Why does the Dow matter Yahoo Finance UK

Post on: 16 Март, 2015 No Comment

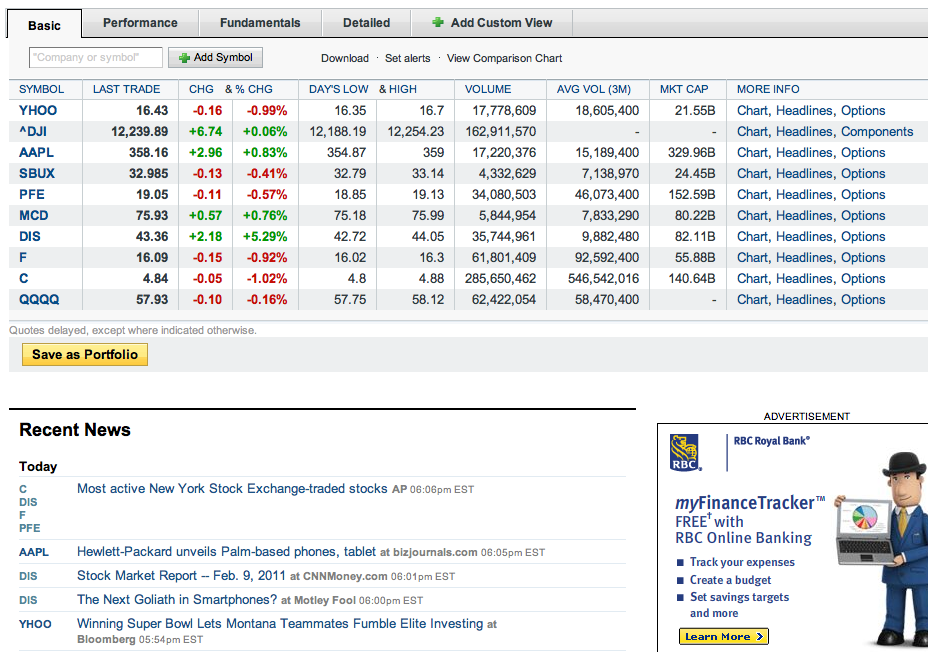

RELATED QUOTES

The Dow Jones has broken through its pre-crisis peak to hit an all-time high. Why should you care?

Some argue that with only 30 companies. the Dow — full name Dow Jones Industrial Average — does not deserve its place as the most important financial barometer in the world.

Indeed, critics can point to a catalogue of flaws and anachronisms they say undermine the index as a financially important measure.

One gripe is its opaque admission criteria. When Charles Dow created the index in the 19th century, he set out to pinpoint those companies which he thought formed the backbone of the US economy, an ideal his successors aim to maintain. Unlike most indices, which group companies based on market capitalisation, the Dow’s constituents are hand-picked by committee with the purpose of creating a representative microcosm of US business, in a process the people at Dow describe as discretionary and subjective.

And while it counts among its constituents some of the most highly capitalised companies on the planet, including the world’s largest listed firm, Exxon Mobil, it conspicuously omits tech giants Apple (NasdaqGS: AAPL — news ) and Google (NasdaqGS: GOOG — news ).

The reason for leaving the Silicon Valley titans out in the cold, it said. was because they trade at too high a price.

The Dow is price-weighted, meaning companies with more expensive shares have disproportionate influence over the index, bringing with them unwelcome volatility. Many argue this methodology — which dates back to the Dow’s establishment in 1896 — is archaic and could easily be overhauled. But the people at Dow counter they are taking a longer view, boasting that their index has tracked 23 business cycles in its 116-year history.

Not to mention the deception of the Dow’s name. Its value is not the actual average of the prices of its component stocks but rather the total value divided by a determined figure — the so-called Dow Divisor — which changes with stock splits or dividends to maintain consistency.

But despite such a list of shortcomings, the Dow has confounded critics by correlating with wider markets rather successfully. In the three years to 2012 its rises and falls coincided with movements in the total stock market index more than 95pc of the time.

