What is Value Investing

Post on: 15 Май, 2015 No Comment

last updated February 08, 2015

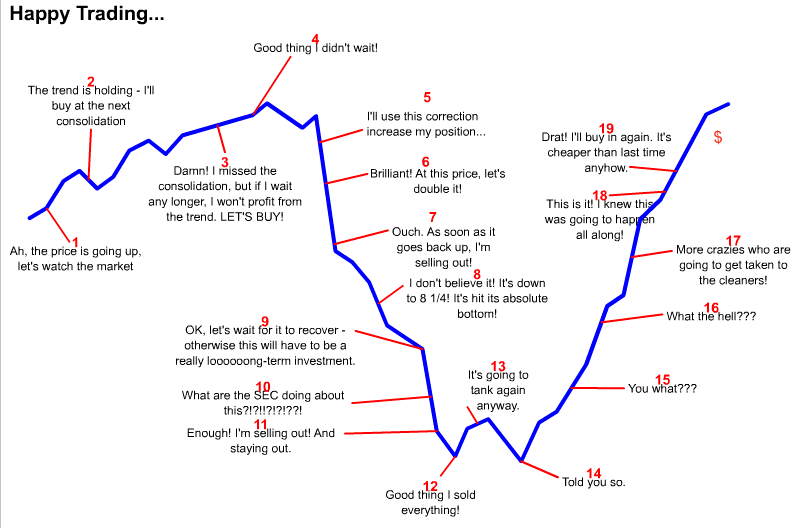

Some people believe that the stock market is financial voodoo and mumbo-jumbo. where success is a combination of luck, timing, and outsmarting other people. Why try? they ask. Isn’t the average investor doomed to fail?

We believe instead that you can succeed.

What is Value Investing?

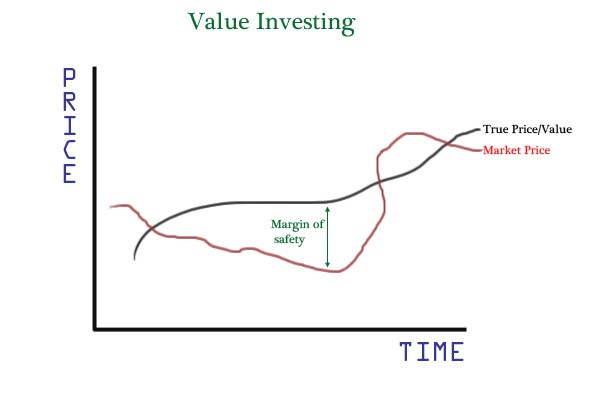

Value investing is a strategy of finding stocks with prices low compared to the intrinsic value of the business.

That’s it, but that explanation packs a lot of nuance in a few words.

Value Investors Love Great Businesses

To be a successful value investor, you have to find great companiessuccessful businesses. These businesses bring joy to their customers. They make honest profits. They manage their debt. Year after year they earn solid revenues. These are businesses we’d like to own, whether they sell farm equipment or publish newspapers or help people find what they’re looking for on the Internet.

When you buy shares of these companies, you own a piece of their business. Where some people believe in buying and selling shares because other people believe the price of the stock will change in the next hour or day or week, we believe in buying shares because these businesses have demonstrated that they can and will continue to succeed.

Value Investors Know the Value of a Business

Having a good business is not enough. Any stock worth investing in must be viable for the long haul: not just the next quarter or year, but five, ten, even twenty years. Think about Coca-Cola or IBM. These businesses continually reinvent themselves to produce new products, find new markets, and dominate their industries.

A stock is more than a piece of the business. It’s a share of the future revenue of the business. That’s why the solidity and the earnings of the business are so important. The price a value investor pays for a stock depends on the revenue the business will produce over time. It’s not investor sentiment. It’s not technical analysis. It’s the belief that, over time, great businesses continue to be great.

Value Investors Are Patient, But Not Greedy

Value investors don’t try to time the market to find the lowest of the low points as the best time to buy. If a company is worth owning at its current price, it’s worth owning. Neither do they try to time the market to find the highest of the high points as the best time to sell. If there are better stocks to own, it’s worth selling.

Investing based on the value of a business takes patience. It takes time to find great deals. Bargains happen. Perhaps the company’s coming out of a tough period. Perhaps the whole market is down. Perhaps no one has noticed this little-known company with huge prospects right now. Perhapsand ideallyyou know something about the company or the industry that will produce a huge opportunity in the next few years.

Research, buy, wait, and watch. The free market rewards the patient and the thoughtful. No one has a perfect record of future predictions, but with care, you don’t have to be. Choose great companies. Do some research. If you’re careful and plan well, three times out of five you can reap the reward of a value investing-based buy and hold philosophy .