What is a W8 Form

Post on: 16 Август, 2015 No Comment

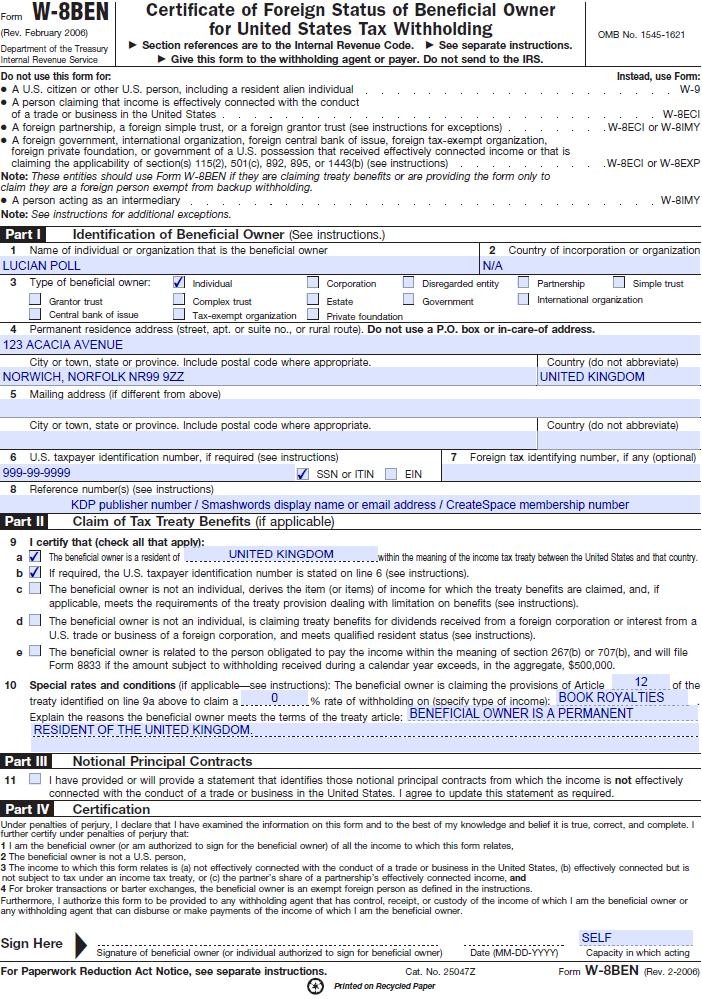

I f you’re a US citizen wondering why you’ve never heard of form W-8, it’s really no wonder at all. Form W-8 is filled out by foreign entities (citizens and corporations) in order to claim exempt status from certain tax withholdings. The form is used to declare an entity’s status as non-resident alien or foreign national who works outside of the United States. The benefit is that these individuals receive a certain tax treaty status that affords them certain right, such as lower withholdings from dividends paid by US corporations.

There are many different types of W-8 forms. These forms are typically requested by withholding agents, usually firms or brokers and not the IRS. For example, brokers typically request Form W-8BEN, the form used to lower withholdings from dividends, from foreign nationals. Form W-8ECI is used by foreign entities to certify that all income on the form is associated with trade or business within the United States. (This is slightly different from Form W-8BEN, which certifies allocated funds, such as dividends from stocks and mutual funds.) Form W-8EXP is filled out by foreign governments, international organizations, banks of issue, tax-exempt organizations, private foundations, and governments of US possessions. In other words, nothing the typical tax-payer needs be concerned about. Form W-8IMY is filled out by foreign financial intermediaries. Again, nothing Joe TaxPayer needs to worry about.

A withholding agent will typically request a Form W-8BEN of any foreign client. If you are a foreign investor, filling out this form may significantly lower your tax withholdings. A withholding agent must generally withhold 30% of the income distributed to a foreign national, unless the national can be associated with tax treaty status via a Form W-8.

The form requires some pretty typical information: name, taxpayer identification, country of origin, etc. You’ll also need to provide a statement describing the national principal contracts to which the income is associated. Writing and updating this statement can get complicated. When in doubt, discuss any questions with a certified tax professional.

Form W-8ECI is another form that will help you lower your withholding if you a foreign national in a partnership that conducts trade or business within the United States. Like Form W-8BEN, this form will require typical identification information, along with a rather in depth description of nature of the expected income.

The last W-8 a typical, non-corporate taxpayer might need to know about is Form W-8CE. This form is used to certify that a taxpayer is a “covered expatriate,” and subject to special tax rules. If you are a recently expatriated citizen waiting on differed compensation after your date of expatriation, you’ll want to fill out Form W-8CE within 30 days after you expatriate. The form must be filed for each tax-deferred account, item of deferred compensation, or interest in a non-grantor trust.

One thing is certain: W-8 forms are not the sort simple tax form the average payer can easily navigate. If you’re one of the few taxpayers required by the IRS to fill out Forms W-8, you would be well-served to consult a professional. If you need help filing your taxes this year, you may want to consider both Turbo Tax and H&R Block . Their free online tax software can make your tax nightmares disappear.