What Is An ETF How ETFs Work ETF Investing TheStreet

Post on: 14 Апрель, 2015 No Comment

NEW YORK ( TheStreet ) — The prevalence of Exchange-Traded Funds (ETFs) will impact all investors, whether they know it or not. But investors who understand how ETFs work — and how Wall Street uses them — are better prepared to make rational investment decisions. Below you will find an introduction to ETFs, the first of a four-part series which also touches upon: the impact of ETF arbitrage. ETFs and stock market correlation and the future of ETF investing.

What Is an ETF?

An Exchange-Traded Fund (ETF) is a security that tracks an index or basket of securities and is traded on an exchange. ETFs are traded just like stocks, experiencing price fluctuations throughout the day. The underlying assets that ETFs track can include stocks, bonds, commodities, and currencies.

How Are ETFs Created? The Creation/Redemption Process

An ETF sponsor first creates an ETF fund, which an Authorized Participant (AP) can use to create or redeem shares. An AP, usually a large financial institution, forms creation units, which are baskets of stocks holding 50,000 shares or more. The AP can then exchange the creation units for ETF shares with the ETF fund. Since this trade is done in-kind (securities are traded for securities), the transaction is not subject to a capital gains tax.

In the diagram above: ETF shares and creation units flow between the fund and the authorized participant; ETF shares and cash flow between the authorized participant and investors; cash and securities flow between the authorized participant and the capital markets.

Once created, the AP can sell ETF shares to investors on the open market. To redeem ETF shares, the AP exchanges the ETF shares for the basket of stocks. Since the AP can create or redeem shares at any point throughout the day, ETF trading is also associated with high-frequency trading.

What’s Inside the ETF Prospectus?

Each ETF has a prospectus and summary prospectus, describing the ETF holdings and investment strategy. Investors should pay attention to whether the ETF has a full replication, active management, or leveraged/inverse investment strategy. Investors should also know the fees, expenses, additional risks, and tax implications of the ETF before purchase.

There Are Four Types of ETFs:

Passively Managed. A passively managed ETF tracks an index by holding the actual components of the index. The goal is to get the same returns as the underlying index.

Actively Managed. The ETF may or may not have a benchmark index. Instead the ETF fund advisor seeks to gain a specified return by holding a portfolio of securities and other assets. The fund manager can buy or sell the underlying assets of the ETF at any time to try to make higher returns than a benchmark index. Only about 4 percent of ETFs are actively managed.

Physical ETF. The ETF holds physical assets to track the underlying index. Most ETFs in the United States are these plain-vanilla type ETFs.

Synthetic ETF. Instead of holding the physical assets of the benchmark index, a synthetic ETF holds swaps or derivative securities. Examples of synthetic ETFs include leveraged, inverse, inverse-leveraged, or swap-based ETFs. These ETFs involve much higher risks than plain-vanilla ETFs, relating to liquidity, counterparty, and tracking error risk. In the United States, synthetic ETFs only account for 3 percent of the total number of ETFs, but 10 percent of daily ETF trading volume, according to a report by Morgan Stanley Smith Barney. 1

What Are the Benefits of ETFs?

Low Expense Ratios. An ETF tracks an index like a mutual fund, but with much lower costs. In 2011, ETFs had an average expense ratio of 0.55 percent while open-end mutual funds had an average expense ratio of 1.34%, according to a report by Morgan Stanley Smith Barney.

Tax Advantages. The creation/redemption of ETFs is an in-kind transaction, and not subject to the capital gains tax. Instead, the capital gains tax is only incurred upon the sale of the ETF by the investor.

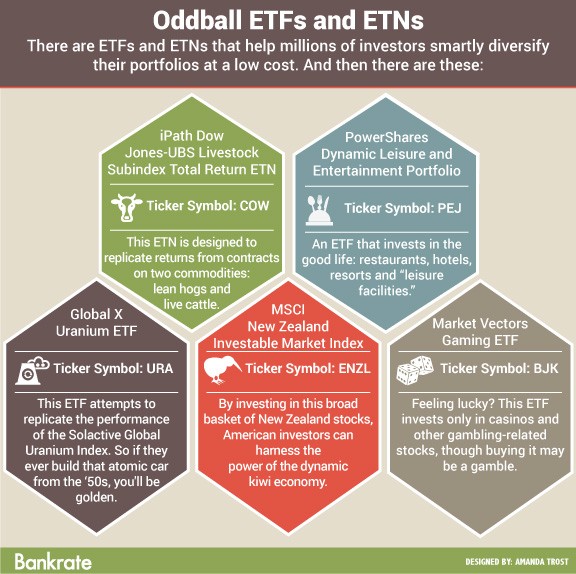

Diversification. ETFs give investors access to broad indices and securities they would not have been able to trade otherwise. ETFs exist based on bonds, commodities, currencies, equities, and derivatives. An investor can also choose ETFs to track a specific sector or any major index.

However, investors should be aware that some ETFs may lack diversification and be concentrated in a few assets. For example, IBM makes up 10.98 percent of DIA, the SPDR Dow Jones Industrial Average ETF. and Apple makes up 19.82 percent of the QQQ, PowerShares ETF. according to XTF.

