What to do when a mutual fund changes benchmark

Post on: 16 Март, 2015 No Comment

By Kumar Shankar Roy Apr 04 2010. Kolkata

All equity mutual funds have a benchmark that allows the investors, as well as the fund manager, to see how the scheme performed against the standard. In the Indian context, there are dozens of indexes such as the Sensex, BSE 500, CNX IT and MSCI India, among others, that mutual funds use to gauge the performance of their scheme’s portfolio. Now, what happens when the asset management company announces a change in your scheme’s benchmark and how should you react to such a development? Financial Chronicle tries to find out the right answers.

ING Mutual Fund recently said that the benchmark index for ING Core Equity Fund, ING Dividend Yield Fund, ING Contra Fund and ING Domestic Opportunities Fund will be BSE 200, against the earlier benchmark of BSE 100. “We have changed the benchmark to align more closely (than before) the benchmark of the scheme to the investment objective of the scheme and get a wider universe of stocks to invest in,” said an ING Mutual Fund official. In May last year, Edelweiss ELSS Fund announced a change in its benchmark from the BSE 500 to the Nifty. In October 2009, Canara Robeco Emerging Equities Fund decided to track the CNX Midcap from BSE 200.

For equity funds, the appropriateness of the benchmark is not based on convenience alone. “Internal compliance and risk control measures force some fund managers to select the same stocks that comprise the benchmark but leeway is given in terms of assigning weightages. It is understandable why some schemes prefer to track a bigger index. That is because it gives you more stocks to play with,” said Dhirendra Kumar of New Delhi-based Value Research, a mutual fund tracker.

When a change is being effected, mutual fund investors should try to compare the scheme portfolio with the benchmark portfolio. “Many fund managers display a tendency to track a broader index when they feel the market may correct soon. The tracking of a broader benchmark ensures that the hit taken, if a correction happens, is lower compared with a narrow index,” said Anil Rego, chief executive officer, Right Horizons, a Bangalore-based investment and wealth management firm.

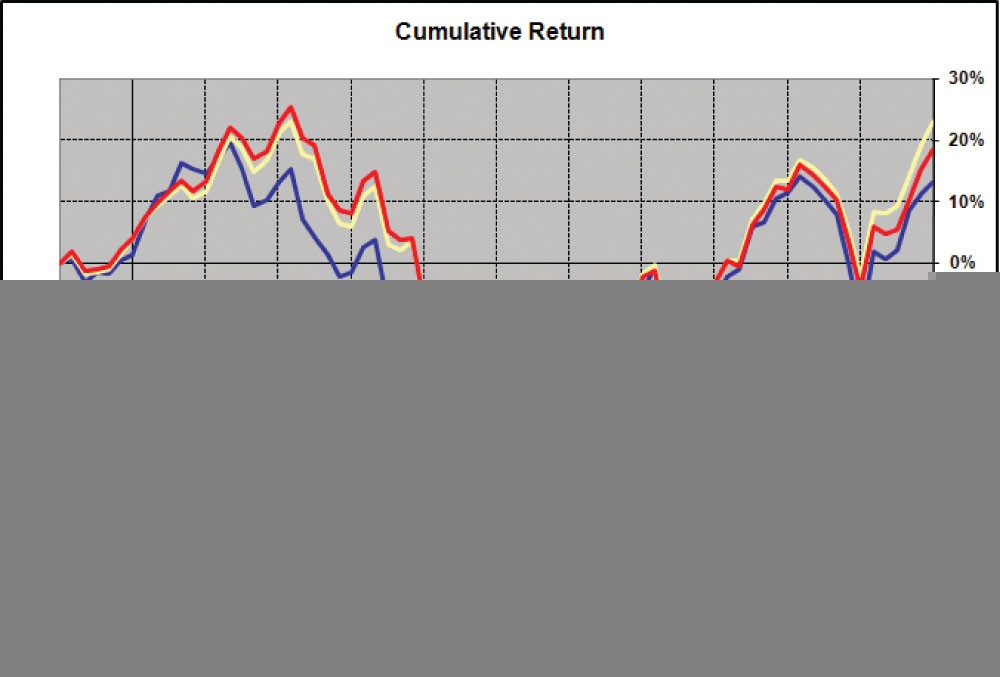

The performance prior to the change in the scheme’s benchmark, as well as the performance post the change, should be looked into. “While an underperformance occurred since the scheme and benchmark were not matched properly, a continued underperformance after the change is a signal that things are not right,” said Sanjay Das, a Kolkata-based financial planner.

Ask yourself why a there change in the benchmark. “If you bought a mutual fund because it was mid-cap oriented, then a benchmark that is skewed towards a large-cap index should be a warning sign. It is better to exit such a fund because that may indicate a change in strategy, which is not what you wanted in the first place,” said Srikanth Meenakshi, director of Fundsindia.com.