Why Apple shares are dirt cheap

Post on: 1 Май, 2015 No Comment

Ahead of Apple’s earnings, the numbers tell it all: If shares don’t soar after its quarterly report, it will likely trade at valuation levels not seen since the depths of the financial crisis, making it the cheapest large-cap tech stock.

As Apple prepares to report its fiscal second quarter results after the bell on Wednesday, a huge question on investors’ minds is whether or not the stock’s multi-year run will finally come to end. While nothing is certain, there is good reason to believe the bearishness in Apple is over, and that a new powerful rally is looming on the horizon.

If Apple is trading anywhere near the current price level come Thursday morning, the stock will become just as undervalued as it was during the financial crisis. Why? Because unless Apple’s stock absolutely skyrockets over the next few trading sessions, its trailing price-to-earnings ratio currently at 18.5 is going to significantly contract due to the near 100% rise in quarterly earnings expected out of the company tomorrow. For an in-depth preview of what to expect out of Apple’s upcoming earnings, see Philip Elmer-DeWitt’s exhaustive earnings preview .

Based on a poll taken from top analysts who have near perfect accuracy in projecting Apple’s quarterly earnings, Apple’s trailing 12-month earnings per share is expected to rise from the current level of $17.92 to nearly $21.00 this week. This means that in order for Apple AAPL to maintain its already depressed P/E ratio, the stock would have to rise to $388.50 by Thursday. And that would only keep the stock trading at an 18.5 P/E ratio, which happens to be at the lowest end of its historical two-year range.

And if the stock doesn’t move up at all or moves down on earnings, Apple’s trailing P/E ratio will drop below 15.8 the lowest level since the market’s March 2009 lows. This is exactly what makes tomorrow’s earnings one for the books. Either Apple’s stock will have to jump by more than $55 to keep its already miserable P/E ratio in tact, or the stock will likely fall to its lowest valuation since the depths of the financial crisis.

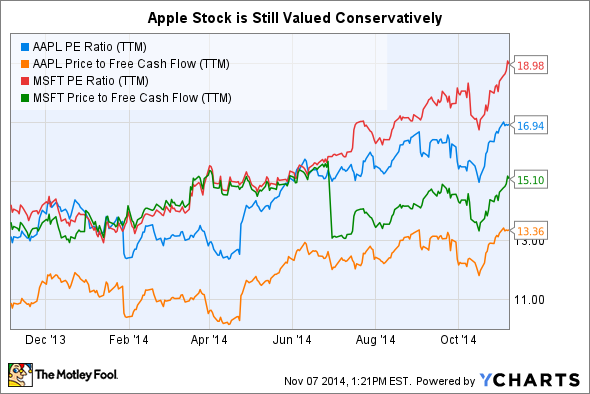

According to my colleague, Apple analyst Horace Dediu, who maintains a technology blog called Asymco. “On a growth-adjusted basis, Apple’s P/E ratio is well within depression levels.” As his chart above indicates, Apple normally trades between an 18 and 24 trailing P/E ratio. Only during the lows of the financial crisis, when the stock was outrageously undervalued after funds indiscriminately liquidated their equity positions, did we see Apple’s P/E briefly drop into the 12-17 range.

In fact, on a valuation basis, if one is able to buy Apple at $320-$330 a share on Thursday morning, it will be the equivalent of buying the stock for about $100 around March 2009. Yet, even though Apple is trading at less than half of its expected five-year growth rate, one could always ask: why does the historical range even matter? Why does Apple’s stock have to trade in its historical range of 18-24? Why shouldn’t it trade between 10-15 like Microsoft MSFT. Cisco CSCO. Intel INTC or IBM IBM ?

