What is Wrong With Emerging Markets

Post on: 16 Март, 2015 No Comment

Investing Daily Article of the Week

Another week, another roller coaster ride in world financial markets as volatility returns after a long absence.

The most dramatic move was in Japan, with the Nikkei Stock Average falling 6.4 percent in a single day last Thursday, putting it 21 percent down from its peak reached just three weeks ago.

In contrast, the Standard & Poors 500 has lost a modest 2 percent during that time period, despite all the ups and downs, as of yesterdays close.

Follow up:

But its been a tough period for the emerging markets.

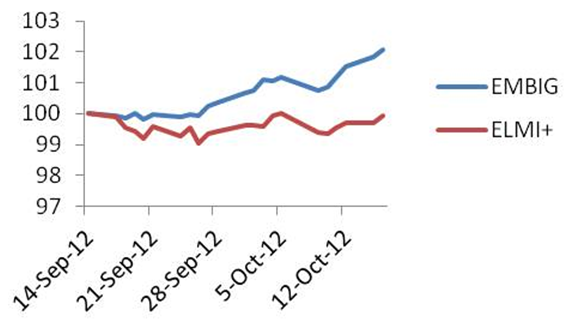

Heres how the two leading diversified emerging markets exchange-traded funds (ETF) have performed over the last three weeks, including yesterdays rebound:

- iShares MSCI Emerging Markets (EEM): -8.3 percent

- Vanguard FTSE Emerging Markets (VWO): -9.5 percent

Now lets see how the leading individual markets have performed, from best to worst, again using the primary ETFs for those markets:

These markets have been hurt by various developments, ranging from rising global interest rates to a pullback from risk assets to slumping commodities prices.

A basic reason is simply that these markets are more risky and less liquid than the US markets.

The US dollar has been another factor lately. It has strengthened against most of the  emerging-market currencies that are linked with the greenback. These include Brazils real, the Indian rupee, the Mexican peso, South Africas rand and the Turkish lira.

For US investors, a strong dollar is a negative when investing abroad. And a declining local currency reduces returns for all foreign investors.

But this recent underperformance isnt new for emerging markets.

For many years now, large numbers of market commentators, including many well-known investors, have extolled the virtues of emerging markets.

The rationale should be familiar. The economies of China, India, Brazil and many more are growing much faster than those in the so-called developed word (primarily the US, western Europe and Japan ).

One of the many reasons for that superior growth is much more favorable demographics (except in China and Russia ), with younger, faster-growing populations that want to improve their standards of living. Another reason is much lower levels of government spending relative to the overall economies, including on entitlements.

Last Decades News

But the investment reality is that the emerging markets have been so last decade.

The often-forgotten truth is that the emerging markets dont operate in a vacuum. Theyre part of the world economy. And theyve been significantly affected by the global financial crisis that arrived in 2008, and its aftermath.

For one thing, the economies typically are heavily export oriented, although less so as domestic consumer spending and infrastructure development occur, for example. Consequently, reduced demand from the US and Europe for their goods has dampened growth.

Historically, the developing-markets economies also have been heavily dependent on capital inflows from foreign investors. This, in turn, is affected by the risks those investors are willing to take.

A basic fact of life since 2008 is that there have been several time periods in which global investors have preferred to limit their risks. In practice, the risk-off phases have meant pulling back on equities, even more so in emerging markets than in the US, say.

Then too, whatever our political challenges here in the US, our system and processes are much more stable than in the developing-markets nations.

The result has been that US stocks have outperformed equities in emerging markets overall, and particularly the biggest ones, by a wide margin.

In the five years through mid-June, starting just before the financial crisis hit in full force, the Standard & Poors 500 returned an annualized average of 6.1 percent.

Here are the returns for US investors in emerging markets, via the two leading diversified ETFs:

- iShares MSCI Emerging Markets (EEM): -1.6 percent

- Vanguard FTSE Emerging Markets (VWO): -1.6 percent

The problem with those two ETFs is that theyre heavily invested in the biggest emerging markets, which have been the worst performers. These are the so-called BRIC markets: Brazil, Russia, India and China.

In contrast, some of the other individual emerging markets among the larger ones have been stellar performers.

Heres the complete rundown of five-year annualized returns, from best to worst:

The bottom line: The emerging markets will likely continue to hold good long-term investment potential. But they require a benign global investment environment to deliver superior returns.