What is Swing Trading

Post on: 12 Август, 2015 No Comment

August 30, 2011 By David Penn

When it comes down to it, there are three ways to trade and invest in the stock market.

Buy and hold. Day Trading. And Swing Trading.

Buy and hold is the way we used to invest or more likely, the way your parents invested their money in olden times.

The good news is that buy and hold is perfect for uninvolved disinterested investors. The bad news is that buy and hold doesnt work.

Buy and hold can trap your money during times when the market as a whole is going nowhere. Even worse, if the market really starts falling, buy and hold could result in serious investment losses.

Click here to learn how to utilize Bollinger Bands with a quantified, structured approach to increase your trading edges and secure greater gains with Trading with Bollinger Bands® A Quantified Guide.

The other extreme is day trading. The world of day trading is a professional, Wall Street world with tons of expensive analysts and rooms full of even more expensive computers. And while the pros can make a lot of money day trading, this is a game the average trader or investor just cant compete in.

That leaves swing trading the sweet spot between buy and hold investing and day trading. Swing trading is ideal for independent traders because unlike day trading you dont have to be glued to your screen all day making hundreds of trades.

With just a few trades a week, a few minutes a day, swing trading only puts your money to work when there are real opportunities in the market. The rest of the time your capital is safely in cash, earning interest and waiting for the next chance to strike.

The fact that swing trading means not just leaving your money sitting in the market all the time is worth repeating. The truth of the matter is that stocks never move in a straight line. Any one whos been watching the stock market over the past few years knows that. But what you might not know is that this fact is what makes swing trading work. Swing trading allows you to trade stocks whether the market is moving up, moving down, or moving side to side.

In a market thats moving up, swing trading will help you catch the big move when stocks that have pulled back rally into strength.

In a market thats moving down, swing trading will help you catch the reversal when a stock has bounced too far too fast and is ripe for a retreat.

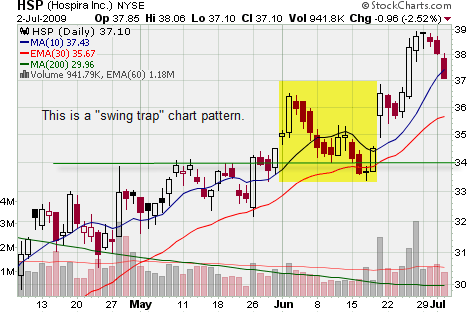

And in sideways markets, swing trading will help you do both catching both the big moves and the reversals as the market moves back and forth in its range.

Why does this work?

This approach to swing trading is based on decades of research into stock price behavior, research that goes back to the early 1990s. What this research said then and continues to say is that short term trading strategies that buy stocks after they have pulled back outperform short term trading strategies that buy stocks after they have rallied.

This insight may surprise you. Most traders have been educated to believe that buying strength is good and that buying stocks after they have pulled back is dangerous.

But this is why we prefer quantitative analysis and a cold, hard look at the data over stock market myths and folktales. And the data is clear: in the short term, stocks that have pulled back outperform stocks that have rallied.

You can read all about this research in books like Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs by Larry Connors and Cesar Alvarez. First published during the financial crisis of 2008, this swing trading classic is now available for free at TradingMarkets.com.

Click here to learn more about Short Term Trading Strategies That Work and to indicate your preference for a free digital download of the book (as a pdf file) or a free paperback copy. Take the time to read the research for yourself. You might be surprised at what you see.

But you know who isnt surprised by these insights? Professional traders. From Wall Street pros to hedge fund traders to the market makers on the floor of the Exchange every day, buying stocks after they have pulled back is an open secret among professionals.

The challenge for the independent trader is to learn how to find the stocks that are pulling back and the stocks that have rallied too far too fast.

Swing traders use a variety of tools, but more important than the individual tools a swing trader chooses are some of the fundamental concepts swing traders must keep in mind. These are not folktales or common sense notions handed down from trader to trader. These are basic key principles of swing trading that have been statistically quantified and tested. They have stood the test of time, and have been at the core of our success and that of thousands of professional and independent swing traders for decades.

Quantify Everything

Click the link below to read an extended interview with Larry Connors, swing trader, author of Short Term Trading Strategies That Work. CEO and founder of TradingMarkets.com and Connors Research home of The Machine. You can follow Larry on Twitter @LarryConnors1 .

Connors: A lot of what I went through is probably the same process that most people go through. Its almost a sense of self-discovery. When I was first learning how to trade and again this goes back into college there wasnt a lot of information out there on how to properly trade. Value Line was available in our college library. But as far as trading goes, there wasnt any one place that one could learn how to trade, and what was interesting is that pretty much led its way all the way up into the mid-1990s where theres just a lack of credible information out there on how to properly trade

Markets do change. What doesnt change is human behavior. Essentially what we are doing is quantifying human behavior. We are buying at extreme times we tend to be entering positions when theres extreme fear out there. When were selling stocks or ETFs short we are shorting into positions where there tends to be a great deal of greed in the marketplace

The second misconception is that trading skill can be learned overnight. People go to college for four years. A medical student goes to medical school for an additional four years and if they want to become surgeons there are additional years of training after that. My roommate from college is a surgeon. I watched what he went through. He started the process when he was 18. He was done with his schooling at 35 years old and he still goes to conferences throughout the world, always looking to get better. It took him 17 years because of the type of surgery he specializes in before he was allowed to operate on his own.

Trading skill is similar. It cant be developed overnight. It really does have to be learned and experience is the best teacher of them all

For more on swing trading, be sure to visit TradingMarkets.com or click here to subscribe to our free, no obligation, daily e-mail newsletter, 7 Stocks You Need to Know — delivered every evening after the market close.

And to learn more about the upcoming semester of the Swing Trading College, click the link below.

David Penn is Editor in Chief of TradingMarkets.com