You could be forgiven for thinking the two five-year share charts below are identical- but one, the Wilshire 5000, tracks all 4,000-odd equities traded in the US. The other is the super-selective Dow.

Dow Jones Industrial Average five-year price chart. Source: Bloomberg

Wilshire 5000 five-year price chart. Source: Bloomberg

The Dow has also pre-empted movements in other indices. It has historically begun to decline for extended periods before the more speculative Nasdaq index, a pattern which occurred in the stock market downturns that began in April of 1998, January of 2000, December of 2001, January of 2004, December of 2004, and October of 2007.

Like it or not, the Dow is likely to continue as an economic bellwether for some time.

= The Dow Jones Industrial Average: A brief history =

May 26, 1896. The Dow Jones industrial average makes its debut, consisting of the stocks of 12 companies: American Cotton Oil, American Sugar Refining Co, American Tobacco, Chicago Gas, Distilling & Cattle Feeding Co, General Electric Co, Laclede Gas Light Co, National Lead, North American Co, Tennessee Coal, Iron & Railroad Co, US. Leather (preferred) and U.S. Rubber. Of the original 12, only GE remains in the average.

Nov. 7, 1907. A buyout of Tennessee Coal, Iron and Railroad Co by U.S. Steel is completed, marking the only instance in which two current constituents of the Dow combine. General Electric (Other OTC: GEAPP — news ) replaces Tennessee Coal after having been removed twice from the average.

1916. The industrial average expands to 20 stocks. It was expanded again in 1928, to 30, where it still stands.

1928. The Dow begins being calculated with a special divisor rather than simply dividing by the number of stocks. This is to avoid distortions when constituent companies split their shares or when one stock is substituted for another. The index, though, is still called the average.

Oct (KOSDAQ: 039200.KQ — news ). 28-29, 1929. The Dow falls 23pc over the two days in the market’s most-known crash. The 12.8pc fall on Oct. 28 marks the average’s second-worst daily percentage loss in its history. Oct. 19, 1987, stands as the worst. On Oct. 29 1929, the Dow fell another 11.7pc. The days are known as Black Monday and Black Tuesday.

Nov. 14, 1972. Dow posts first close above 1,000.

Oct. 30, 1985. McDonald’s Corp added to the Dow.

Oct. 19, 1987. The Dow posts its worst daily percentage loss in its history, closing down 22.6pc, or 508 points. The one-day crash, known as Black Monday. follows a bull run from a trough of 776.92 in August 1982 to a peak of 2722.22 in August of 1987.

March 29, 1999. The Dow first closes above 10,000.

Nov. 1, 1999. Microsoft Corp. and Intel Corp. are added. They mark the first Nasdaq-listed stocks to join the Dow, representing the growing importance of computers and the Internet to the US economy.

Sept. 17, 2001. The US stock market re-opens for the first time since the Sept. 11, 2001 terror attacks in New York and Washington. The Dow posts its third-worst daily point loss, sinking 684.81 points, or 7.13pc.

July 19, 2007. The Dow closes above 14,000 for the first time.

Oct. 9, 2007. All-time closing high of 14,164.53.

Sept. 29, 2008. The Dow posts its worst daily point loss. Dow ended down 777.68 points, or 6.98pc. The move coincided with the collapse that month of Lehman Brothers and the spread of the 2008-2009 financial crisis.

Oct. 13, 2008. The Dow registers biggest daily percentage gain of 11.08pc.

June 8, 2009. General Motors (NYSE: GM — news ). once the nation’s leading car manufacturer, is removed from the Dow after it is forced to enter bankruptcy.

May 6, 2010. The Dow falls 1,010.14 points from its intraday high in a quick afternoon tumble tied to a computer-driven trading glitch — an event known as the flash crash. The Dow recovered by day’s end to close down 347.80 points, which was still its worst percentage decline since April 2009.

March 5, 2013. The Dow sets a new record high.

Sources: S&P Dow Jones Indices and Thomson Reuters data.