Which Mutual Fund Has the Highest Return with the Lowest Risk

Post on: 22 Апрель, 2015 No Comment

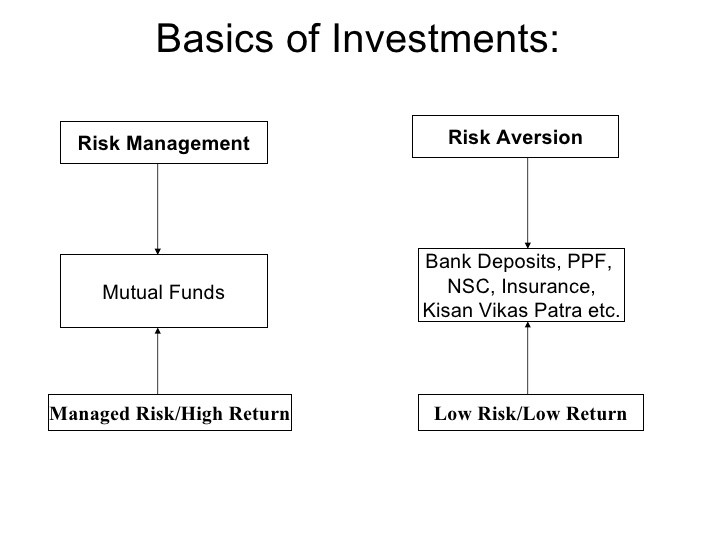

As a retirement investor, you have a tremendous number of relatively safe, affordable and profitable vehicles at your disposal. For a variety of reasons, many folks in your position are drawn to mutual funds. As you may know, mutual funds are managed investment vehicles that hold diversified baskets of stocks, commodities and other financial products and pursue market-beating returns. Due to their diversified nature, mutual funds are generally regarded as safer than individual stocks. This overriding quality produces an all-too-common trade-off: The total return on a given mutual fund is liable to be lower than the total return on a given stock. Your ability to accept this trade-off will determine whether you choose to invest in mutual funds or stick to individual stocks and bonds.

In recent years, so-called aggressive return mutual funds have come into favor. Unlike traditional mutual funds, these funds offer the promise of stock-like returns without exposing their investors to undue amounts of risk. While aggressive return funds tend to be riskier than traditional funds, most are also diversified and competently managed. As such, these investment vehicles have attracted the attention of young investors who hunger for strong returns. If this idea appeals to you, you have a wide range of high-return funds from which to choose.

It's important to note that no single mutual fund in this class is clearly superior to any other. Rather, the quality of a given mutual fund can be judged by the risk-return ratio that it offers. There are several funds that offer approximately equal rates of return at approximately equal levels of risk.

One of the most popular of these is the Vanguard High Yield Corporate (VWEHX). This highly-diversified fund invests in over 300 corporate bonds that pay variable rates of interest. In addition, about 20 percent of its holdings are securitized. As such, this fund offers leveraged rates of return without directly exposing its investors to risky asset classes.

Fidelity Focused High Income (FHIFX) is another popular high-return, low-risk fund. This fund's managers allocate most of its capital to so-called dividend growth stocks that offer yields of between 3 and 7 percent. Most of these small-cap stocks look poised to double or even triple in value within five years.

If you're looking for a more diversified high-yield, low-risk fund, the T. Rowe Price High Yield Fund (PRHYX) might grab your attention. Its holdings are spread across hundreds of different corporate bonds, municipal securities and preferred stocks. This fund has been known to offer annual returns of more than 20 percent.