What Is Liquidity Risk Management

Post on: 16 Март, 2015 No Comment

Liquidity

Liquidity is a relative term that connotes the idea of being able to exit or enter your portfolio position at the time and price that you prefer. Some markets, such as the FOREX market, trade $3.5 trillion of value every day. This means that even the largest investor will be able to sell or buy a position at a moment’s notice at the market price. For an investor in a smaller market, such as penny stocks, one relatively small investor can change the entire market price in a negative direction.

Hedging

Hedging is another risk management tool. Investors purchase non-correlating or negative contracts as insurance on their large positions. For example, if a trader has a large stake in a company, he may buy some inexpensive put options as protection against a rapid drop in price. That is because the value of put options rise when the price of the company falls. Hedgers can also buy an exchange-traded fund or other correlating asset to help protect against liquidity risk. They use correlations to trade more active stocks when their specific one has too little liquidity.

High Frequency Trading

References

More Like This

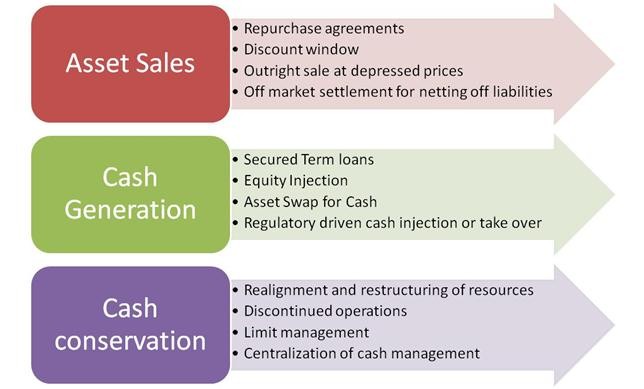

Liquidity Management Techniques

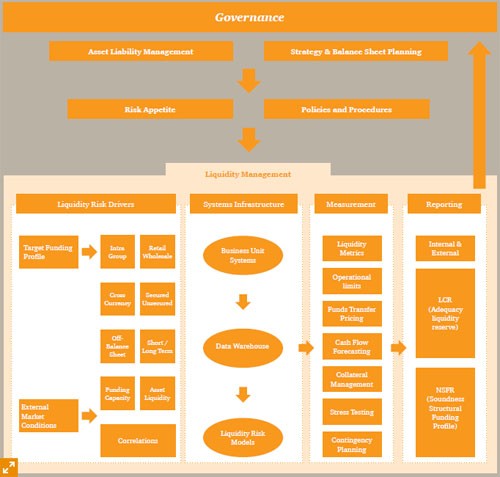

How Do Banks Manage Liquidity Risk?

How to Calculate Liquidity Risk

You May Also Like

A liquidity risk premium is an additional return on bonds that are not actively traded. Illiquid bonds cannot be easily bought and.

Liquidity management means holding cash in the right amounts to benefit a business. Holding cash helps a business take care of emergent.

Banks manage their liquidity risk by carefully monitoring the relationship between their short-term liabilities as opposed to their short-term assets. The management.

Liquid Gold is a brand of wood cleaning and preserving products made by Scott's Liquid Gold. The American company, established in 1954.

Credit risk management is exactly what it sounds like: monitoring risk within a company's or lender's operations. Credit risk management is an.

Comments. You May Also Like. Liquidity Management Techniques. Liquidity management means holding cash in the right amounts to benefit a business. Holding.

Every organization faces some type of risk. In a business sense risk is any threat to accomplishing organizational goals and objectives. In.