Where Do and Bonds Stand

Post on: 16 Март, 2015 No Comment

Recent Posts:

Where Do U.S. Stocks and Bonds Stand?

While we had last Monday off for the Presidents Day holiday, Japan reported that it emerged from recession, though hardly with all its afterburners aglow. GDP rose at a 2.2% annualized rate in the fourth quarter, which was okay, but still well below economists expectations.

Of course, the economists got it wrong (not surprisingly), but the markets seemed happy enough, pushing the Nikkei index up 0.5%.

Stock markets here in the U.S. have been hitting all-time highs again, with only the Nasdaq lagging. It doesnt need much of a gain to hit a high, but it isnt there yet. Meantime, the S&P 500 and S&P mid- and small-cap indexes have hit several highs, as has the Russell 2000 and now the Dow Jones Industrial Average as of today.

While theres been much made of recent gains in the Nasdaq Composite of late, you may be surprised to learn that the index is still 1.8% below the all-time high it hit in March 2000, almost 15 years ago. The bursting of the tech bubble has really taken a long time to recover from, and like I said, we arent there yet.

By the way, more than half of Vanguards equity and balanced funds were at all-time highs as of last Wednesday night, including almost all of the domestic stock funds.

Why? For one thing, the U.S. economy is sound. Yes, I know that we got a so-so report on industrial production, showing strength in January but downward revisions for the fourth quarter, and Greece remains a mess and ISIL continues to gain ground in the Middle East. Still, all of those worries cant stop the train that is running on stronger employment numbers, rising wages and greater spending.

That being said, and proving once again that you can spin numbers to suit just about any perspective you like, this week the media was making note of the fact that consumers took on more debt in the fourth quarter, and that delinquencies, particularly among those with student and auto loans, were on the rise.

First off, student loan delinquencies have been rising for years. This is really nothing new. And as for auto loans, its a small blip in whats been a long downward trend.

But what doesnt seem to have made the headlines is the fact that (a) consumers often take on more debt when they are feeling confident and (b) all of that extra debt thats being taken on doesnt mean people or, rather, households cant afford to finance it. One piece of data that Ive talked about for years, and which I think gives a very good read on consumers and debt, is the level of household debt coverage, if you will.

Even though the data hasnt been updated yet for the fourth quarter, the Federal Reserves household debt service ratio, which looks at the level of debt relative to income, is near an all-time low and way, way below the average over the period since the data was first collected more than 30 years ago.

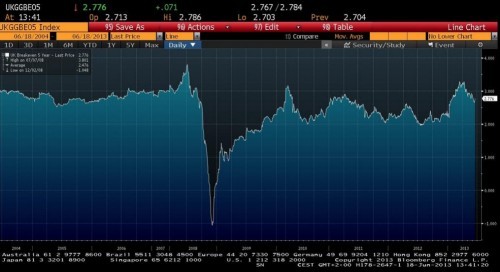

Meanwhile, the Feds latest minutes seem to confirm something Ive been talking about for a while, which is that inflation may not give the Fed a reason to hike rates this summer, and the start of whats referred to as normalization may be further down the road than anticipated.

Heres how I think it could play out: First, the Fed has been and will be very transparent about its intentions. Second, a rate hike in the summer is definitely not a given, but we could see one little nudge up simply to satisfy the markets and to show that the Fed is on top of the economic situation. But after that nudge, well, it doesnt mean the Fed will continue with regular monthly rate hikes at all.

Unlike the situations that presented themselves to predecessors Greenspan and Bernanke, Janet Yellen isnt facing a situation where regular, monthly rate hikes will be necessary. Not yet, anyway. So, despite the Feds waffling, and even if we were to see a small hike in the summer, bonds could still get a reprieve from the impact of regular rate hikes. And stocks will benefit from the fact that the interest rate environment remains very, very constructive, meaning stocks are a good buy.

Daniel P. Wiener is editor of The Independent Adviser for Vanguard Investors. a monthly newsletter that keeps abreast of recent developments at Vanguard, and the annual FFSA Independent Guide to the Vanguard Funds.

investorplace.com/2015/02/nasdaq-japan-stocks-bonds-us-economy-fed/.