What is the best way to invest money for 5 years

Post on: 16 Март, 2015 No Comment

Like many people around this time of year, I received a nice little check from the IRS for my 2011 tax return. I started thinking of all the things I could do with the extra money a 47 plasma TV, maybe an iPad, or some new ice hockey goalie equipment. You know, the important things in life. Also on the list of things I want, however, is a luxury condominium with a sweet view of downtown. Except that costs more than any tax return that I will ever see. I figure Ill be ready to buy a home in about 5 years (because 5 year plans never go wrong) and as a result, it is probably about time that I start saving for it. So I decided to put my big screen TV hopes on hold and put the tax return money towards my future home. But that was as far as I got before I realized I didnt know where to put it.

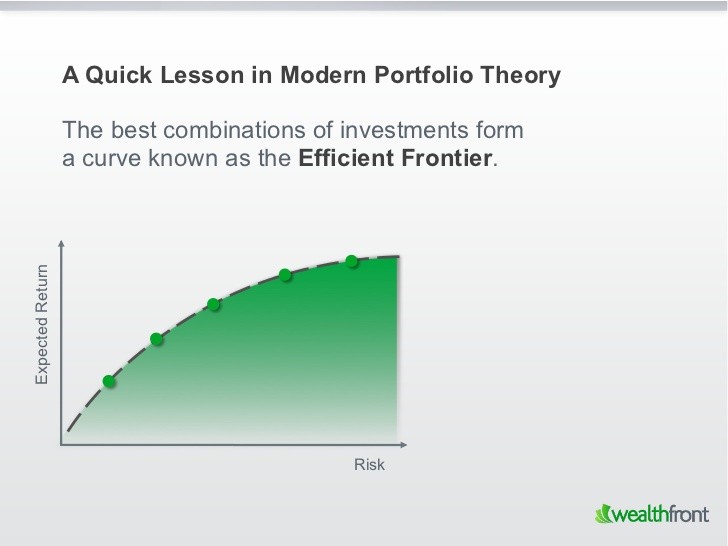

Where should I put money that I need in 5 years? The 5 year investment is tricky, because it is short enough that you cant afford the stock market risk like you can with a 20 year investment horizon, but long enough that it would be silly to let it sit in a non-interest bearing account. There are a couple of basic options out there. There are your standard savings and rewards checking accounts, Certificates of Deposit (CDs), and finally, investment accounts. These days savings accounts wont get you much more than 0.75% APY, and even the best 5 year CD will only get you 1.80% APY all according to bankrate.com. (Also check out Smartmoney.coms take on the best short term investments). These options dont even keep up with inflation, so 5 years from now your spending power will actually be reduced as a result of putting your money in these low yield accounts. If you want the chance of earning interest greater than inflation, you are stuck with investment accounts which is kind of scary.

At least with the savings accounts or CDs you know that in 5 years your money will actually be there. But if you invest in stocks and the market goes bad that luxury condo youve been dreaming of quickly turns into a suburban town home. Just because you open an investment account, however, doesnt mean that you have to invest in all stocks. In fact, you probably shouldnt. As described in the my asset allocation post. a sound retirement portfolio will include bonds and treasury notes in addition to stocks. Those who are 40 years from retirement can afford to take on much higher risk (because they have a long time to make up potential losses) and are recommended (according to Vanguards target date funds) to invest in 90% stocks and 10% bonds. Those who are only 10 years from retirement are recommended to invest 66% stocks, 32% in bonds and 2% in cash. You can see the increase in bonds (in blue) as you get closer to the retirement goal in the graphic below from Vanguards website.

What asset allocation is best for a 5 year investment? When I started thinking of the Target Date Funds progression to less risky assets, it suddenly hit me. The 5 year investment is an awful lot like your target date fund investments when you are in retirement. And think about it: When you are in retirement you certainly cant afford for your nest egg to take a big hit in the market, but you need continued appreciation to try and live off the nest eggs interest. So what exactly does an in-retirement asset allocation look like? I went straight to Vanguards website and copied down the asset percentages for the 4 funds shown below. On the chart, the risk and expected rate of return decreases from left to right. Ive included two target date funds that have a target retirement date close to 2012 just as a comparison, but it is the allocation percentages from the Vanguard In-retirement fund (VTINX) that you will want to use. While I was looking on the website I came across Vanguards Life Strategy funds. which believe it or not, have a fund specifically designed for 3-5 year investment horizon (VASIX). This would also be an reasonable asset allocation, though it is more conservative than VTINX; likely due to to the fact that that it is meant to be used to save for something as soon as 3 years away.

What kind of return can I expect from these funds? Keep in mind that because this is an investment in the stock market and bond market, there is no way to predict your annual yield over 5 years. BUT, based on the asset types in each fund we can make an educated guess about what kind of returns to expect over the long run like 20 plus years. I know in some ways that is not helpful because we are looking at a 5 year window, but that is the best we can do; it is impossible to predict an investments 5 year return with any accuracy. With that said, over the long run, I figure that these funds will average a 4% return annually. Why is that? The goal of most in-retirement funds (at least Vanguards) is to get a 4% return. The idea is that while in retirement, you can spend 4% of your nest egg every year, but by earning 4% through investments, your nest egg never loses value. Since Vanguard advocates for using the 4% rule in retirement planning calculations, I have assumed that their retirement investments (such as VTINX) are structured to provide roughly the same return. As it turns out (see graph below) VTINX has actually averaged a 5.30% average annual return since its inception (which was only 8 years ago so the numbers dont mean that much).

Morningstar.com provides the actual (not average) annual return in each year since 2003. This look shows how volatile the annual yield can be, ranging from negative 10.93% in 2008 to a positive 14.28% return in 2009. What Im trying to say is this: if you invest in VTINX and keep it for 30 years, your average annual return would probably be around 4%. However, it is entirely possible that for the 5 year window between 2012-2017 (when you own the fund) the fund would have an average annual return of 10%, or even 1%. It is riskier than a CD, for sure, but it is certainly well managed risk. And besides, 4% return on my investment sounds pretty good to me, especially when I can only get 1.8% with a CD.

OK. Youve convinced me. But I dont have an investment account, so what do I do? It is pretty easy:

- Open a Vanguard or Schwab investment account. Make sure that you are opening an investment account and not a retirement account like an IRA, Roth IRA or 401(k). Why those two firms? Both Vanguard and Schwab allow you to buy their brand of ETF index funds (which have the lowest expense ratios ) for free. FOR FREE! There are no other investment firms out there with this kind of access to index funds, and as explained in my Target Date Fund Series. I think buying index funds (not individual stocks) is the smartest thing you can do. In addition Im consistently impressed with the advice and service that I get from both these firms (yes, I have accounts at both).

- If you open a Vanguard account and are going to invest more than $1,000, then you can simply buy the VTINX ($1,000 minimum) or VASIX ($3,000 minimum) fund mentioned above. If you are starting out with less money you will have to buy 3 or 4 index fund ETFs to mimic the asset allocation of either VTINX or VASIX. But dont worry, Ive made it easy for you take a look at the chart at the bottom of the post. It gives you the symbol of the ETF you should buy (right hand side) along with the percentage of your investment that you should spend on each ETF. Two quick notes if you want to mimic the VTINX asset allocation: First, To put 5% in cash, you wont have to buy a particular fund, just leave 5% of your savings unspent in the account. Second, if you have a Vanguard account they dont have an ETF for inflation protected securities, so just put that extra 20% in the BND fund.

- Keep adding to your investment account (use the same percentages detailed in step 2).

- Rebalance every year.

- Buy a home! (or whatever else you have been saving for)