When Will the Fed Raise Rates

Post on: 16 Март, 2015 No Comment

The most likely answer: 2015

Skyhobo / E+ Collection / Getty Images

One of the most important longer-term questions for the financial markets is “When will the Federal Reserve raise rates?”

The Fed’s policy of near-zero short-term interest rates has been one of the key drivers of returns for investors in recent years, influencing everything from the yields on certificates of deposit to the performance of the bond market and the relative attractiveness of stocks. When the Fed finally changes gears, the impact on the financial markets could be enormous. With that in mind, here’s a look on the reasons for the Federal Reserve’s current low-rate policy and what factors would prompt it to raise rates.

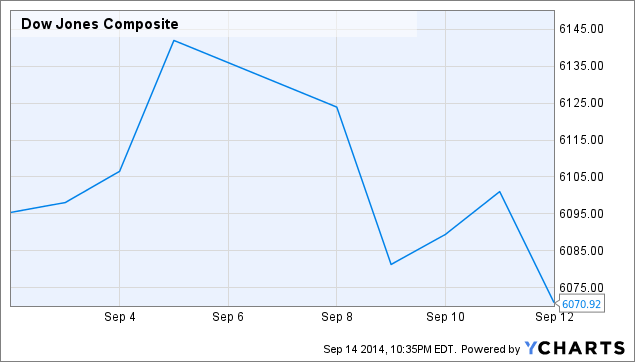

The Current Expectation (as of September 2014)

The current consensus is that the Federal Reserve is likely to raise rates at some point in 2015, with its June 17 meeting being the most likely date for the first increase. Analysts expect the fed funds rate to finish 2014 at its current level, rise to a level in the range of 0.5% to 1.0% by the end of 2015, and hit 2.0% to 2.25% by year-end 2016.

Members of the Federal Open Market Committee (FOMC) — the rate-setting body within the Fed — also provide their expectations for future rate levels using the now-famous dot plot. Currently, the members’ average expectation is for rates to hit 1.27% at the end of 2015, 2.68% in 2016, 3.54% in 2017, and 3.79% in the long run. The September 2014 dot plot can be found here .

Following the September, 2014 Fed meeting, FOMC Chair Janet Yellen says that the Fed will continue to keep rates low for a considerable time. So how long is this, exactly? In a post-meeting press conference, Yellen said, I know ‘considerable time’ sounds like it’s a calendar assessment, but it is highly conditional and linked to the committee’s assessment of the economy. In other words, the Fed doesn’t have a particular date in mind. Instead, it is waiting to make sure that the economy can stand on its own before it begins to raise rates.

Graphs from cmegroup.com showing the market’s updated expectation for the fed funds rate as of certain dates is available here .

The Fed and Interest Rates: A Brief Review

The FOMC determines the country’s interest rate policy by setting the target for the federal funds rate. or the interest rate at which banks with balances at the Federal Reserve borrow from each another an overnight basis in order to meet the Fed’s requirements for the amount of cash they need to have on hand. The Fed accomplishes this by managing the total money supply by buying or selling government bonds, which in turn injects money into or out of the financial system. Putting money into the system is designed to bring rates down, while taking money out should bring them up.

When the Fed wants to spur economic growth. it reduces interest rates. When it wants to curb inflation by dampening economic activity, it raises interest rates.

Why Has the Fed Set Rates Near Zero?

The Fed’s current target for short-term interest rates is a range of 0% to 0.25%, a level at which it has held rates since December 16, 2008. The Fed slashed rates by a total of four percentage points during 2008 in reaction to that year’s financial crisis and the subsequent meltdown in the financial markets. With the banking system in crisis, the Fed sought to bring rates as low as possible both to keep the economy afloat and to help banks earn a higher “spread” between the rates at which they could borrow and lend money.

The Fed has kept rates in this 0-0.25% range since that date based on its belief that the U.S. economy would be unable to sustain positive growth without continued central bank stimulus. In fact, the Fed’s inability to cut rates lower than zero has prompted it to engage in additional stimulus measures known as “quantitative easing ” and “Operation Twist .”

What Would Cause the Fed to Change Course?

The Fed, in an effort to be more “transparent,” frequently made tweaks to its policy direction through late 2012 and early 2013. Throughout most of 2013, the Fed said that it would consider raising rates once unemployment fell near 6.5%, or until the inflation rate climbed to 2.5%. However, since unemployment fell near this 6.5% level quicker than expected, the Fed abandoned the use of forward guidance based on economic targets following its March 19, 2013 meeting. In doing so, it hoped to avoid confusion about its policy direction.

The Fed has also said that it intends to continue its stimulative quantitative easing (QE) policy through October 2014. Given previous Fed statements that there will be a time lag between the end of QE and the first rate increase, this means the first change to the fed funds rate is unlikely to occur until mid-2015 at the earliest.

An important goal of this steady approach is the Fed’s desire to employ measures that would cause bond yields to rise very gradually over a period of several years, rather than disrupting the markets through sudden actions that take investors by surprise. In addition, the Fed sees inflation as being below its ideal target level, so it will maintain an accommodative policy in order to head off the possibility of deflation .

When the Fed Finally Raises Rates, What Happens to the Financial Markets?

One outgrowth of the Fed’s policies is that the markets have become dependent on its stimulus. The Fed’s approach of low rates and aggressive quantitative easing (QE) contributed to a bull market in stocks and caused bond yields to fall to historic lows. Once this artificial demand is removed from the market, the thinking goes, bond yields are destined to rise sharply as their prices fall .

As a result, any indication that the Fed is finally ready to raise interest rates is likely to depress bond market performance. While this is still at least a year away, investors know that a policy shift will need to occur eventually – and it could have a meaningful impact on the bond market once it does.

When Will the Fed Stop Raising Rates?

Ultimately, this could prove to be the million-dollar question. To see more on this topic, see my article, Are Bonds a Good Investment? Bill Gross May Have the Answer.

What Action Should You Take?

Typically, the wisest course is to make investment decisions based on your long-term objectives and risk tolerance rather than reacting to anticipated events that may not necessarily come to fruition. However, in a scenario of rising rates investors who tilted their portfolios toward short-term bonds and investments a lower degree of interest rate sensitivity would likely see better returns than those who took the opposite approach. Also, it would be reasonable to expect outperformance for high yield and floating rate bonds during a period of rising bond yields.

For more on how to approach this scenario, see my article How to Protect Against Rising Rates .

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Be sure to consult investment and tax professionals before you invest.