What is a Trailing Stop Loss Order

Post on: 16 Март, 2015 No Comment

There are two mistakes that most people routinely make. They let emotions play too big a role in their decision making and they fail to adequately plan for the worst case scenario before the worst case scenario actually happens. These two mistakes arent a big deal when youre planning dinner, but they can be disastrous when it comes to investing in the stock market. Reacting emotionally to the market can lead to bad decisions, which is compounded by the fact that we react to worst case scenarios rather than plan for them!

Fortunately in investing, we can use some of the tools to protect ourselves against it. Ive recently been reading more about it and one of the best ideas Ive seen is the use of stop loss orders and trailing stop loss orders to your advantage.

Stop Order

A stop order is an order to buy or sell once the price of the underlying stock reaches a specified price, called the stop price. Once it reaches the stop price, the order is put out on the open market. A buy stop order is an order to buy a stock after it reaches the stop price, which is always set to be higher than the current market price. A sell stop order is an order to sell a stock after it reaches the stop price, which is always set to be lower than the current market price.

You can also make it a stop-limit order by setting a limit price in addition to a stop price. The stop price activates the order and it becomes an ordinary limit buy or sell order.

Stop Loss Order

A stop loss order is just a name given to a sell order with a stop price. They use stop loss as a way to indicate the purpose of the order, since you are usually trying to stop a loss. The idea is that you set a stop price under the current market price for a sell order. If the stock falls to or below the stop price, you sell the stock in the market as a market order.

In general, a stop loss order is setup as a percentage of the current market price and is used to remove emotion from the decision making. You buy a share of Bargaineering (BRG) at $10 and decide you want to, at most, lose 10% of your investment. You would make the purchase and then set a stop loss order at 10% less than the share price, or $9. If BRG ever falls to $9, then you would sell the stock at market price. If it goes up, as it probably would . then you keep holding on.

Why a stop loss order? Its recommended that you set up these types of orders when you are not going to be able to review your stocks on a regular basis. If you go away on vacation and cant check your stocks for a while, a stop loss order can be used to protect you against a sudden drop you cant respond to. Its also said that these orders remove some of the emotion out of the process.

Trailing Stop Loss Order

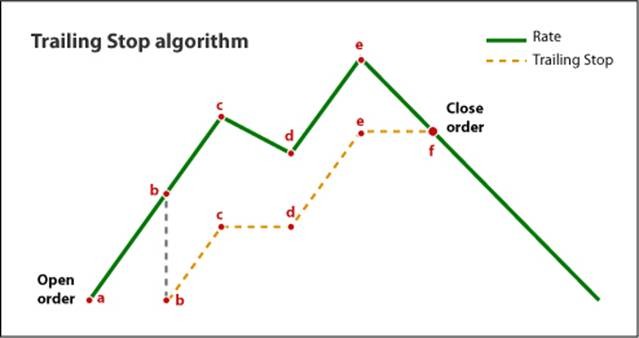

A trailing stop loss order is a stop loss order that adjusts as the stock increases in price but doesnt adjust when the stock decreases in price. In our case of BRG, lets say the price goes up to $100. Your existing stop loss order with a stop price of $9 is probably not going to do you any good. With a trailing stop loss order, as the stock rocketed up to $100, the 10% trailing stop would adjust upward in lock step. At $100 a share, the stop loss order would have a stop price of $90 (10% under the share price). If the shares fall to $95 a share, the stop price remains $90.

This has two benefits. The first is that you dont have to monitor the stock on a daily basis. Second, you have essentially locked in the gains. If the stock falls under $90, then your broker would execute a sale and you still collect the proceeds from your then unrealized gains.

This was a very simple discussion of stop loss and trailing stop loss orders, so if you want to learn more I recommend you do a little more digging online about the various strategies and techniques you can employ using these orders. I think its important to understand the vocabulary so you can speak the language, hopefully Ive achieved that here.

If you have insights or thoughts to add, please do so in the comments!