What Is The Best Method To Find Day Trading Strategies That Work

Post on: 16 Март, 2015 No Comment

Many investors and traders are confused when looking for a day trading strategy that works. They often think that in order to be successful, a strategy has to be complicated and hard to understand. From my experience, the opposite is true. Often the best trading strategies are simple in nature and are not that hard to understand. This does not mean it is easy to develop a quality trading strategy that works over time, just that once discovered it is often surprisingly simple in concept. Of course there are working strategies that are super complicated and are next to impossible for a non-math wiz to understand but there are the exception rather than the rule.

One fact many market participants might be shocked to discover is even the high frequency trading models (HFT) are often based on simple concepts. The trick is they can calculate and execute in fractions of a second, and have access to loads of historical and statistical information to help improve results. The key here is the implementation is complicated and expensive for these types of systems which puts them well out of reach for anyone but the largest brokerages and hedge funds.

The first thing anyone should do when looking to develop a day trading strategy is to decide on what type of strategy it will be. Will it be a trend following strategy or a counter-trend strategy? A trend following strategy only looks to trade in the current direction of the trend. A counter-trend strategy on the other hand, looks to fade moves and go against the trend in potential reversal areas. Without identifying what you are looking to create, it is very easy to go down the wrong path or start trying to make a jack of all trades system. Most of the time you end up with something that does not work if you do not focus your efforts into a specific type of trading system.

Once you decide on what type of day trading strategy you want to work on, the next step is to identify what markets you are looking to exploit and what time frames you will trade. Each market trades in similar but unique ways. Stocks trade differently than do futures. Commodities trade differently than Forex. It is very unlikely to be able to develop a trading strategy that is able to work on all markets it is simply too hard. Again focus is the key. Gravitate toward the market where you have the most experience in trading as this will help you in your development efforts. Additionally, it is important to look at the time frame of the market which in turn deals with the type of trading system. On a very short term time-frame such as a 1 minute chart, most systems are scalping based systems which look to take small profits. On larger time-frames the profits are larger because the market has more room to make bigger moves. The trade off is the risks involved and the frequency of trading. Shorter time-frames have lower absolute risk per trade (stop losses are much closer) and more frequent trades. Longer term time-frames have higher absolute risks per trade and do much less frequent trades.

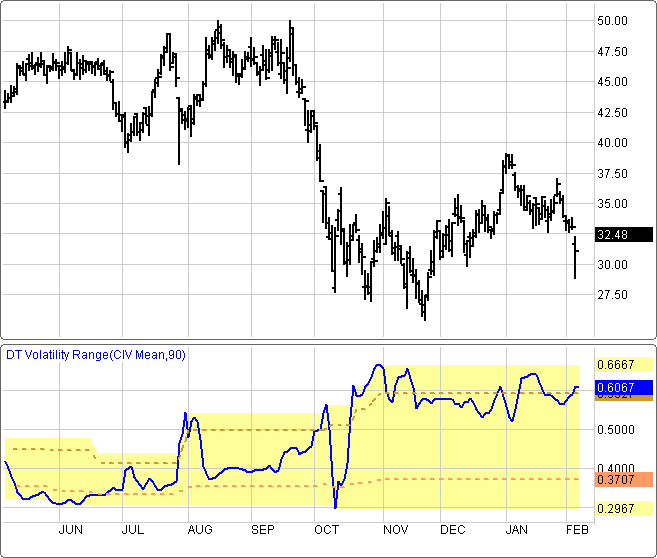

Once you have determined the type of system, the trading frequency and the market to be traded you can begin to study the market. One of the best things to do initially is to put some indicators on a chart such as moving averages, stochastic or MACD. It is unlikely that any canned indicator will be profitable as a trading system itself over the long haul. What you are trying to find is a starting point to begin working. One thing to keep in mind is to focus on a long period of time. Even if you are working on a short term scalping system on a 1 minute chart it is important to test your ideas and theories over at least a few years of data. It is very easy to focus on a few months of time and develop something that works because it is in sync with the market action over that time. When you move beyond the tested time it falls apart. Stick to ideas that have universal appeal rather than focusing on short term volatility patterns which do not repeat. Many traders have lost a lot of money trading a system that is correlated to short term patterns that do not repeat because they did not test the idea properly.

Another idea to keep in mind is often your initial idea will be wrong but the opposite will be true. For example, lets say you have developed a method to enter longs using modified moving averages and volume as a trigger. It works over a few months of time but then the equity curve of results heads straight down over the long run. This is a very good indication that if you did the opposite you would have the start to a winning system. From my experience over the years, I have many more day trading strategies that were developed from failure than I do from being correct on my first try. The reason this happens is actually quite simple. Each trade is simply an odds be that it will move X in your favor before moving Y against you. If the Y happens first most of the time you will lose if you trade that system. However, if you reverse the system and target Y instead of X (going the opposite direction) you now have something that works.