Why a Strong Loonie Doesn t Mean Better Prices

Post on: 9 Июнь, 2015 No Comment

T his is a guest column by Robb Engen, one of the bloggers behind Boomer & Echo

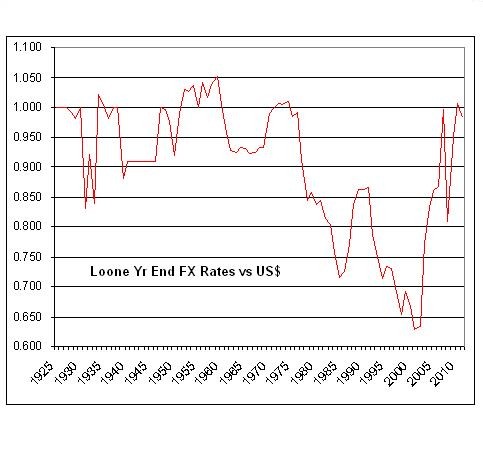

It upsets me to hear my fellow Canadians complaining about paying higher prices than our neighbours to the south just because our dollar is now hovering above par. Most of us grew up with the Canadian dollar valued between 60 and 80 cents U.S, but now that the loonie is soaring we seem to believe that we are entitled to lower retail prices.

The problem with Canadians thinking this way is that it’s taking a very complicated economic formula and making the answer too simplistic. Getting mad at your local retailer doesn’t help. I’m going to show you the reasons why you shouldn’t expect Canadian retail prices to decline just because of the high Canadian dollar, as well as some of the ways that you can take advantage of our strong currency.

What Caused The Consumer Rage?

On September 28, 2007, the Canadian dollar closed above the U.S. dollar for the first time in 30 years, at US$1.0052. And on November 7, 2007, it hit US$1.1024 during trading, a modern-day high.

Suddenly consumers began to notice the disparity between Canadian and American retail prices and demanded to know why they were still paying sometimes 30 or 40 percent higher prices for the same goods.

Books, cards and magazines were the biggest offenders since they publish both prices right on their product. And by comparing the retailers’ Canadian and American websites, consumers were able to quickly determine that they were getting screwed by shopping in Canada.

So Canadians fled to the border in droves looking to save money on everything from cars, motorcycles and snowmobiles, to televisions, furniture and appliances. We petitioned the government to do something about the outrageous prices offered by our local retailers. Some retailers chose to lower prices amidst the growing pressure, but most ignored the issue and hoped it would go away.

But then a funny thing happened. By November 30, 2007, the Canadian dollar was once again back at par with the U.S. dollar, and on December 4, the dollar had retreated back to US$0.98.

Exchange Rates Aren’t That Influential on Prices

In the short term, prices in Canada may not respond to exchange rate movements for a number of reasons. For one thing, prices reflect both the cost of the manufactured goods and the sellers’ margin. This margin is not tradable to the same degree as manufacturing products. Therefore, Canadian retail prices may not respond immediately to fluctuations in the exchange rate.

Canadian prices, especially for tradable goods, may reflect U.S. prices in the long term, but they tend to react very slowly to exchange rate movements. Currency is very volatile, so to make long term pricing decisions based on short term movements would be detrimental to business. After the loonies’ mighty rise to US$1.1024 in late 2007, its value plummeted below US$0.80 just one year later.

The relationship between a stronger dollar and consumer prices becomes even more complex, considering that Canadian producers also rely on imports to produce goods sold to Canadians. This indirect impact of a stronger loonie involves more moving parts and is likely to take longer to reach consumers.

Why Goods Are More Expensive In Canada

Even if cheaper imports tied to the U.S. dollar could have a direct impact on consumer prices in Canada, there are many other factors influencing price differences between Canadian and American store shelves.

- Higher labour costs in Canada

- Higher Canadian taxes

- Higher freight costs (The population of Canada is about the same as California but its geographical area is roughly that of the continental U.S.)

- Bilingual labeling requirements

- The time and cost to update price listings and catalogues

- Import contracts are often signed weeks or months ahead of the product’s arrival on store shelves.

Another factor is the tendency for retailers and wholesalers to simply absorb profits or losses due to changes in the exchange rate. For this reason, the fact that cheaper consumer goods are arriving from the United States or China does not mean their price will automatically fall for Canadian shoppers.

So How Can You Take Advantage of the Strong Loonie?

While you shouldn’t expect Canadian retail prices to fall dramatically in comparison to our American neighbours, there are still many ways that you can take advantage of the purchasing power of the Canadian dollar.

- Vote with your feet – Retailers will continue to charge whatever the market will bear for their products. One successful tactic that got some retailers to lower their prices back in 2007 was the number of Canadians willing to drive to the U.S. to go shopping . If faced with enough pressure from declining sales, most retailers will discount in order to gain your business back.

- Import a big ticket item – Buying a car, motorcycle, boat, or snowmobile in the U.S. and importing it to Canada can save you thousands of dollars. Be sure to do your homework first, as not all manufacturers will honour their warranties across the border.

- Shop online – Maybe you can’t make it down to the U.S. in person. One of the best ways to take advantage our high dollar is to simply shop online at American retail stores. Many bargains can be found on sites like eBay, which lists products in USD.

- Buy some U.S. assets – American stocks have rallied but there are still bargains to be had. Take advantage of the low foreign exchange rates by purchasing some quality U.S. stocks for your RRSP. And with the U.S. housing market still depressed, why not take advantage and pick up a cheap rental or vacation home?

- Take a vacation – Not only is the loonie trading higher compared to the U.S. dollar, but it has also gained value on other currencies around the world. Now is a perfect time to take the family on a vacation in the U.S. or abroad.

So instead of sitting around and complaining about how high Canadian prices are compared to our neighbors to the south and waiting for our local retailers to act, take matters into your own hands and use our strengthening currency to your own advantage.

About the Author : Robb Engen writes about Canadian personal finance at Boomer & Echo . Together with his mom, (she’s the Boomer, he’s the Echo) they offer their own unique perspectives on saving, investing and personal finance.