What is a Secular Bear Market (Definition Chart) and How to Invest

Post on: 31 Май, 2015 No Comment

The stock market has risen about 90% since the March 2009 lows. Mind you, that rally followed a steep 57% decline. Still, in light of the gains of the past two years, how can some analysts say were still in the midst of a secular bear market?

Bulls vs. Bears

For those who are new to stock market lingo, a bull market is one where the primary trend is upward. A bear market means stock prices are falling. A secular trend usually refers to a longer-term trend, whereas a cyclical trend reflects the short-term market momentum. So you can have a cyclical bull market within a larger secular bear market and vice versa.

In a secular bull market, prices generally move higher, with occasional, shallow corrections. You would think that a secular bear market is just the opposite, with prices moving steadily lower, interrupted by a few cyclical bull rallies. A true secular bear market, however, moves very differently.

Rather than a straight move from the upper left to the lower right on a chart, a secular bear market looks more like a sawtooth pattern, with sharp moves to the upward and the downward, ultimately ending at lower price levels.

Are We in a Secular Bear Market Right Now?

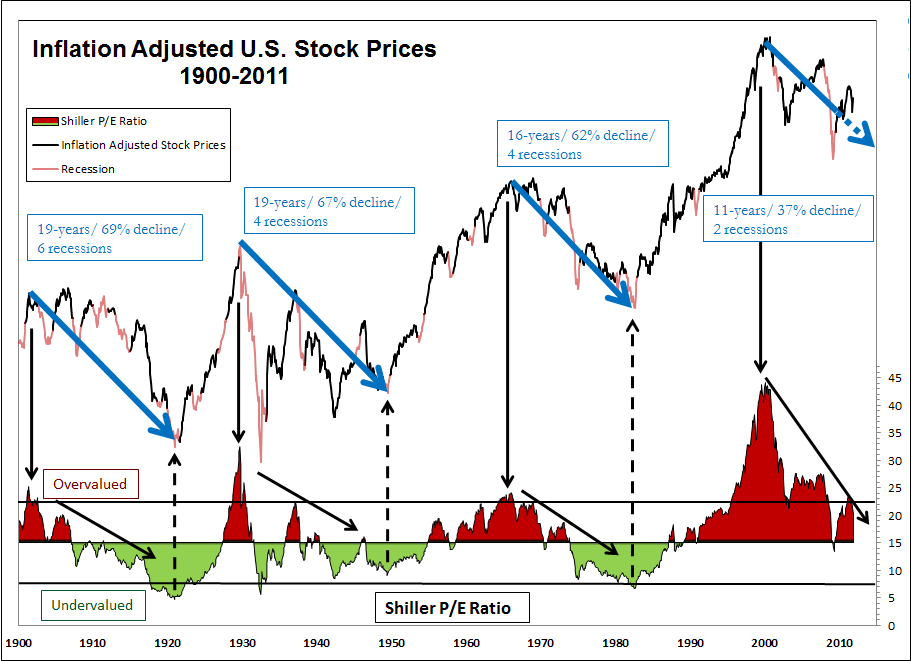

If youve been following the markets over the past 10 years or so, that pattern ought to sound pretty familiar. In fact, over the past 100 years, weve experienced a number of secular bear markets. If you believe we are currently in the midst of one, this would be the fourth of the century. Take a look at the chart below, courtesy of UBS Technical Analyst, Peter Lee:

Some will inevitably disagree, but I am in the camp that says we are in a secular bear market that began in 2000 and will likely continue through about 2020. Since 2000, weve seen plenty of movement in the stock market, both to the upside and the downside. The result of all of that volatility? A decline of about 12% in the S&P 500. Thats what a secular bear market looks like.

How NOT to Invest in a Secular Bear Market

Buy-and-hold is probably the worst approach to take during a secular bear market, especially if you plan on retiring in the midst of one. You could end up needing to tap your investments just as their value has declined the most, and you may not have enough time to recoup your losses.

How to Invest in a Secular Bear Market

The first step is recognizing you have a secular bear market on your hands. Once youve done so, a more active approach works best in a secular bear market. You need to be prepared to buy and sell to lock in gains and cut short losses.

Reviewing a few approaches will help you invest wisely without becoming glued to your computer screen like a crazed day trader:

1. Core and Satellite Approach

This method involves a combination between a more conservative and aggressive approach. On the conservative side, known as the core, you will choose a set of index ETFs or mutual funds that will effectively mimic the large market and give you exposure to potential equity upside while minimizing the risk inherent with individual stocks. On the more aggressive side, the satellite portion of the portfolio would consist of individual stocks or securities that you would choose based on their strengths using perhaps fundamental or technical analysis. Given the risk associated with this investment style, you will also need to be prepared to more actively trade these stocks. For example, you might choose to sell after a big rally or buy more upon a drop in stock price. With this approach, you can also constantly reallocate your core and satellite portfolio according to your investment risk tolerance .

2. Routine Rebalancing

Even the most passive investor usually rebalances at least once a year. For example, suppose your preferred personal investment portfolio asset allocation is something like 50% stocks, 30% bonds, and 20% cash, but your stocks are up so much that they now represent 60% of your portfolio (this is a common occurrence in volatile markets like secular bear markets). You should the simply sell some of your stock investments to get back to your 50% target.

3. Do Your Homework and Be Confident