Why Dollar Cost Averaging is an Effective Investment Strategy

Post on: 13 Август, 2015 No Comment

Why Dollar Cost Averaging is an Effective Investment Strategy

by John Kiernan on March 17, 2011

All investors should have a system they use to approach investing. The ultimate goal of this system is to help the investor effectively make consistent investing decisions without being tossed to and fro by market conditions.

People who suffer the greatest investing losses are those who are constantly getting in and out of ‘hot’ stocks and those who buy and sell according to the dips and spikes of the market. Not only is this approach less-than-profitable, it is also stressful and time consuming.

An alternative option is to accept a systematic approach to investing. One such approach is called dollar cost averaging (DCA). DCA is a stress-free, effective way to invest in the market.

How Does Dollar Cost Averaging Work?

The process is amazingly simple. You invest the same amount of money at regular intervals.

John Doe might decide to invest $150 on the first of every month. Jane Doe could invest $75 every Monday. Once they have decided in what they will invest, the only remaining decisions that a person must make are how much and how often.

Here’s an example of how it works:

Month #1: Your stock costs $30 per share. Your $150 would buy 5 shares.

Month #2: The price drops to $28 per share. Your $150 would buy 5.38 shares.

Month #3: The price jumps to $31 per share. Your $150 would buy 4.84 shares.

At the end of the third month, you would own 15.22 shares worth $471.82.

Compare that to a person who bought $450 worth of shares on month #1. They would have bought 15 shares which would now be worth $465.

Of course, you will use DCA over years rather than months, but this illustrates how dollar cost averaging can be an effective strategy.

If you want to see the impact of dollar cost averaging and compare it to lump-sum investing over the long term, you can play around with the DCA calculator in this post .

Is DCA an effective investment strategy?

As we all know, markets go up and markets go down. The tremendous advantage of DCA is that when markets are down, you purchase more stock, and when markets are up, you purchase less stock. Thus, this system is in line with the traditional advice to buy low and sell high. In fact, you’re buying more low, and buying less high.

4 Reasons Why Dollar Cost Averaging is a Solid Strategy that Works Well for Most Investors

- Dollar Cost Averaging is a Stress-Free Strategy

Many companies, banks, and investment brokerages will allow you to set up automatic transfers, withdrawals, and deposits. In fact, some 401(k) plans require a regular monthly contribution. This makes the process of investing extremely convenient. In addition, you never have to pay attention to the ebb and flow of the market or stress yourself out trying to decide if it’s a good time to invest or not.

If you plan to invest $5,000 into your retirement account one year, there is probably a good chance that on January 1st you don’t have a $5,000 check. However, you are more likely to be able to get $416.66 that month. As you get paid, you simply remove a portion out of your paycheck and invest it towards retirement.

A couple of years ago, when the market conditions looked so weak, many investors found they did not have the stomach to stay invested. So they sold out with a loss. However, a DCA strategy will help you benefit from each market downturn. As the market gets worse, you know you can pick up more shares. There is no more guessing about when the market will or won’t turn around. Every month that the market experiences another dip, you’ll be there to buy more shares. As the Wall Street Journal points out. using DCA when the market is falling is a very good strategy.

Most mutual fund companies have minimum investment amounts. However, if you are willing to automatically add a set number of dollars each month, then they will reduce the minimum needed to invest. For example, a mutual fund might have a $5,000 minimum investment amount. However, if you set up a monthly $100 contribution, the minimum investment necessary would be reduced to $2,000.

2 Potential Disadvantages of Dollar Cost Averaging

If you are going to do DCA investing, you need to be sure you are with a broker that does not charge fees per transaction. Typically, if you invest directly with the company that owns the index fund or mutual fund, you won’t pay fees. However, if you use a third party or purchase stocks, you may be charged a fee per transaction.

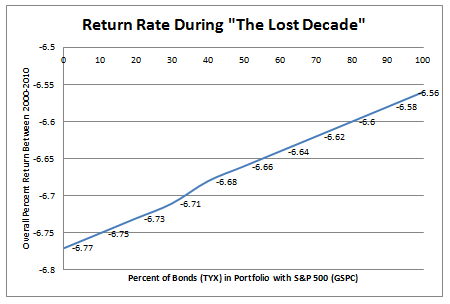

Since the market does typically increase in value, one might see better returns if they invest in lump sums as early as possible. In fact, this study that first appeared in the Journal of Financial Planning compares lump sum investing to dollar cost averaging. You can see the results below:

Of course, the simple translation is that more often than not lump-sum investing outperformed DCA. While lump-sum investing may increase your returns, it is also a more risky way to invest when compared to dollar cost averaging.

Overall, for most investors, dollar cost averaging will prove to be a very effective strategy.