What Is An Investment Portfolio

Post on: 25 Май, 2015 No Comment

What Is An Investment Portfolio?

or copy the link

One of the trickiest things about getting started in investing is understanding all the jargon and lingo that everyone uses. There are so many terms that are thrown around that it can be difficult to understand just what people are talking about. One of these commonly misunderstood terms is used all of the time in investing. It is investment portfolio. What is an investment portfolio exactly?

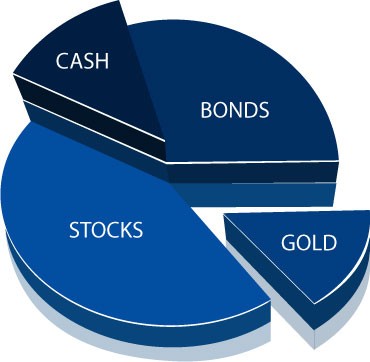

An investment portfolio is a mixture of investment types all held simultaneously, and is a method of decreasing or limiting the risk associated with investing. By balancing the portfolio you limit the risk of being left without investment options or earnings should there be a down turn in any particular area of the financial industry.

Portfolio Items

A portfolio can encompass any combination of investments, including bank accounts, bonds, stocks, warrants, deeds, options, futures, certificates and businesses. Any item that is likely to retain its value and/or produce a return can be included in an investment portfolio.

The types of items included in investors’ portfolios vary based on individual circumstances and investment goals. The first thing you will want to do in establishing a portfolio is determine your investment budget and what goals you want to achieve through investing.

Different kinds of investment vehicles offer different rates of return. Each vehicle carries its own unique degree of risk as well. Understanding the investments available to you and the manner in which each can be used to reach your financial goals is essential to knowing what to include in your investment portfolio.

Establishing an Investment Portfolio

A financial adviser can help you make sound decisions regarding what investments you need in your portfolio. He will also be able to help you figure out how many of each type of investment you should include. Establishing a portfolio can take time and getting it balanced in the proper way can take even longer especially for those with limited investment capital.

You may even have an investment portfolio now and not even realize it. Let’s say for example that you have a handful of small investments in different locations. Perhaps you have an interest baring savings account with your local bank, a single bond given to you as a present when you were young, and a couple of stocks you purchased on a whim. All of these items combined are an investment portfolio. Granted it’s not a very impressive or well balanced one, but it is a portfolio nonetheless.

Balancing Your Portfolio

An investment portfolio should be structured in such a way as to help you achieve your financial goals. Having a handful of investments but no real investment strategy is not going to get you through retirement or pay for your children’s college education.

In order to get what you want out of your investments you need to put some work into it. Figure out what you want to achieve and then structure your portfolio to meet those goals.

Different kinds of investments carry varying degrees of risk and offer different return rates. Balancing your portfolio to manage risk and still get the best return possible should be the goal of any investor.

Sub Portfolios and Asset Bundles

Your investment portfolio may contain a number of sub portfolios or investment bundles as well. For instance, a stock portfolio is a diversified sub portfolio consisting of stocks in a variety of sectors and industries that limit your risk of losing all stock investment capital should there be a downturn in any particular area of the stock market.

Shares included in your portfolio can also be diversified by selecting stocks from different size companies and companies of different organizational structures. You may have large cap, publically traded stocks in addition to small cap, shares held in a cooperative for example.

Some investors refer to these sub portfolios as asset bundles. These bundles can be compared to other portfolio options to determine if the overall investment portfolio is well balanced. In such an analysis, assets are slotted into bundles according to their similarities and the performance of each bundle is analyzed, as is the complementary nature of all the bundles combined.

A Well Balanced Portfolio through Stock Sector and Industry Analysis

A general comparison in the performance of stocks within sectors can be of benefit to investors in choosing stocks for inclusion in a well balanced portfolio. Spreading stock holdings over several sectors allows you to minimize risk.

By spreading your stock holdings over several sectors you lessen the chances of losing all of your investments should a crisis hit any particular sector. For example, a crisis which hits the financial sector will have some residual impact on other sectors’ performance within the market, but will have limited impact on your overall stock holdings provided you do not have all your stocks within that single sector.

Further diversifying your stock holdings by spreading investments throughout different industries protects your financial portfolio from catastrophic losses. A crisis which hits the financial sector, and specifically impacts real estate for instance, will have some impact on the larger market but will have limited influence in the science and technical instruments industry which falls under the electronics sector.

In order to achieve the best balanced portfolio possible, you should consider the interconnectedness of different industries as well. For example, a crisis in the real estate industry can influence other industries and sectors as well. Such a crisis may impact the banking, insurance and retail industries. The most solid portfolios are balanced in such a way that when one industry struggles, your other holdings can compensate and save you from disastrous losses.

A better understanding of various terms will help you in your journey to investing. Now that you realize that you have an investment portfolio, you can learn to balance it and help it grow. Remember that diversity is key in any strong portfolio.

Assignment:

• What types of investments do you have in your portfolio?

• What should your next purchase be to make your portfolio more balanced?

• Make a list of areas where your portfolio is lacking so that you can keep these areas in mind as you plan future purchases.