What You Need to Know about “Strategic Beta”

Post on: 16 Март, 2015 No Comment

Share | Subscribe

Many times on the Blog, we highlight trends within the ETF industry. One major development that really stood out last year, more so than the others, was the considerable growth we saw in strategic beta — an investing strategy that we believe will continue to be a significant contributor to ETF flows in 2014 and for years to come.

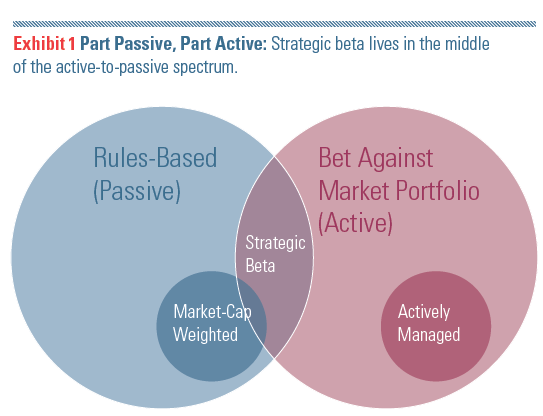

Before discussing the flows, let’s first explore what we mean by strategic beta. While there is no single definition for strategic beta ETFs, it can most easily be defined as investments based on indexes that are not market-cap weighted. Unlike traditional market-cap weighted index funds, strategic beta equity funds hold a basket of stocks that are selected and weighted by characteristics other than company size. For example, one strategic beta fund may focus on high dividends while others may emphasize low volatility, momentum or quality. The objective of strategic beta is to improve performance by passively tracking an index that is not based on market-cap weighting. In other words, strategic beta is an enhanced form of passive investing.

Traditionally, tracking such targeted market exposure was only feasible through actively-managed funds pursuing alpha. Not anymore.

In 2013, we saw a record-breaking $65 billion flow into strategic beta equity ETFs, nearly a third of total ETF industry flows. That’s almost double the $34 billion we saw flow into this space in 2012.

Strategic beta equity funds gathered a record total of $65.1 billion — nearly a third of global industry flows in 2013 — with asset growth in excess of 50%.

Two categories within strategic beta equity captured the majority of these flows:

1.   Equity dividend ETFs. Many investors last year turned to equity dividend ETFs to meet their income needs in the low interest rate environment, and we believe they will continue to do so. Many retirees in need of income with an opportunity for capital appreciation may also gravitate toward these types of investments.

2.   Minimum volatility ETFs. One of the biggest concerns we hear from investors today is related to the recent run up in stocks. As a result, investors may be hesitant to invest in equities because they fear increased risk and stretched valuations. These concerns lead us to believe that minimum volatility ETFs may serve as compelling solutions to such investors in the current market environment as these funds are designed to provide diversified access to stocks with lower expected volatility than the overall market.

As investors seek strategic beta solutions, and as these solutions become more readily available, it’s important to keep in mind that no matter the strategy, diversification is key. Strategic beta is meant to compliment a diverse portfolio of investments, not replace market-cap weighted funds altogether.

20Blog%20%7C%20Global%20Market%20Intelligence&el=What%20You%20Need%20to%20Know%20about%20%E2%80%9CStrategic%20Beta%E2%80%9D /%