What is the best Portfolio diversification strategy

Post on: 15 Июнь, 2015 No Comment

This is the fourth blog post that I have written in response to several questions asked by an accountancy student from the University of the Philippines Visayas (Cebu Campus) regarding the Philippine stock market. As I have said before, I have responded via a blog post because the answers I am giving are quite lengthy not to mention the chance and opportunity to inform the public about value investing and investing in the Philippine stock market.

The previous questions and answers to such questions are found in these posts:

Actually this is a series of questions that were raised in a comment. To appreciate and learn more from her questions, I suggest that you read the previous posts. The next set of questions is as follows

. Now, we’re down to the portfolio diversification and security selection. Which industry do you think is appropriate to invest in during these times? Actually, we have ‘randomnly’ picked some companies (given the many listed companies at PSE) without no basis at all. we’re still undecided as to the allocation percentages but we’re putting more weight loss on IT, Food and Beverage, Medical and Telecommunication.

Here is my response to the above questions:

Dear Enji,

Sorry for the late response, I had been busy with other matters

Your question talks mainly about portfolio diversification. Although you seem to be asking two questions, the second one being “Security selection.” Both questions can be given a single answer. You will have to read between the lines to know what the answer is. (Anyway I will give you a conclusion):-)

Wikipedia defines diversification in finance as “a risk management technique, related to hedging, that mixes a wide variety of investments within a portfolio.” Another definition of diversification given is that it is “the spreading out investments to reduce risks.”

In other words the main purpose of portfolio diversification is to reduce risk. In lay man’s term it is, proverbially speaking “Not to put your eggs in one basket.” Of course everybody understands the meaning of that and that is if the basket gets lost, you loose all your eggs. Therefore according to this theory, in investing in the stock market you should not put your investments in one stock or place it in several stocks in the same industry because if the stock goes down, then your investment goes down the drain as well.

Portfolio diversification is plain and simple common sense. A sensible man would indeed adhere to this theory.

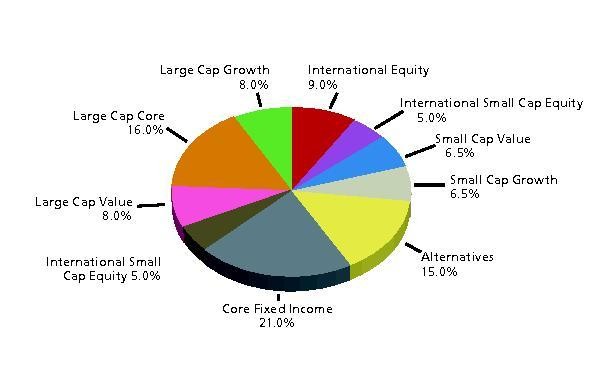

Portfolio diversification in finance usually involves three stages. First, the portfolio is distributed among multiple investment vehicles, such as stocks, mutual funds, bonds, and cash.

Secondly the risk in investments is varied by applying portfolio diversification in the different vehicles of investment. For example investment in mutual funds are diversified to funds that use different strategies (Examples of such are growth funds, balanced funds, index funds, small cap, and large cap funds)

In the stock market, portfolio diversification may be done by industry. For example, instead of putting all investments in a certain property stock, the investments are spread out in other industries (such as holdings, financials etc. )

The last stage is diversification by geography, that is investments will be distributed in industrialized nations, emerging economies, among others to maximize the rate of return.

As you can see diversification is very simple and requires only plain common sense. In the Philippine stock market since we only have six industries (financial, industrial, holding firms, property, services, mining and oil), professionals would recommend that in order to apply proper portfolio diversification, you should place your stock in two or three industries. They would add that investing in all industries is all securities would be ideal since the more “baskets” you put your eggs into; the more the risk is reduced.

This is the heart and soul of portfolio diversification in Modern Portfolio Theory. MPT teaches that rational investors will apply portfolio diversification in their investments to reduce the risk of loss and to maximize their returns. The more you portfolio diversification there is, the more you reduce risk.

You cannot believe the math involved in MPT when it comes to portfolio diversification. It is not your ordinary day today. It involves doing math the “has greek letters on it.” The math involved is beyond the comprehension of the ordinary investor. In MPT, the selection process for a certain security to apply the portfolio diversification theory becomes very mathematically complicated that to come up with a solution quickly you will need to plug the numbers into the computer. Somehow this gives the ordinary investor a feeling that investing in the stock market is best left to the “professionals.”

So now you know what most investment professionals teach about portfolio diversification. As always after I tell you what the “norm” is, I will also point out to you what Warren Buffet thinks about portfolio diversification. According to Warren Buffett, diversification “. is a protection against ignorance. It makes very little sense for those who know what theyre doing.”

