Which Type Of REIT ETF Is Right For You

Post on: 18 Октябрь, 2015 No Comment

U.S. stocks have rebounded with full force since the housing market crisis simmered, with major equity indexes sitting at, or nearing, all-time highs. While many on Wall Street have undeniably enjoyed stellar returns since the bottom in 2009, the ultra-low interest rate environment at home and around the globe continues to pose a major challenge for income-seeking investors of all types [see 101 High Yielding ETFs For Every Dividend Investor ].

As a result, dividend-paying securities have become very appealing, as meaningful current income has been hard to come by amid the loose monetary policies implemented by major central banks. One particular corner of the market that has rebounded with great vigor and also offers a lucrative opportunity to generate yield happens to be one of the culprits behind the last economic downturn: real estate .

More specifically, REITs have surged in popularity among income-hungry investors as they hold a special place in every dividend investors heart; these securities must pay out 90% of their income to shareholders in order to avoid taxation at the corporate level. As such, this breed of dividend-paying stocks has a history of generating attractive yields, although, as the recent financial crisis demonstrated, this corner of the market is also laced with risks [see Monthly Dividend ETFdb Portfolio ].

Differentiating REIT ETFs

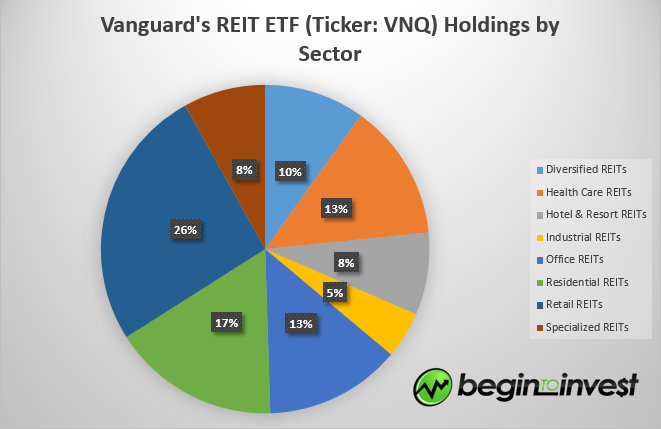

The evolution of the ETF industry has spawned multiple instruments that make it easy and cost-effective for mainstream investors to add real estate exposure to their portfolios. In fact, the Real Estate ETFdb Category boasts over $30 billion in total assets under management and includes over a dozen options; in addition to popular broad-based funds, investors can also focus in on specific corners within the sector, including ETFs that target specifically mortgage or residential REITs for example.

While the various REIT ETFs out there are generally influenced by the same macroeconomic factors, they are far from identical. In fact, the differences from one type of REIT ETF to the next can be significant, and these differences have a meaningful impact on returns [see Differentiating Dividend ETFs ].

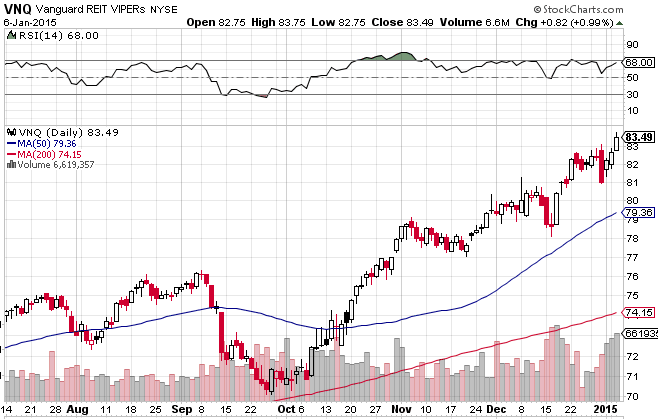

The chart below aims to help investors differentiate among the biggest REIT ETFs from each sub-category by comparing their trailing five-year returns and 200-day volatility as well as their respective annual yields as represented by the size of each bubble:

- Vanguard REIT ETF (VNQ, A+ )

- iShares FTSE NAREIT Mortgage REITs Index Fund (REM, B- )

- iShares FTSE NAREIT Residential Index Fund (REZ, A- )

- iShares FTSE NAREIT Retail Index Fund (RTL, A- )

Keep in mind that the above chart is based on trailing returns, and as such, its composition is bound to change over time. There’s no universally right choice from the above ETFs; for some, a high-yield mortgage REIT ETF like REM makes sense, while others may wish to take on a less-volatile approach with a broad-based fund like VNQ. The takeaway here is to remember to take a thorough look under the hood before pulling the buy trigger as each ETF features a host of unique advantages and nuances.

[For more ETF analysis, make sure to sign up for our free ETF newsletter ]

Disclosure: No positions at time of writing.