Flexibility. Unlike mutual funds, ETFs can be traded throughout the day and prices are reported every 15 seconds. Investors can also use ETFs for a number of different trading strategies such as shorting ETFs, trading on margin or hedging risk.

Transparency. Unlike mutual funds, an ETF’s holdings must be released at the end of each day. Even managers of actively managed ETFs must disclose positions and investment strategy.

What Are the Risks of ETFs?

Because of the size of creation units, usually only institutional investors can participate in the creation/redemption process. Investors must depend on the Authorized Participant to create or redeem ETF shares.

Tracking Error. This is a measure of how closely the ETF follows the benchmark index. Tracking error tends to be much larger for ETFs based on more illiquid assets. The average tracking error was 52 bps

basis points

in 2011, down from 74 bps in 2010 and 125 bps in 2009, according to a report by Morgan Stanley Smith Barney. 2

Liquidity. For the most part, ETFs help increase liquidity and trading of more illiquid assets. However, when liquidity suffers an extreme drop, the bid-ask spread of ETFs can significantly widen and ETF pricing can become difficult or impossible. In the 2010 Flash Crash, major participants pulled out of the market, causing a drop in liquidity, a large amount of cancelled orders, and serious price declines. ETFs accounted for 70 percent of cancelled transactions, as investors were temporarily unable to correctly price the ETFs, according to a report made by the SEC and Commodities Futures Trading Commission.

Leveraged/Inverse. Leveraged and inverse ETFs try to out-perform the market by 2 or 3 times. However, this means these ETFs can also underperform the market by 2 or 3 times. These ETFs are used to make extremely short-term bets or to temporarily hedge market exposure. Since these ETFs reset daily, an investor should only hold them for one day. Holding a leveraged or inverse ETF for longer periods of time will eventually lead to losses.

How Are ETFs Valued?

ETFs are valued by their Net Asset Value (NAV). The NAV is found by dividing the total value of the underlying assets by the number of shares outstanding. The ETF is selling at a premium if its price exceeds its NAV and a discount when its price is lower than its NAV.

The Growth of ETFs

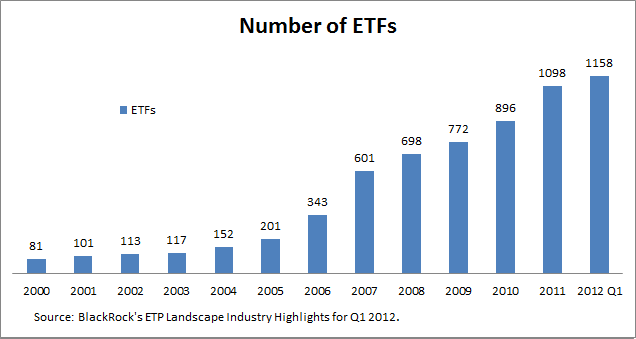

The first ETF, SPY, was created in 1993 by State Street Global Advisors. SPY is an ETF that tracks the S&P 500 and is still the largest ETF today with a market capitalization of over $100 billion.

Now the ETF market includes over 1200 ETFs and has a market capitalization of almost $1.2 trillion. The ETF market started to grow rapidly in 2007, when net issuance went from $74 billion in 2006 to $151 billion in 2007, according to the 2012 Investment Company Fact Book. Since 2007 net issuance has remained above $100 billion each year. ETFs are expected to continue growing in size and complexity in the future.

While mutual funds have only grown an average of 3 percent a year since 2002, ETFs have grown an average of 25 percent in that span, according to a report by Goldman Sachs. ETFs also account for 25-30 percent of daily trading volume, compared to only 10-15 percent in 2004. 3

However, the activity in the ETF market is concentrated in the top funds. The 10 largest ETFs account for 36 percent of market share and the top 20 account for 48 percent. The top ten most actively traded ETFs account for 62 percent of daily dollar volume, and the top three ETFs account for 47 percent. This is an improvement from 1993-2000, when three ETFs generated 90 percent of daily dollar volume, according to a report by Morgan Stanley Smith Barney. 4

What Is ETF Arbitrage?

Arbitrage is related to high-frequency trading and is the act of simultaneously buying and selling the same or similar assets to profit from the price deviation between the assets. Since ETFs are created to track a specific index or basket of assets, ETFs provides a good opportunity for arbitrage when the ETF price differs from its NAV.

When the ETF price exceeds its NAV (ETF premium), an Authorized Participant (AP) can buy the underlying securities on the market, exchange them for ETF shares, and then sell the ETF shares on the market for a higher price.

When the ETF price is lower than its NAV (ETF discount), an AP can buy the ETF shares on the market, exchange them for the underlying assets, and then sell the assets on the market for a higher price.

ETF arbitrage should increase the efficiency of ETF pricing, but certain limits to arbitrage may restrict how closely an ETF can track its NAV. For example, transaction costs and liquidity problems can prevent arbitrage and increase price deviations.

— Written by Caitlyn Grudzinski in New York