What is Technical Trading

Post on: 7 Июль, 2015 No Comment

What is Technical Trading: An Introduction to Technical Trading

Those new to the world of investing and trading quickly get confused when introduced to technical trading. The confusion is easily understood. With terms like “Fibonacci number,” “candlestick charts,” “Bollinger bands,” “stochastic oscillator” and “Elliott wave,” how could a newcomer not be totally bewildered?

What is Technical Trading: The Theory Behind Technical Analysis

The general theory among technical analysts, sometimes called “chartists” or “technicians,” is that future price movements in a stock can be predicted from historical prices and volume data. While no one knows for certain when, or even if, history will repeat itself, there are traders who have used technical analysis to amass fortunes trading stocks and commodities. Pioneer traders like Paul Tudor Jones and Ed Seykota have utilized technical analysis to reveal patterns from which they have traded, yielding millions of dollars in profits.

But can you identify these patterns and trade them profitably? That’s something you’ll need to decide for yourself. But the following information will provide an introduction to the potentially profitable world of technical trading.

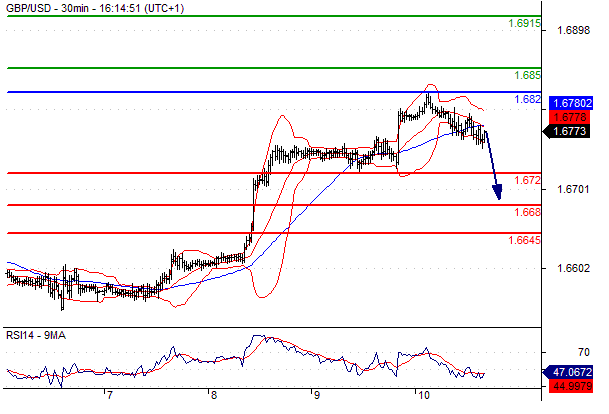

The technical analyst’s primary tool is the stock chart. A stock chart records the price movement of a stock over a fixed period of time. With this price information, the analyst will use a variety of other methods to manipulate the data to show potential points to enter or exit trading positions.

The most common chart is a line chart. Typically, only the closing price of the stock is recorded, with all of the previous daily closing prices connected by one continuous line. This is a very popular type of chart used on Web sites, on television and in newspapers.

Another popular chart among technicians is the candlestick chart. Developed by Japanese rice traders, the candlestick chart shows a great deal of information quickly. In a candlestick chart, each day is recorded by one candlestick. Each daily entry consists of the “body” of the candlestick, as well as the “wick,” or the tail extending from both the top and the bottom of the candle. Essentially, the candlestick looks like an upright candle that has been burned at both ends.

The prices on the chart where the candle begins and ends represent the closing and opening prices of the stock. The wick — the line extending above and below the candle — shows how high and low the stock traded during the day. So from one candlestick, the technician can see the stock’s opening and closing prices and the daily trading range. Some charting software provides color or shading to the candlestick to indicate a daily loss or gain.

Japanese candlestick charts provide the chartist a quick overview of a stock’s essential price movement for that day, and over time.

There are other types of charts also used by market technicians, including bar and dot charts. Charts can also be set up for differing time durations, such as weekly or monthly charts. So rather than charting data daily, the price is recorded once for the week or month.

There are a variety of chart types and durations. Technicians can mathematically manipulate the data from the stock chart to develop entry and exit points for their trades. A common method is by overlaying the results on top of the chart to find these points to open or close trades.

What is Technical Trading: Overlays & Moving Averages

Moving averages are some of the most common and simple technical indicators to understand. The moving average calculates the average closing price over a specified number of days. So, for example, to calculate a 10-day moving average, simply add the last 10 closing prices and divide that number by 10.

Before looking for fresh batteries for the calculator, understand that there are both computer software and Web sites that will do these calculations.

Short-term trends can be identified with a 10- or 20-day moving average, but the duration of moving averages can be longer. Some traders use a 50-, 100- or 200-day moving average to show long-term trends in the markets.

Moving averages laid on the top of stock charts can show the technician market trends, turning points in price movement and how quickly a price is rising or falling.

What is Technical Trading: Overlays & Trend Lines

A trend line is drawn over the top of a chart by a technician outlining the general trend of a stock. The technician will watch for the stock price to deviate away from the general trend to identify when to exit a position.

Multiple trend lines can also be used. A channel can be created by drawing a trend line at the upper and lower ranges of the trend and extending the trend lines into the future. If the stock price then goes outside the channel, the trend has broken down and signals the technician to close out a position or, possibly, open a new one.

It’s been said that the trend is your friend. Trend lines help technicians identify those trends, identifying when to get in and out.

What is Technical Trading: Overlays, Support & Resistance

Ever notice that a stock will go down to a certain price level, but never below it? This is commonly called “support.” At this particular price level, the general market realizes that the stock is being sold at an attractive price, and buying support comes into the market to prevent the stock from going any lower.

The opposite is also true. A stock that keeps going up to a certain price repeatedly only to then fall back again and again is facing resistance. At this resistance point, the general market realizes that the stock is overvalued. At this point, owners sell, believing the stock can’t go higher. The selling keeps the price from exceeding this price level.

Identifying support and resistance points for a particular stock can give the trader entry and exit points for a potential position.

What is Technical Trading: Statistical Indicators

Price data can also be manipulated using statistical models, showing the technician possibly profitable trades. These statistical methods were originally developed for scientific uses, but have also been effective in assisting traders in the markets.

A common statistical indicator is the relative strength index, or RSI. Relative strength weighs moving average prices separately for days, measuring when the stock increases or decreases. The resulting indicator shows when a stock is considered overbought and likely to decline, or when the stock is oversold and likely to rise.

Other oscillators, such as stochastics, also identify overbought and oversold conditions in a stock. Typically, these oscillators use a scale other than the price of the stock. And oscillators can be adjusted for long- and short-term trading horizons.

Statistics-based trading indicators can be used alone or in combination with overlays and volume indicators to help traders profit from market movements.

What is Technical Trading: Volume-Based Indicators

Rather than focusing solely on price, volume indicators identify changes in the daily trading volume of a stock. Some indicators can take into account changes in volume, as well as price.

On-balance volume is an indicator using solely volume. With zero as a neutral point, volume of stock traded is added or subtracted as the stock price increases or decreases. On-balance volume is typically used to confirm price movements in a stock and reduces the effects of sudden price fluctuations during a primary trend movement.

Money flow is a common volume indicator that also accounts for changes in price. Rather than using just price, volume is calculated to determine an average valuation of the amount of stock traded over the last period. As the valuation changes in relationship to previous time periods, the technician can determine if money is moving into or out of the stock.

Smart technicians know that price isn’t the only piece of data out there to use when developing trading strategies. Many smart technicians use volume indicators just as often as price indicators in their trading.

The list of those critical of technical analysis is also quite distinguished. Warren Buffett, aka the world’s richest man, a renowned value investor, has chided technical analysts by saying that he turned the chart upside down, but the technical analysis still gave him the same answer.

But technical analysis continues to be used by more and more traders. It’s not uncommon to hear commentary in the media about how a stock is trading in relationship to its 50-day moving average. Some market watchers believe that most trading done in the foreign currency markets is based on technical analysis.

The debate over fundamental and technical analysis will continue to be discussed well into the future. But until then, professional traders will continue to rack up big profits using technical analysis in their trading.