What stock sectors offer the best dividends

Post on: 19 Август, 2015 No Comment

July 21, 2014 | Bryan Borzykowski, special to CNBC.com

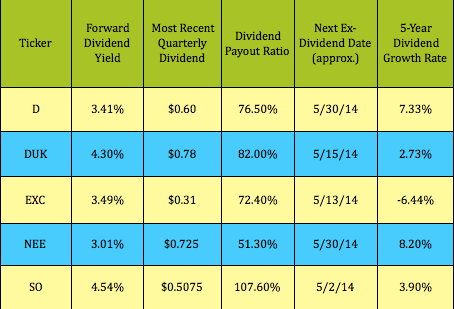

Ask any investor to name a sector or two that pays dividends and youre likely to get telecoms and utilities every time. These industries have traditionally been paid the most, with the average telecom offering a nearly 4.8 percent yield and utilities paying about 3.5 percent.

What many investors dont realize is that other sectors can also be a great source of income. While no industry on the S&P 500 pays as much as telecoms and utilities, they are catching up.

Kick Images | Photodisc | Getty Images

Technology, for instance, was once devoid of dividend payers. In December 2003, just 22 IT stocks paid a dividend. Thats jumped to about 45 in July of this year.

When it comes to annual dividend growth, financials and consumer discretionary stocks have seen the largest increase in 2014, with 17.6 percent and 19.6 percent gains, respectively, through June.

The relationship between dividends and sectors is a little bit complicated, said Joseph Gerard Paul, chief investment officer for U.S. value equities at AllianceBernstein. When people think about dividend investing, they think about those sectors that are characterized by stability and high payout ratios.

The problem with traditional players

After the recession, people flooded into industries with high-paying companies. Telecoms and utilities were popular, but so were real estate investment trusts and consumer staple stocks, which both pay attractive yields.

While those industries helped buoy peoples returns, it also pushed up valuations in those sectors to the point where many dividend-paying companies now look overvalued.

These sectors are pretty overpriced, said Paul, adding that utilities in particular look expensive on a book-value basis.

Other sectors look pricey, too. The S&P 500 Consumer Staples Index (S5CONS ) has a price-to-earnings ratio of about 22 times, according to S&P Capital IQ, which is also near its 10-year high. In 2009 it was trading at about 15 times earnings.

For investors like Paul—he likes to own companies that are undervalued and pay an income—looking for payouts across all sectors is critical.

You have to intersect the search for yield with valuation, he said. Thats going to give you a better chance to win in most market environments, because you can collect yields and get capital appreciation.