What s the difference between active and passive fund managers

Post on: 13 Октябрь, 2015 No Comment

Hands on. an active approach can beat the market. Photo: William West

KEY POINTS

- How much you invest via each style will depend on your individual attitude towards risk andthe nature of particular asset classes

- If an investor has a low risk tolerance then they wont be pleasedif the index, and therefore an ETF or fund, has a high allocation to more risky corporate bonds

- When a market is very volatile or underperforming, good active managers should be able to outperform by finding the companies that are doing better than the market

- Matching an index doesnt just involve picking stocks, but also portfolio construction and implementation.

Active versus passive? Passive versus active? Does anyone really care? Well they do, but its not an either/or debate rather, it should be a discussion about whats the best way to integrate both into a healthy investment portfolio.

If the global financial crisis has taught us anything, its possibly the importance of a diverse asset allocation.

Ask anyone who invested all their money in Centro, or Westpoint or unfortunately, the list goes on.

A matter of definition

Put simply, active investment refers to trying to do better than the market. Passive investment, on the other hand, targets the market return usually by investing in an index fund that replicates the market, or by buying an exchange-traded fund (ETF) that does the same but via units traded on the sharemarket.

Scott Fletcher, investment sp ecialist, intermediaries, at Russell Investments. says that in the past the active versus passive debate has had an almost theological tone.

Any argument that seeks to discredit one at the expense of the other in all circumstances is simplistic and obsolete. these days the debate is moving on to issues around when and how to use both approaches, based on the risk and return objectives of the investor and the nature of the asset class involved, Fletcher says.

Russell Investments often advises investors on the use of active managers but it isnt just the active corner thats proposing a mix of

the two.

Robin Bowerman is head of retail at index manager Vanguard Investments and should be firmly in the passive corner.

Its about how you blend the things together, he says. Its actually looking at the individual investor.

Asset allocation is key

We would say the most important decision that any investor makes is definitely the asset-allocation decision. Getting that right is absolutely critical.

Both styles of managing have their purposes and how much you invest via each style will depend on your individual attitude towards risk andthe nature of particular asset classes. To help you decide how you want to do that, we dissect the main issues below.

Before the GFC everybody thought they could do better than the market. But as it turned out it was mainly the market that was making investors so much money.

It also turns out that sometimes not even the professionals are very good at this. A Standard & Poors survey on index versus active managers found that the great majority of managers underperformed relative to their benchmarks over a five-year period.

The table shows that small-cap fund managers were theonly group of managers to routinely outperform the index (over one, three and five-year periods).

The right active manager

This doesnt mean you should disregard active managers entirely. The trick is choosing the right active manager. And for certain asset classes like small caps you should definitely use them.

Past performance is not supposed to be an indication of future performance its often just a guide to which particular investment style works during a certain period but the calibre, experience and qualifications of individual managers can be a good gauge of whether or not theyre any good at their job.

So lets assume your starting position for putting together a portfolio of managed funds is passively investing in a fund, or group of funds, to achieve purely market return.

Index funds and ETFs are a cheap way to achieve passive market returns. But being cheap doesnt mean theyre nasty.

People are looking at moving towards index investing as a way to lower the whole cost of the portfolio, Bowerman says.

Low cost, high return

One sort of concern weve got around that is people are also talking about if you go low cost it equals lower return, whereas all our research shows the lower the cost the higher the return.

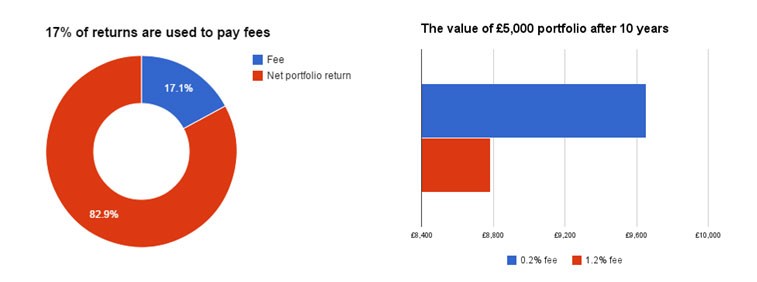

The truth is that fees often eat into returns. So no matter how good your manager is, if theyre charging high fees thats money going into their pockets instead of yours.

There are also many more products available to investors these days that make it possible to invest passively.

The growth of ETFs, which now cover many emerging markets and different types of asset classes, also make it much easier and cheaper to construct a somewhat active portfolio out of passive tools.

The point with index investing, with the growth in the number of index funds and the recent number of ETFs coming to market, is that the good news for investors is they have very low-cost, transparent ways of buying the market return, Bowerman says.

