Why companies are raising their dividends

Post on: 26 Май, 2015 No Comment

Why companies are raising their dividends

data-share-img= data-share=twitter,facebook,linkedin,reddit,google data-share-count=true>

Matt Yglesias presents the case against dividends today and its a case Im sympathetic to. But before you can determine whether stocks should be paying dividends, its important to understand why stocks are paying these dividends. And the answer is in the chart above.

The blue line, in this chart, US after-tax corporate profits as a share of GDP and it shows that theyre at an all-time high of around 11%, when theyre normally closer to 6%. This is the chart which should worry anybody invested in the stock market: while the markets price-to-earnings ratio still seems pretty sane, thats only because corporate earnings are much higher than theyve ever been in the past. If this number starts reverting back towards its historical mean, then stock prices are certain to fall, possibly quite sharply.

What investors are looking for, then, is reassurance that the impressive profits theyre seeing today are here to stay, rather than being some kind of historical anomaly. And so thats also the message that CEOs are seeking to send to their shareholders.

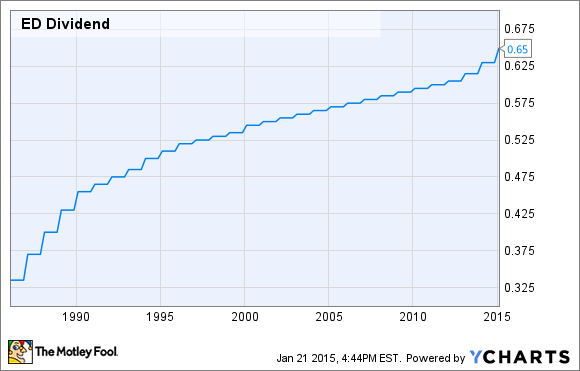

Its here that dividends start being a lot more attractive than stock buybacks. Its exactly the same reason that youd much rather get a thousand-dollar raise than a thousand-dollar bonus. Dividends arent bond coupons: they can go down, if they have to and, in hard times, you can be sure that they will go down. But in general, no company will set a dividend this year which it doesnt think it can meet next year, and the year after that, and the year after that. A dividend is a company telling the market that the cash its throwing off today isnt some kind of exceptional good fortune, but is rather something that shareholders should get used to, year in and year out for as far as the eye can see.

And that is a message which is much more supportive of a stock price than any stock buyback. (Especially since buybacks are easy to announce, and very few people bother to check whether the companies which announced them actually followed through on their promise.)

If youre going to return a certain amount of cash to shareholders, then there are lots of reasons why it makes sense to do that with a buyback rather than through a dividend payment. But once a buyback is over, its over. A dividend is much more predictable than a buyback program; whats more, its often something which grows predictably, as well. (AT&T has been raising its dividends every year for 30 years.) In a low interest rate environment, a permanently-increasing income stream, even if it only increases in line with inflation, is worth a small fortune .

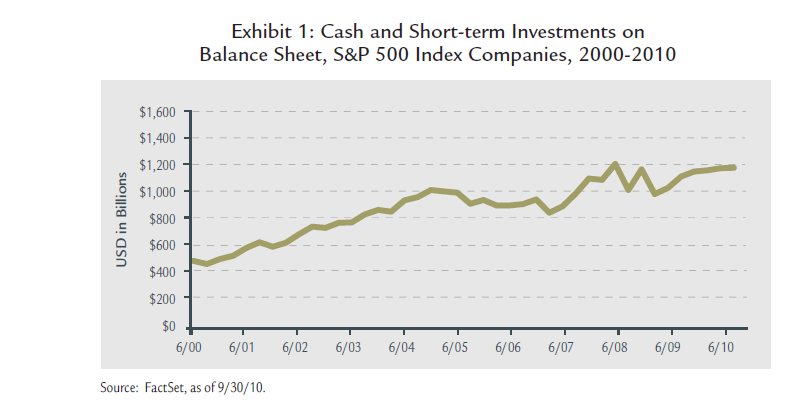

When a company earns profits, there are lots of things it can do with the money. It can hold on to the profits as a cash balance; it can spend that cash buying back its own stock; it can pay that cash out as a dividend; it can give its employees raises, or bonuses; it can reinvest the money in R&D or other capital expenditure; it can acquire other companies; and so on and so forth. But if you invest your money in employees or capex instead of using it for dividends or buybacks, then that reduces your profits which in general is bad for your share price.

There are exceptions to the rule, or course Amazon is a great example of a company with a stratospheric share price, and p/e ratio, despite (or because of) its lack of visible profits. But then again, it was none other than Matt Yglesias who described Amazon as a charitable organization being run by elements of the investment community for the benefit of consumers. He cant really have it both ways. And in any event, if you want to keep your profits high, and send a message to the market that theyre going to stay that way, then it makes a certain amount of sense to boost your dividend.