Why Does Diversification Matter

Post on: 2 Май, 2015 No Comment

Share

The secular decline in bond yields starting in late 1981 combined with long, smooth business cycles enabled equity markets to have an annual return through June of this year of roughly 11.8 percent. Now fixed income markets during that same time period yields about 8.5 percent but with much less volatility. So what that meant for one is that it didn’t matter too much what their asset allocation looked like during this period or their mix between stocks and bonds. But, rather, as long as they were invested, it meant they were likely to meet their modest growth target of seven to eight percent.

However, since the global financial crisis the macroeconomic environment has changed significantly. Globally, central banks have had to get more creative. What you’ve seen is them pump liquidity into markets in order to try to influence economic growth.

This has had the impact of a very low market volatility environment. However, we believe that it’s likely that normal levels of volatility will be reintroduced to markets and challenge investors.

One must, therefore, consider the relationship or correlation between stocks and bonds in the current environment and then evaluate their portfolios in this context to see if their portfolios are properly positioned in order to achieve their investment goals.

For example, in the 1990s, both stock and bond markets moved together. However, it wasn’t a problem for investors because both markets were generally upward trending. However, more recently what you’ve seen is, again, stock and bond markets start to move again in the same direction. However, unlike the 1990s, you had experiences like the taper tantrum in the spring of 2013 where both markets moved together but downward. Now what is the implication if that’s the type of period that we see going forward?

2:08

Given the uncertainty of the current market environment, we believe that a specific absolute return and volatility objective will help investors achieve the growth they need but with a level of risk that they’ll find tolerable.

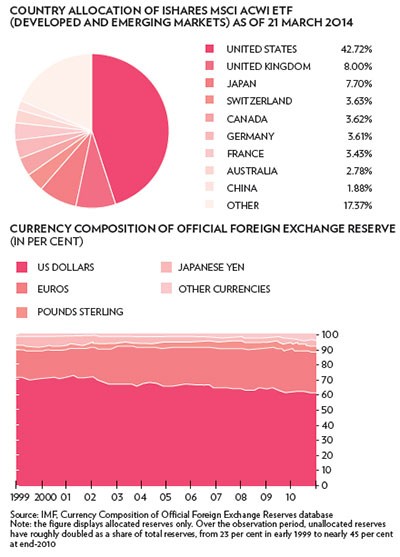

We believe that it’s best to achieve diversification by taking away traditional asset class labels like stocks and bonds and, instead, looking across asset classes, across currencies, geographies and even sectors for good, long term investment ideas.

We then combine the ideas into a single portfolio seeking to provide a targeted return objective of three month treasuries plus five percent annually over a three year rolling period but with a target risk objective of less than half the volatility of global equities over the same three year period. Most importantly, we’re looking to achieve this independent of the direction of traditional stock and bond markets.

For more information on the Invesco global targeted return strategy please contact your Invesco relationship manager.

Important Information

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The investment techniques and risk analysis used by the portfolio managers may not produce the desired results.

The strategy uses investment techniques such as derivatives, leverage, and short sales, which may increase portfolio volatility.

The strategy seeks diversification through exposure to different asset classes. However, because of its concentration in cash or near-cash as cover for derivatives exposure the strategy is classified is non-diversified by the SEC.

Correlation indicates the degree to which two investments have historically moved in the same direction and magnitude. Standard deviation measures a fund’s range of total returns and identifies the spread of a fund’s short-term fluctuations.

Invesco Advisers, Inc. is an investment adviser; it provides investment advisory services to individual and institutional clients and does not sell securities. Invesco Distributors, Inc. is the U.S. distributor for Invesco Ltd. Both are wholly owned, indirect subsidiaries of Invesco Ltd.

The opinions expressed are those of the speaker, are based on current market conditions as of 9/30/14 and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

12/14 11257 invesco.com/us