Three assumptions

But if you do decide to invest exclusively in index managers, Fletcher, of Russell Investments, says youre assuming three things markets are efficient, indices weighted to market capitalisations are aligned with your goals, and the index itself is efficient.

Any time you believe there are reasons to doubt one or more of these assumptions, its justifiable to consider incorporating an active approach, he says.

If the most conservative allocation is100 per cent index, then you needto look at the individual asset classes and decide where, if anywhere, you believe you have extra confidence or knowledge that would help you outperform, Bowerman says.

If youre highly confident in smallcaps and you know something about them, why wouldnt you go and invest a certain amount in that? he says.

Conversely, in fixed interest and listed property, where its extremely difficult and theres a lot of evidence to suggest managers dont outperform, youd think about 100per cent in index.

Five reasons to choose an active approach

Russell gives the following five reasons for choosing an active over apassive approach:

■ No replicable index is available.

■ The passive index is at odds with the investors purpose.

■ The standard passive index is inefficiently constructed.

■ The investment environment favours active management in general.

■ Skilled managers can be identified.

The first point about not being able to find a relevant index applies to certain alternative investments.

As for a passive index being at odds with the investors purpose, this is a little more complex but essentially means you need to have some understanding of the index a product is being managed against.

In fixed interest, for example, an index could include high-yield debt along with government debt.

If an investor has a low risk tolerance then they wont be pleasedif the index, and therefore an ETF or fund, has a high allocation to more risky corporate bonds.

Russells Fletcher also cites fixed interest as an example of an inefficiently constructed index.

For example, the index might continuously reweight to lower-quality government debt when issuance is increasing, such as in the environment of burgeoning

budget deficits during the GFC,

he says.

The fourth point, where the investment environment favours active management, refers to the cyclical nature of markets.

When a market is very volatile or underperforming. good active managers should be able to outperform by finding the companies that are doing better than the market.

Identifying skilled managers, as alluded to above, is one of the most important but most difficult elements.

This is crucial, especially in developed markets where the case for active management is more based on slicing up the market into subsectors [such as small cap] and finding managers with a sustainable advantage in terms of people, philosophy, process, performance and pricing, Fletcher says.

The one thing thats definitely changed in this debate over the past 10 years is that there are now more ways to be passive.

There are more ETFs, which offer simple exposure to both Australian and international indices. There are more than 60 ETFs and exchange-traded commodities, including currency ETFs.

When ETFs were launched a decade ago, there were only three and they werent strongly supported by retail investors, who either didnt understand them or thought they could beat the market. Their gains in popularity are thanks to the GFC.

If you look at the US, where you have fixed interest and every flavour of ETFs that you can think of, youve still got the core-satellite approach, where people use the ETFs for exposure across sectors and asset classes and probably still buy direct equities to take positions where they have confidence, Bowerman says.

Fixed income ETFs

ETFs covering fixed income the one asset class that has been difficult for retail investors to access outside managed funds should soon be available in Australia, making it possible to construct a portfolio entirely out of listed products.

Bowerman says this will be particularly useful for self-managed superannuation funds.

Youre going to [be able to] add a fixed-interest ETF and youve got a portfolio solution as opposed to just an equity solution, he says.

Fixed-interest ETFs arent available in Australia yet because of regulation issues that are currently being examined. But ETF providers are in discussions with the Australian Securities Exchange and hope for a positive result soon. Through the GFC, high-quality fixed interest did the job for investors, Bowerman says. It was an absolute saviour for people who had good allocations to it. It was the one thing that was a safe harbour when the GFC was its most severe.

Fixed-interest index funds are available and make up one of Vanguards biggest asset classes in terms of the funds it manages. More than 20per cent of Vanguards $15 billion in funds under management is in fixed interest. Butan ETF option would be cheaper, and possibly easier, for investors.

Not even the biggest index manager in Australia Vanguard Investments advocates a completely passive approach. Nor does Russell suggest you go completely active.

Know your risk profile

Before you take any of the steps outlined above you need to consider your risk profile. If a small allocation to an active, alternative equity fund has you tossing and turning in your sleep then its probably not worth it even if it is in small caps, where most active managers outperform.

Russell also cautions against trying to mimic the Australian market return by buying direct shares yourself.

It will still not be possible to match the performance of the index, nor to do it as cost-effectively as a professional fund manager, he says.

Matching an index doesnt just involve picking stocks but also portfolio construction and implementation. Even if you can get the first one right, youll struggle on the other two fronts, where the economies of scale enjoyed by larger portfolio managers give them an advantage.