Where To Be Greedy When Others Are Fearful Take Two

Post on: 23 Май, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

Last week we saw an escalation of geopolitical turmoil. As a result, stocks were shaken, and volatility finally moved higher. Historically, events and news like this tend to create great buying opportunities because they are driven by fear, not fundamentals.

The sanctions that the West are imposing on Russia have little economic impact. Much has been made of Europe’s reliance on Russian commodities, particularly energy. This gives Wall Street something to speculate about in terms of the negative economic drag it might have on Europe. This doesn’t come as a surprise since we already know that the European economy is very weak. We also know that the European Central Bank (and its global central banking counterparts) has been a driving force of economic stability in Europe. This will continue. Europe (and the rest of the world) will simply have to trade elsewhere. The bigger loser is Russia, not the rest of Europe.

Last February, we had a similar decline in stocks, driven by a currency devaluation in Argentina and the fear that a debt and currency crisis might spread across emerging markets. Again, it was a fear with little fundamental underpinning.

While that was transpiring, I reminded Forbes readers about Warren Buffett’s famous philosophy on dealing with uncertainty-driven sell-offs in stocks: “Be greedy when others are fearful”. Back on February 4th, I also argued that stocks were hitting the bottom. It happened to be spot on.

Here’s an excerpt from that Forbes piece (see the full article here ):

“Warren Buffett wrote a famous op-ed piece in the New York Times in October 2008 in which he that said the following:

‘A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful. And most certainly, fear is now widespread, gripping even seasoned investors. To be sure, investors are right to be wary of highly leveraged entities or businesses in weak competitive positions. But fears regarding the long-term prosperity of the nation’s many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now.’

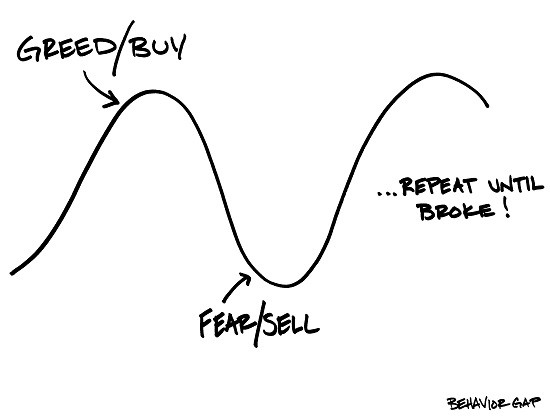

This is important because it shows you the mindset of a great investor and how great investors react when the stock market falls. Instead of running away in fear, great investors welcome market corrections as opportunities to buy cheaply.

Let me be clear, Buffett was talking about 2008, the depths of a massive global crisis. This is not 2008. It’s 2014. The world and the economy are in a much better and more stable place. The point of Buffet’s piece is that you don’t get rich buying into a high market or selling into a falling market. You can get rich by buying into market corrections and beaten-down markets.

A Chart Worth Watching

Given that there is no recession risk on the horizon (quite the opposite given the growth outlook for the year), it’s highly unlikely that we would see a 10% correction in this environment.

The graph shows a line line that starts from November 2012 lows to earlier this year.

It’s important to note that trendline in the chart above has significant fundamental relevance. The lift off from November 2012 coincides with a lift off in global stocks that was driven by a comment from a candidate in the running to become the new head of the Bank of Japan. His comment was a precursor for the massive policy shift that has taken place in Japan — a policy shift that has created, and continues to create, massive amounts of new money that flows into the global economy from Japan.

Now, let’s step forward. And this trendline is back in play.

Here’s a look at the updated chart …

You can see this trend holds nicely — a near perfect 45 degree angle. The 1880-85 level is the next point along the path, which would put this decline at a little more than 5%, just shy of the decline we had in February. Following the graph, the path of this trend shows that dips recover quickly. In fact, the sell-off early this year was fully recovered in less than a month.

What drives this beautiful trend and what has driven the low volatility in stocks (the reluctance for people to seek out insurance against stock declines)?