What Is Portfolio Diversification

Post on: 11 Июнь, 2015 No Comment

Definition

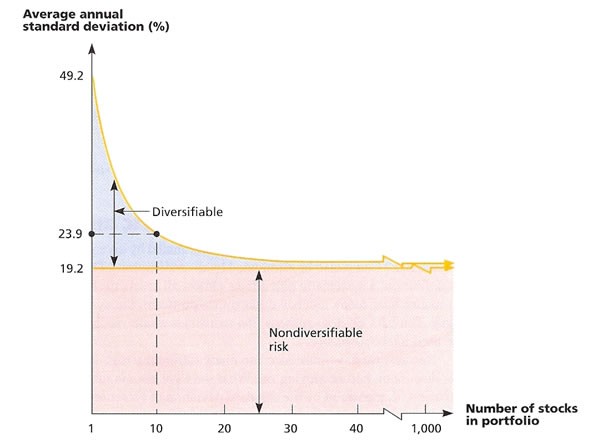

Portfolio diversification is the practice of spreading out portfolio capital into several different areas. A portfolio of ten different stocks is more diversified than a portfolio of five different stocks. Spreading investment capital over multiple financial markets such as stocks, bonds and futures is another form of portfolio diversification.

Stock Market

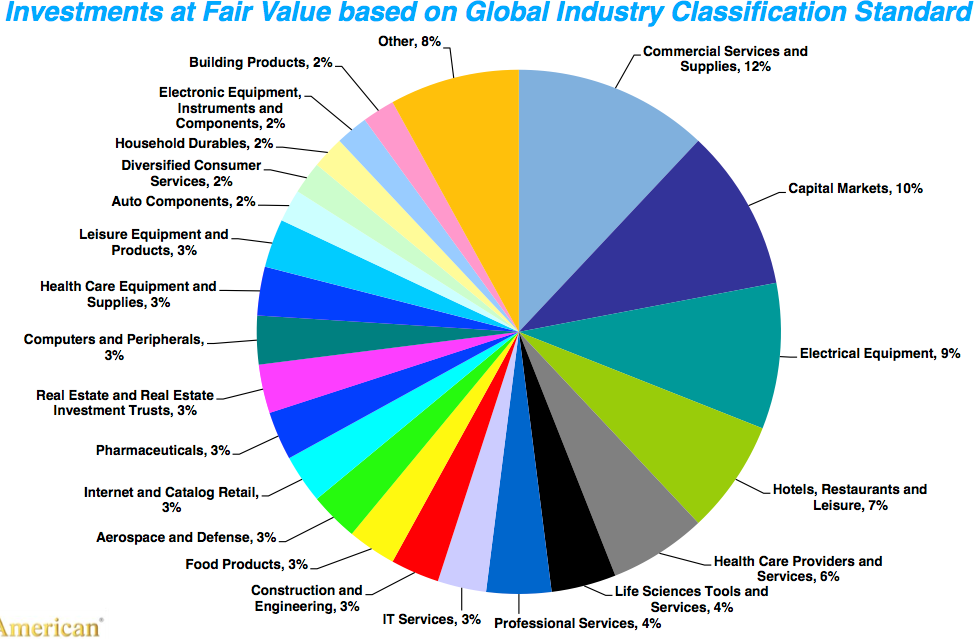

Portfolio diversification in the stock market consists of not only investing in multiple stocks, but investing in stocks representing different sectors of the market. A portfolio that focuses only on one sector, such as technology, is not diversified even if capital is spread over several stocks. This is because the stocks are subject to the same factors and will likely be highly correlated. Instead, someone holding technology stocks could diversify by investing in other sectors, such as pharmaceuticals, real estate and retail.

More Like This

How to Do the Variance of a Portfolio

What Is a Portfolio?

You May Also Like

A robust real estate portfolio remains essential for serious investors. The holdings in a real estate portfolio can range from condominiums and.

Efficient financial management combines safety of principal, alongside opportunities for growth. Diversified investment portfolios are designed to neutralize economic.

The key to a successful investment portfolio is diversification. This means you are not heavily weighted in one sector or stock. Commodities.

The real estate market is often cited for creating many of the world's wealthiest people. The market does pose a small degree.

Diversified portfolios greatly reduce risk while smoothing investment returns by owning many securities across a wide range of industries. This allows investors.

The Advantages of International Portfolio Diversification. The underlying reason for a diversified portfolio is that it is typically less risky than a.

Diversification is a risk-management technique that uses a wide assortment of investments in a singular portfolio. This is to attempt to gain.

Although the rule of thumb for real estate brokers remains a 6 percent commission, in reality that commission is negotiable and can.

Diversification is a way of stabilizing your investment portfolio and reducing risk. The stock and bond markets are made up of shares.

Proper asset allocation plays an important role in the health of your investment portfolio, and ultimately in your ability to meet your.