What is the CoT Report How to read the CoT Report

Post on: 17 Май, 2015 No Comment

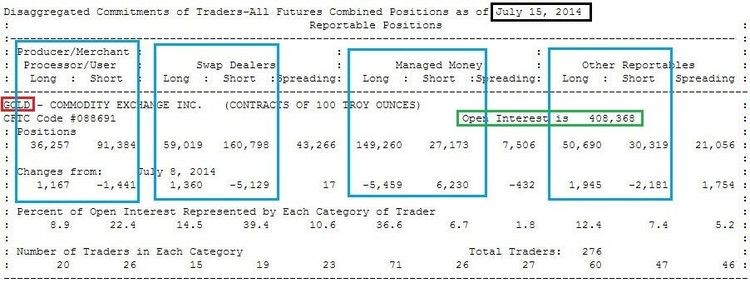

COT, or CoT is an acronym for Commitment of Traders, released every Friday at 3:30PM EST for the Open Interest (OI) in different markets. It is published by the CFTC, US Commodity Futures Trading Commission and releases data for the Open Interest for the previous Tuesday. The CFTC starting publishing the CoT reports since September 2009. The CoT report gives details on the open interest of traders across different markets such as commodities. metals. financial instruments etc and where a minimum of 20 traders or more hold positions that equal to or above the reporting levels.

The CoT is a report on the overall position of the commodity exchange, namely the COMEX or NYMEX.

The participants of the Commitment of Traders report are classified into three categories.

- Commercial Traders (ex: Hedge Funds Institutions)

- Non-Commercial Traders (ex: Large Speculators such as JP Morgan, BullionVault, etc)

- Non Reportable (ex: small speculators)

The report that is published takes into account all three, but due to the fact that first segment of Commercial Traders hold the largest positions who buy or sell contract for delivery along with non-commercial traders who speculate purely for profit are often considered in the report.

What is Open Interest in the CoT Report. Open interest in the report is nothing but the sum of Non-Commercial and Non Reportable who have taken a long position

The CoT report is useful to help traders/investors understand whether or not to take up a certain position (long or short)

You can access the CFTCs CoT release schedule here .

Reading the Silver CoT Report

Silver CoT Report, published by the CFTC

In order to understand and read the Silver CoT Repor t, we should first take a look at the report and define the various sections mentioned in the report. The Silver CoT Report is published in references to contracts for 5000 troy ounces of Silver and the numbers published are in accordance to this reference. The current format of the CoT report is known as the Disaggregated Report and varies from the previous reports known as the Legacy Reports. While nothing much has changed, the disaggregated CoT report has a bit of changed terminology

- The Producer/Merchant/Processor/User is nothing but the Commercials

- The Swap Dealers/Managed Money/Other Reportables are what is referred to as Non-Commercials

- When reading the CoT report, more attention is paid to the total Commercials v/s Non-Commercials as it signifies the positions taken up by future contract holders against speculators.

- The Long. represents the total number of long positions held from the previous week by either of the main players (Commercials/Non Commercials). Likewise, the Short represents the total number of short positions held.

- The Spreads or Spreading is the total short positions that were held during the long positions. In other words, if Commercials held 2000 long positions with 1500 short positions, then the report shows 500 long positions with 1500 in spreading.

- The Changes in the Commitment shows the difference from the previous weeks report and gives insights in how the positions are being changed.

If you are interested to learn more about the reports and how the data is collected, click here .

Summarizing the COT/Commitment of Traders Report

The COT Report has been gaining more popularity in recent times. The CoT report basically shows the difference between trading positions taken by the speculators and commercials. The Commitment of Traders report shows the balance between the buys and sells held in the futures markets, expressed in different markets such as currencies, commodities, precious metals and so on. The report is published once a week by the CFTC. Reversal in trends can be often identified by the CoT report which would show either the speculators or the commercials either dumping or loading up their positions.

The CoT report as a standalone analysis report does not help much and neither is it useful for short term or even intraday trading strategies. The CoT report is more suited for long term traders because the data published tells you what has happened in the past. In the long term perspectives, certain cycles can be identified.

For the short term or intraday trader, using the CoT report can be beneficial in order to put things in perspective and looking back into the data for the past few weekly reports can help give a sense of direction for the future direction of the trend.

EDIT: After looking around for a while, I came across CME Groups interactive chart for CoT. You can access this interactive and free CoT tool from here or view the embedded silver COT Report .

CoT Report More Resources

Trade Stocks and Commodities with the Insiders: Secrets of the COT Report (Wiley Trading) — Written by Larry R. Williams, who is perhaps best known for his Williams %R indicator, the book, Trade Stocks and Commodities with the Insiders is a great reading resource for those who want to learn about the CoT report like a story. Having read this book, I would definitely vouch for this as a great starting point. CoT report is helpful not just to read what the smart money is doing but also helps to build a strong basis for trading methods such as Supply/Demand trading.

CoT indicator for MT4 is a great indicator that was developed based off Larry Williams book mentioned above. It features some great tools including Open Interest, CoT Index and allows you to view data based on Commercials/Non-Commercials and Speculators.