is Popular

Sometimes topics crop up in the PF blogosphere, seemingly out of nowhere, and rattle around from blog to blog for a while. Dollar cost averaging is a recent example. The Digerati Life brought it up on September 23, Lazy Man and Money responded the next day, and The Suns Financial Diary shared its thoughts on the 28th. There are probably several other mentions out there I missed.

Before I add my voice to the echo chamber, Ill define the term. Dollar cost averaging refers to buying an investment, usually a stock or stock fund, over time in installments of equal dollar value.

It is often confused with the laudable and similar idea of regularly saving. Setting aside a certain amount of your pay every week or month may look like dollar cost averaging, but its not exactly the same thing.  Implicit in the question is dollar cost averaging a good idea is the premise that there is an alternative, that you could have invested it all at once rather than slowly as you earned it.

In its purest form, the question of the wisdom of dollar cost averaging boils down to the following hypothetical. Imagine you have $12,000 you wish to invest in the stock market. Do you put it all in now or do you put in $1,000 a month for 12 months?

Assuming that your goal is to maximize your expected return (a fairly safe assumption) and that having that $12,000 in the market is the right thing for you to do (more of a leap, but its a premise of the question) then you should put all the money in the market now. Dribbling it out over the next year will only reduce your returns if the market has a tendency to go up, and if it didnt have a tendency to go up, why would you want to invest in it at all?

Put another way, the dollar cost averaging choice is between buying at todays price and buying at the average price over the next year. If you think the market is more likely to go up than down, you must also believe that todays price is more likely to be lower than the average price over the next year. This isnt really all that subtle or complicated.

And yet dollar cost averaging enjoys widespread popularity. Partly, this may be confusion with the wholesome idea of sticking with a regular savings plan, something which deserves to enjoy widespread popularity.

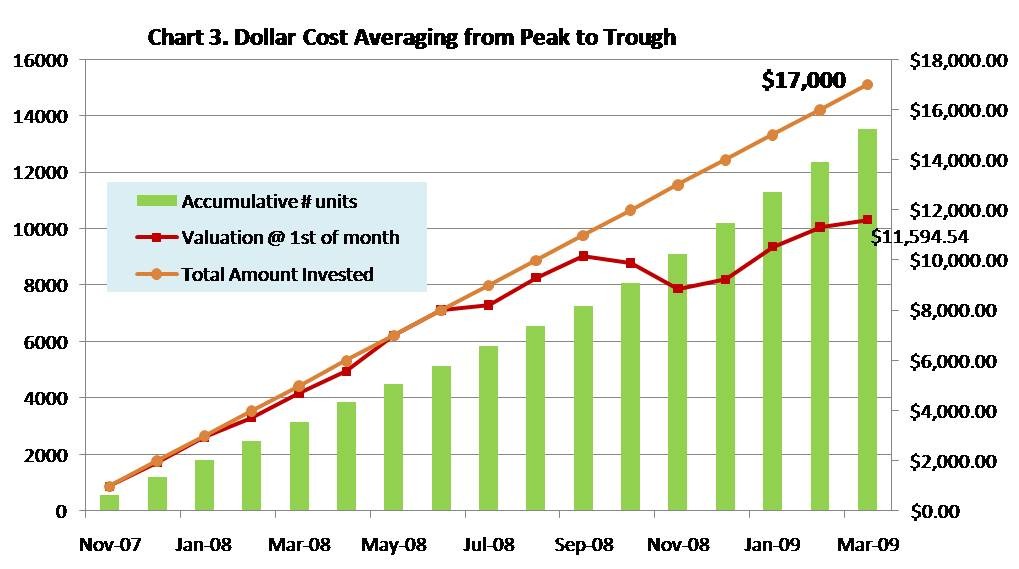

Further, as SVB at Digerati Life tells us, weve just finished a year in which the average price of the market was a lot lower than the year-ago price, which was, as it happens, approximately todays price as well. So maybe the reason dollar cost averaging has arisen as a hot topic just now is not such a mystery. SVB cites an example recently provided by Wells Fargo, an outfit obviously interested in inspiring regular investments.

But there is more to the appeal of dollar cost averaging than short-term hindsight and marketing hype. There is some interesting psychology. As Ken French (hes a really important finance professor, trust me) explains in this video. people like dollar cost averaging because it makes them feel better, or at least maximizes their likelihood of feeling better.

Folks feel worse about buying something that goes down than they do about not buying something that goes up. Irrational, but true. So the missed opportunity of maximizing gains by not investing all $12,000 at the start is not so important when compared to the fear the market might go down after the $12,000 is invested. The appeal of dollar cost averaging is that each investment that could possibly be regretted later is reduced in size and made pseudo-automatic so the investor feels less specific responsibility. And, after a year, it is likely that the investor will have at least a few investments to feel positive about, even if the overall average is a loss.

But, as with all investment questions, the bottom line is the bottom line. The goal for your investment portfolio should not be to make you feel happy about how smart you are, it should be to provide for your retirement. Professor French discusses this as an interesting behavioral finance finding, rather than yet another example of emotions conquering logic and costing people money. But that is exactly what it is.

Investing. PF Blogs | Frank Curmudgeon | October 5, 2009 11:59 am