What is Spread Betting Total Spread Betting

Post on: 16 Март, 2015 No Comment

W hat a good place to start. So lets try and answer the question of what is spread betting for you. Spread Betting or Financial Spread Betting as it is some times known is.

A derivatives product that allows you to trade on the price movement of lots of different markets including currencies, stocks, indices, commodities and other markets.

Well, thats great thank you Wikipedia for that wonderful explanation. However, if you are just starting out on your financial spread betting journey or you are a complete spread betting beginner, then maybe a little bit more of an explanation might be in order.

Its all about up and down.

Most things in life go up and down right? Just look at your bank balance. The markets are pretty much the same. The overall price of a market can go up or down too.

I guess we have all caught a bit of a financial report or an announcement on the news saying something like. The FTSE 100 closed today up 45 points at 16,832. Or The NASDAQ closed down 57 points today.

So, from the above we know that an overall market price can go up or down. This is the one thing drives the whole principle of financial spread betting.

You are essentially speculating on what you think the price of a market will do. Either go up or go down. Honestly, that is at the core of all you are doing when financial spread betting.

Yes, we totally agree and its true there are many tools, techniques and strategies that can help you increase the accuracy of our speculations and we cover this some of this in our trading strategies area. However, always keep this simple principle in mind.

Up and down, I get it. But how do I trade it?

You can use spread betting to speculate on price movements irrespective of whether the markets are going up or down.You can go long (buy) i.e. you think the price is going to go up or you can go short (sell) i.e. you think the price is going to go down.

If you go long and the market price goes up your profits will rise in line with any increase in that market. Similarly, if you go long but the underlying market price falls, you will incur losses.

Where does money come into it then?

Do you remember the phase points mean prizes? Well, points also mean prizes in spread betting too (and losses we cant lie, be careful losses can exceed your deposits.). We have also talked about the market price going up and down right? Well, the primary unit of measurement in most markets for the up and down movements is know as a point.

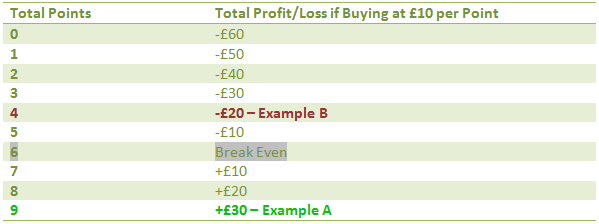

When you place a trade (either long or short) you enter the trade at a buy price for that market. At this point you also decide how much money you want to bet per point. i.e. £10 per point.

Your profit or loss will be dictated by the movement in points of the underlying market.

Take a look at the example and graph below..

- You enter a trade long when the market price is 100

- You decide to bet £1o per point

- The market price then rises 6 points

- You would then make £60 profit (£10 x 6 points)

Dont forget the Spread in Spread Betting?

One of the most important things in our eyes about spread betting is something called the spread. So what is it and why is it important?

Just like other forms of trading, including traditional share dealing, all spread betting brokers and companies quote two prices for all the spread betting markets. The difference between the ‘buy’ price and ‘sell’ price is known as the spread.

- Buy price (price where you go long if you expect the underlying market to rise)

- Sell price (price where you go short if you expect the underlying market price to fall).

The reason the spread is so important is because the market price needs to reach your buy or sell price before you start making money!

We have heard many tales from traders who placed their first ever trade without understanding the spread and had an initial panic wondering why they were running a loss straight away. Thats the spread, so you need to make sure you take the spread into account when setting profit targets and considering money management.