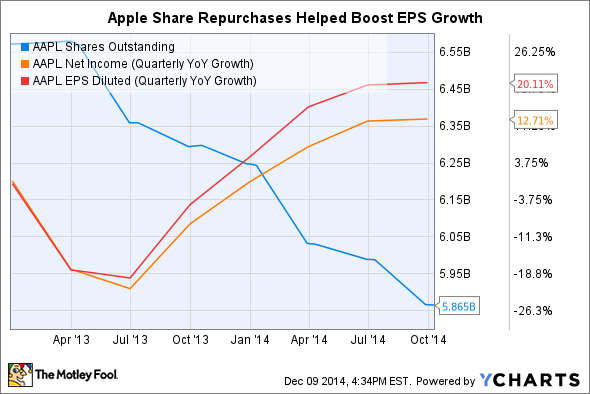

The fundamental difference between other large cap tech stocks and Apple is Apple’s unique cash generating abilities, its cash position, and its extraordinary 70% growth. Apple trades at a lower cash multiple than any other large cap tech stock and has more net cash on the balance sheet than any other company in the S&P 500. At a $305 billion market capitalization, Apple trades at only five times its cash. Remove that cash from its market capitalization, and Apple trades at only a $245 billion enterprise value, or $268 a share that’s only 14 times earnings.

But even more impressive is Apple’s ability to generate cash. In the last four fiscal quarters alone, Apple’s total cash rose 50% from $39.8 billion to $60 billion a jump from $43.26 in cash per share to $64 in cash per share. Based on very realistic projections, Apple will probably end the year with $81 billion in cash, or $86 in cash per share. For the 2012 fiscal year, it will likely post at least $120 billion in cash or $125 in cash per share.

In fact, it is very likely that Apple will have more cash than its current market capitalization in less than five years. Once Wall Street begins to catch on to this reality, Apple shares should see a major upside correction. And this is precisely why Apple shouldn’t trade below a 20 P/E ratio over the next several years.

In fact, if Apple traded between a 10-15 trailing P/E ratio, it would almost immediately become a buyout candidate. On CNBC’s Fast Money, host Guy Adami has mentioned on several occasions over the past month that he thinks that Apple could trade down to $270-$280 a share this fall. The most reputable Apple analysts all expect it to report at least $27 per share in earnings for the 2011 fiscal year, which ends in October. If Apple is trading at $270 a share in November, as Adami predicts, and the analysts are right, it would be trading at a mere 10 times trailing earnings.

This doesn’t seem like a big deal until one considers Apple’s cash, cash generation, market capitalization and forward earnings expectations. At $270 a share, Apple’s market capitalization would be $248.7 billion. Yet, after backing out Apple’s $81 billion in cash, the company would trade at an enterprise value of $167.7 billion theoretically, the price it would take to buy the company outright. This compares to Microsoft’s $180 billion enterprise value.

But Apple not only posts nearly double Microsoft’s revenues, it also grows at a pace that is three to four times that of Microsoft’s and it has four times Microsoft’s cash generating abilities. Apple would also trade near Google’s GOOG enterprise value despite recording more than four times its revenues and having four to five times more cash than Google not to mention that it far outpaces Google’s 17% growth.

However, that isn’t even the most important reason why Apple wont likely trade down to $270-$280 a share come November. With shares at that level, Apple probably wouldn’t be listed on any stock exchange except SharesPost. With the company producing nearly $50 billion in cash per year, a leveraged buyout of Apple at $200 billion a premium to its $167 billion enterprise value would pay itself off in 3-4 years at most. Who wouldn’t take that opportunity? In fact, Apple would be remiss not to take itself private if it trades anywhere near $270 a share in November.

It’s clear that Apple should trade at a P/E ratio somewhere between 18 and 22, with a 20 P/E being where it’s appropriately valued. In the short-term, it may take time for some on Wall Street to grasp the recent outright supernova in Apple’s cash generation which is up nearly 20% last quarter alone in the end, Apple tends to gravitate towards fair value. I suspect that once Wall Street sees the cash growth in Apple’s fiscal second and third quarter, we’ll start to see another significant run-up in the stock price.

Based on my expectations of Apple recording $27.30 in EPS on $111.7 billion in revenue for fiscal 2011, Apple should trade well into $500 a share sometime between October and December this year. That is up from my previous price target of $400 share that I published this past August. For the short term, expect Apple to trade up quite significantly over the new two trading weeks as it will probably reach fresh all-time highs by next Friday. Given the recent rare opportunity to buy Apple at an extremely cheap valuation, I’ve been betting on some 2011 Apple leaps over the past few weeks and plan to remain long Apple for an extended period of time.

Also on Fortune.com: