What Is a Stock Market Correction When Is It a Crash

Post on: 31 Май, 2015 No Comment

When Stock Prices Fall, How Can You Tell If It’s a Correction or a Crash?

Barclays Capital trader Mario Picone holds his head while working on the trading floor at the New York Stock Exchange on September 9, 2011 in New York City. Photo by Justin Sullivan/Getty Images

Definition: A stock market correction, or pullback, is when the stock market declines 10% in a relatively short period of time. It’s a natural part of the stock market cycle. As a matter of fact, in each of the bull markets in the last 40 years, the stock market has had a correction. In fact, experienced investors often welcome a correction to allow the market to consolidate before going toward higher highs.

A stock market correction can be caused by some kind of event that creates fear and subsequent panicked selling. It can be a gut-wrenching time, and many beginning investors will feel like joining the mad dash to the exits. However, that’s exactly the wrong thing to do. Why? The stock market usually makes up the losses in three months or so. If you sell during the correction, you will probably not buy in time to make up your losses.

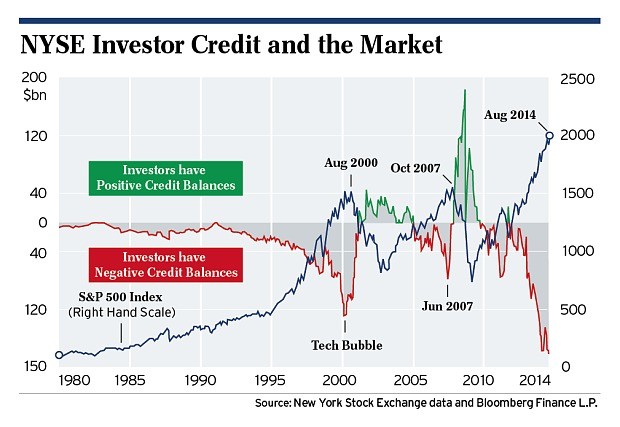

Corrections are inevitable. When the stock market is going up, investors want to get in on the potential profits. This can lead to irrational exuberance. This can make stock prices go well above their underlying value.

Why a Correction Is Not a Crash

A correction is different from a stock market crash. which is when stock prices plummet more than 10%, often in just one day. Crashes are so frightening, they usually lead to a bear market. That’s when the market goes on to drop another 10%, leading to a decline of 20% or more.

Unlike a correction, a stock market crash can cause a recession. How? Stocks are how corporations get cash to grow their businesses. If stock prices fall dramatically, corporations have less ability to grow. Businesses that don’t grow will eventually lay off workers to stay solvent. As workers are laid off, they spend less. Lower demand means lower revenue. This means more layoffs. As the decline continues, the economy contracts and you have — Voila! — a recession .

If a correction is relatively benign, and a crash can cause a recession, how can you tell the difference? It’s not easy. A correction can turn into a crash if the stock market declines more than 10%. Trying to decide if a correction is turning into a crash is known as timing the market. This is nearly impossible to do, since there are so many factors that can influence the direction the market goes in. That’s why the best strategy is to have a diversified portfolio with a balanced mix of stocks, bonds and commodities. You will profit from market upswings with the stocks, and be protected from stock market corrections with the bonds and commodities. With diversification, you will feel safe to ride out any stock market corrections .

If you look at the history of the Dow. you’ll see that most recessions are accompanied by stock market declines of 30% or more. These declines are part of the normal downturn in the business cycle. and are tied to larger economic events. That’s different from a stock market correction, which can occur when the economy is still in the expansion phase.

Why would the market correct even when economic data is good? The stock market is an effective leading economic indicator. That’s because investors usually look at future expected earnings, itself a prediction of corporate profits. Investors buy or sell stocks based on these future projections of the business world. If investors are overly optimistic based on their expectations of future performance, they can create a rally that doesn’t match current economic performance. If the market gets over-extended, then any bit of news that creates doubt can cause a mild sell-off.

However, as long as the future trend still looks optimistic, the buying will resume and lead to an even stronger bull market rally. In other words, a stock market correction can help the stock market catch its breath and hit even higher peaks. Article updated September 5, 2014