What Is Consumer Confidence

Post on: 16 Март, 2015 No Comment

The Consumer Confidence Index may be closely monitored by retailers, economists and industry experts who are trying to gauge the overall health of the economy, but what a confidence index is supposed to measure and what it actually measures may, in fact, be two very different things.

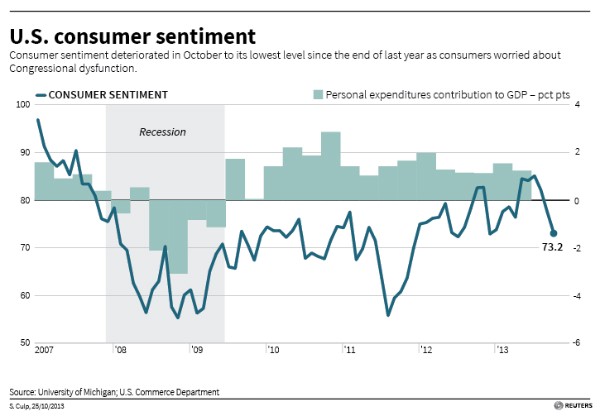

The Conference Board released it latest Consumer Confidence Index earlier this week and Americans’ confidence in the economy, it seems, is rather low. The index says that consumer attitudes fell to 50.4 in July from 54.3 in June due primarily to concerns about the current job market, a drop that has experts speculating that our economy is about to take a dive.

The Conference Board uses five questions to quantify how 5,000 participants feel about the current job market, business conditions and where both will be in the next few months. The University of Michigan’s puts out a similar rating each month. It’s Index of Consumer Sentiment asks 500 people four questions in an attempt to measure essentially the same thing.

Both sets of questions are written in the third person; they don’t ask consumers to talk about how they feel about themselves specifically. Instead, participants are asked to assess the state of the economy now and how they think conditions will be, in general, six months from now. There are only three possible answers the participants can give to these questions: positive, negative or neutral. At no point are answers about personal spending habits solicited.

This can be problematic since how a person feels about the general population doesn’t always dictate what they are going to spend. Consider, for example, a recent MetLife study in which 48% people worried about making ends meets, but they still lent money to struggling family members.

“People might feel bad,” Brad Sorensen, director of Market and Sector Analysis for Charles Schwab, says. “It doesn’t necessarily mean they’ll spend less. There’s no tight correlation between the two.”

According to the Associated Press . economists watch confidence closely because consumer spending accounts for about 70% of U.S. economic activity and is, therefore, considered critical to the economic rebound. Sounds reasonable enough, if you don’t stop to consider what exactly consumer confidence is measuring.

Sorensen explains that the survey’s administers are essentially trying to figure out “how the average American feels.” They do this by looking to two major confidence indexes, one that was recently released by the Conference Board and another that is conducted by the University of Michigan.

Many economists and investors have used the recently released index to revive the idea of a double-dip recession. Robert Shiller, professor of economics at Yale University, for example, told Reuters. For me, a double-dip is another recession before we’ve healed from this recession. The probability of that kind of double-dip is more than 50%.

But the end may not be so nigh, according to others.

Jeffrey Saltzman, an industrial psychologist who has conducted his own employee confidence surveys, says that this type of interpretation involves “reading way too much into it, in some respects.” He agrees with Sorensen that monitoring mood isn’t the same as monitoring hard figures. Saltzman believes that the market tends to react to the index because “people on Wall St. take it at face value.”

For example, a trader who won’t have access to raw data from a quarterly earnings report may use a recently released confidence index to forecast where the stock market is headed tomorrow. The market, in turn, reacts to his forecast based on the index and not the actual spending habits of consumers, which can turn out to be drastically different. This is why, as Sorensen notes, the confidence index has a short-term, but not long-term impact on the rise and fall of stocks

Additionally, Saltzman says that it’s not exactly what these indexes are quantifying, if anything, that gives them credence. Instead, it all comes down to how often they measure the intangible. The Conference Board and the University of Michigan release their consumer confidence surveys each month … and they’ve both been around for decades.

The Index of Consumer Sentiment was actually started first in 1946. The Conference Board’s Consumer Confidence Index, which has grown in notoriety since it surveys more individuals, was started in 1967. Both surveys have changed very little since their inception. Their track record, therefore, has been established by how the scores change month to month, against itself, not the actual status of the economy.

Despite this, Saltzman say there is some merit to the data.

“I could ask you a lousy question,” he points out. “But if I asked you that same question in the same way every single month, I would still have still useful information.”