Weird hugh. So why does the Oracle of Omaha issue such rash statement about portfolio diversification, a principle that makes a lot of common sense? To understand this let me explain.

Let me point out that Buffett is not totally against portfolio diversification. The most number of stocks he holds in publicly listed companies is about 15 or less. However take note of what he said about portfolio diversification through investing shares of stocks in all stocks in the stock market, By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals. (Investing in all stocks in the stock market is best achieved through investing in an index fund, that is a mutual fund that mimics the return of a certain stock market by buying shares of stocks in all stocks listed in a certain exchange. One Philippine Index fund I know is the Philequity PSE Index Fund)

What Buffett is against is “over diversification” this includes most of the portfolio diversification theories that are taught in Modern Portfolio Theory.

Warren Buffett used to quip, I cant be involved in 50 or 75 things. Thats a Noahs Ark, way of investing you end up with a zoo. I like to put meaningful amounts of money in a few things. Instead of portfolio diversification, what Warren Buffett is strongly recommending is “focus investing.” Focus investing is simply limiting your portfolio to a few stocks that is a few wonderful companies that has durable competitive advantage. Take note that his above statement on portfolio diversification through investing in an index fund is directed at the “know-nothing” investor. If you are an investor who knows what you are doing in the stock market here is Warren Buffet’s advice when it comes to portfolio diversification:

If you are a know-something investor, able to understand business economics and to find five to ten sensibly priced companies that possess important long-term competitive advantages, conventional portfolio diversification (broadly based active portfolios) makes no sense for you.

Robert Hagstorm in his book “The Warren Buffett way” explains one of the reasons why Warren Buffett’s “Focused investing” approach makes more sense than the traditional MPT portfolio diversification approach. In page 25 of the Warren Buffett Way Hagstorm writes, “Whats wrong with conventional portfolio diversification? For one thing, it greatly increases the chances that you will buy something you dont know enough about. Philip Fisher, who was known for his focus portfolios, although he didnt use the term, profoundly influenced Buffetts thinking in this area. Fisher always said he preferred owning a small number of outstanding companies that he understood well to a large number of average ones, many of which he understood poorly. “ (Click here to get a copy of “The Warren Buffett way at my Guerilla blogger eStore )

In his 1993 Chairman’s letter to shareholders Buffett has this to say about portfolio diversification “The strategy weve adopted precludes our following standard portfolio diversification dogma. Many pundits would therefore say the strategy must be riskier than that employed by more conventional investors. We disagree. We believe that a policy of portfolio concentration may well decrease risk if it raises, as it should, both the intensity with which an investor thinks about a business and the comfort-level he must feel with its economic characteristics before buying into it.”

So there you have it! The first reason why you should focus your investment in only a few outstanding stocks is because it will increase your chances of buying something you don’t understand. Over portfolio diversification will also make you have too many companies to monitor. You will never get to know each company very well. This goes against the very heart of value investing and that is that you must only invest in something that you understand. Buffett likened “over portfolio diversification” to having a harem of 40 women. According to him “. you never get to know any of them very well.” Add to this is the fact that over diversification will divert your focus and energies from truly sorting out the wheat from the chaff.

The second reason as to why investor’s should follow Buffett’s focused investing approach is discussed by Timothy Vicks in his book “How to pick stocks like Warren Buffett.” In pages 60 to 62 of said book, Vicks mentioned a study conducted by Robert Hagstorm in 1999. He writes that based on the study, “. portfolios with the largest number of stocks tended to post returns that barely deviated from the mean return of all similarly sized portfolios. The smallest portfolios, in contrast, offered the highest deviation of average returns. “ (See table below) (Want to get a copy of “How to pick stocks like Warren Buffett Click here )

So, the second reason why investors should avoid over diversification and should maintain a focused portfolio of a few outstanding companies with a durable competitive advantage is because this gives the investor a much greater chance of beating the market.

Now going back to your question as to which industry you should invest in for portfolio diversification purposes the answer is, ANY COMPANY IN ANY INDUSTRY for as long as these are wonderful companies with durable competitive advantage! As to what are wonderful companies with durable competitive advantage that question has to be answered in another post. I’ll probably include that in the next post since I will be answering your questions on valuation techniques.

I hoped I have filled your day once again with simple and practical wisdom from the world’s greatest investor.

Till then,

The Guerilla blogger-investor

Hi. my name is Zigfred Diaz, Thanks for visiting my personal blog. Never miss a post from this blog. Subscribe to my full feeds for free. Click here to subscribe to zdiaz.com by Email

You may also want to visit my other blogs. Click here to learn stock marketing investing. Click here to learn more about How to Earn cash online. Visit my travel blog to learn more about great travel ideas .