Why Bernanke s Quantitative Easing Loathsome to Many Actually Boosts the Stock Market

Post on: 29 Май, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

The Federal Reserve wasn’t supposed to be the sole determiner of policies to end economic recession, but an impotent Congress pretty much ceded the job. With Congress barely able to order lunch without inciting gridlock, Fed Chairman Ben Bernanke has played an outsized role in deciding how to create jobs and growth in an economy with too little of either. And while many on Wall Street despise the bold and unconventional steps he’s taken to right the ship, there are reasons that anyone who invests in stocks should be sorry to see him go.

Certainly, many would cheer his exit. Bernanke’s quantitative easing plan (the QEs), in which the Fed has bought massive amounts of financial assets to increase their value, offends conservatives both in the audacity of its market interference and its potential for fueling inflation. It has turned Bernanke, a Republican and a George W. Bush appointee, into a Republican target. Mitt Romney, who supported Bernanke back in 2010, now says he would throw him out.

Yet anyone who has owned stocks in the past few years has fed at the trough of Bernanke. Since 2009, Bernanke’s hints and promises that the Fed would DO SOMETHING have created more than a few good days on Wall Street. Quantifying a stock market rise due to quantitative easing is impossible (too many variables affect stock prices), but Bernanke and his critics agree that the QE actions caused stock prices to rise.

Note those upswings after Fed intervention announcements in November 2008, March 2009 and November 2010. The latest was Aug. 31, when Bernanke basically said he won’t hesitate to initiate QE3 if things don’t pick up.

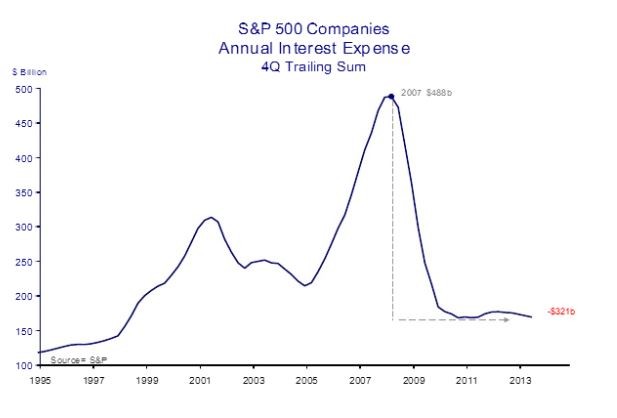

Bernanke argues that pumping money into the system has kept the economy from falling into deeper recession. In theory, quantitative easing spurs borrowing by companies that use it to create jobs; say, to build a new plant that needs workers. Or individuals borrow more and have more money to spend, which fuels economic growth generally. (Cost isn’t the biggest issue. The Fed often makes money on the transactions.) The expectation is that Bernanke will continue buying sprees until the economy is healthy enough to prop up markets and jobs alone, although even sympathetic economists are beginning to question how much more QE can help. A disappointing jobs report published since his reiteration of this policy makes everyone believe that QE-continuing is certain.

Four years in, the strategy has definitely lowered the cost of borrowing without sparking inflation or lowering the value of the dollar. (Another concern from critics.) But it obviously didn’t create enough jobs. In fact, companies like banks that used their newfound liquidity for acquisitions often cut jobs, which almost offset actual job creation.

No so good for the U.S. unemployment rate. Employment gains at growth companies like Amazon (AMZN ) and Salesforce.com (CRM ) can’t offset losses at troubled outfits like Hewlett-Packard (HPQ ) and Citigroup (C ).