What Shiller P

Post on: 1 Май, 2015 No Comment

MattAndrejczak

SAN FRANCISCO (MarketWatch) — With the U.S. stock market back at record levels, a central question facing investors is whether stocks are too expensive or if there’s still time to put money to work.

The Dow Jones Industrial Average DJIA, -0.82% is up 11% for the year and on Friday broke a string of record-setting closes. The S&P 500 SPX, -0.61% ended Friday less than 5 points from its record high, holding to a 9% year-to-date gain. Not surprisingly, there’s plenty of debate over whether stocks are primed for retreat.

Bloomberg News

Robert Shiller

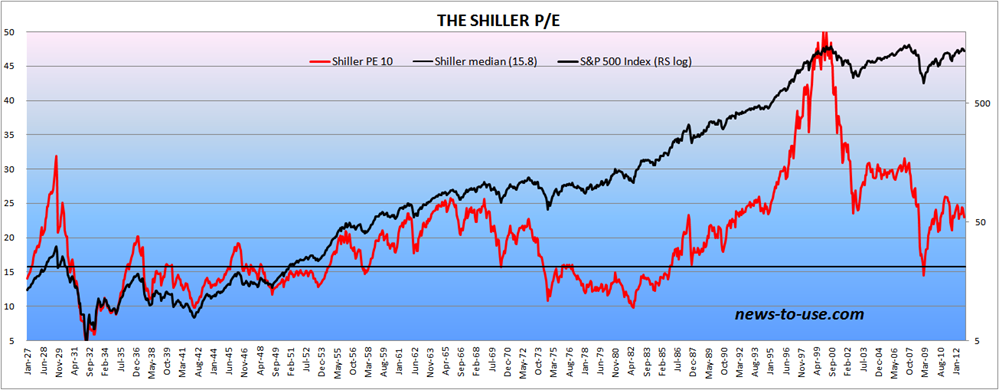

Valuation is a crucial part of the discussion, which has drawn attention to one gauge that measures how heated the stock market is. It’s called the CAPE ratio (but also goes by Shiller P/E and P/E10 ).

The tool was popularized by Yale University economist and professor Robert Shiller. author of the book Irrational Exuberance, published just about the time the dot-com bubble burst in 2000. Later, Shiller was among those warning the U.S. housing market would be pummeled.

The Shiller P/E tool shows frothy market periods in 1929 and 1999 that were followed by huge selloffs.

Even with that blue-chip background, there’s considerable debate over the effectiveness of this valuation measure. Some strategists caution the P/E10 ratio shouldn’t be used as a single valuation tool and advise it isn’t effective when trying to time the market.

They also say it shouldn’t be viewed as a measure to gauge stock market returns for the next 12 months.

However some investors, like financial advisor Kay Conheady, who created the P/E10ratio.com website devoted to the topic, believe the ratio is a good indicator for 10-year trends for the stock market.

What is the CAPE ratio?

CAPE stands for cyclically adjusted price-earnings ratio and is constructed to smooth out corporate earnings cycles to determine if stocks are cheap or expensive. CAPE is calculated by dividing the S&P 500’s SPX, -0.61% current price by the index’s average real reported earnings over the prior 10 years.

Shiller’s measure builds on the thoughts of Ben Graham, the godfather of value investing who was Warren Buffett’s mentor. Graham once said investors should examine earnings over a 5-to-10 year period because economic cycles can distort corporate earnings in any given year.

The Shiller P/E ratio is a lens to view stock market valuation that differs from more standard measures.

Traditional approaches to gauge the market use “trailing” or “forward” price-to-earnings ratios. A trailing P/E takes the S&P’s earnings from the past 12 months and divides that number by the index’s current price. A forward P/E is the collective estimation of what Wall Street analysts predict the 500 biggest U.S. companies will earn any given year, divided by the S&P’s price.

What does the CAPE ratio tell us about the stocks now?