What if you always maxed out your 401(k)

Post on: 16 Март, 2015 No Comment

How much do you have saved in your 401(k)? If you max out your 401(k) contribution every year since you started working, you would have a good size retirement portfolio by now. However, if you are like the average worker, your retirement account balance is woefully low. Fidelity Investment analyzed nearly one million investors’ retirement accounts and here is the result.

This study combines the IRA and 401(k). The average balance is $225,600 as of Dec. 31, 2012. The result looks A LOT better than their last study which looked at just the 401(k) balance. The average 401(k) balance is much lower at $77,300. This makes sense because a lot of people roll over their 401(k) accounts to an IRA when they change job. You could also contribute to both the 401(k) and Roth IRA if you qualify.

This actually looks a lot better than I thought. The average balance of the 65-69 yr old bracket is nearly $400,000. That’s not bad especially if you have social security benefit and a little pension. It is still a little low because retirement can last 30 years or more these days. If you withdraw 4% from $400,000, then that’s only $16,000/year or $1,333/month.

On the table, you can also see how much people contribute to their retirement accounts by age. Younger folks do not contribute much, but that’s natural because they don’t have as much income. This made me curious and I thought I’d figure out how much someone would have if they maxed out their 401(k) contribution as soon as they started working.

Maxed out every year

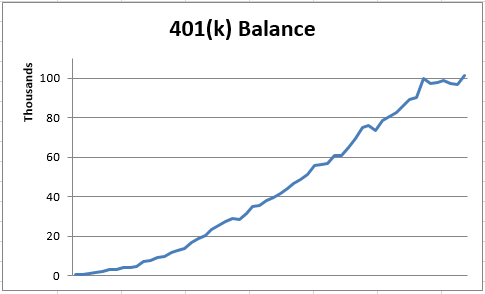

Note. I have our worker contribute the max contribution divided by 12 on the first of every month. The investment is VFINX, the Vanguard S&P 500 index fund. I used VFINX’s price on 1/2/13 to figure out the 401k total (red line below.)

Here is how to read this graph. Figure out how many years you have been working. If you started working in 2002, then that’s 10 years you could have maxed out your 401k (from 2002 to 2012.) If you contributed the max every year, then you should have around $207,287 in your 401k account by now.

Where are you?

Here is the full table. Figure out how many years you worked and see if you have at least that much in your retirement account.

It’s clear that by maxing out your 401k, you’ll be much better off than the average Fidelity investor. I didn’t even add any company matching to this. With company matching, your 401(k) balance should be quite a bit higher than my table here. You can also invest in your Roth IRA and the combined account should be in even better shape.

You can also see the magic of time on this table. If you maxed out $7,313 in 1988, it would have turned into $67,101 today ($727,518 $660,417.)

Here is the same graph with Fidelitys data added.

Closing

Of course, every 401(k) plan is different. Your retirement plan might not have very good investments or your fees might take a big bite out of your total return. I still think it’s worth contributing the maximum to your 401(k) every year. The contribution is auto deducted so you don’t even miss it.

I maxed out my 401(k) contribution a few years after I started working. My IRA is inline with this table though so I guess my 401(k) plan wasnt too shabby. How does your retirement account compare to this table? Are you ahead or behind?

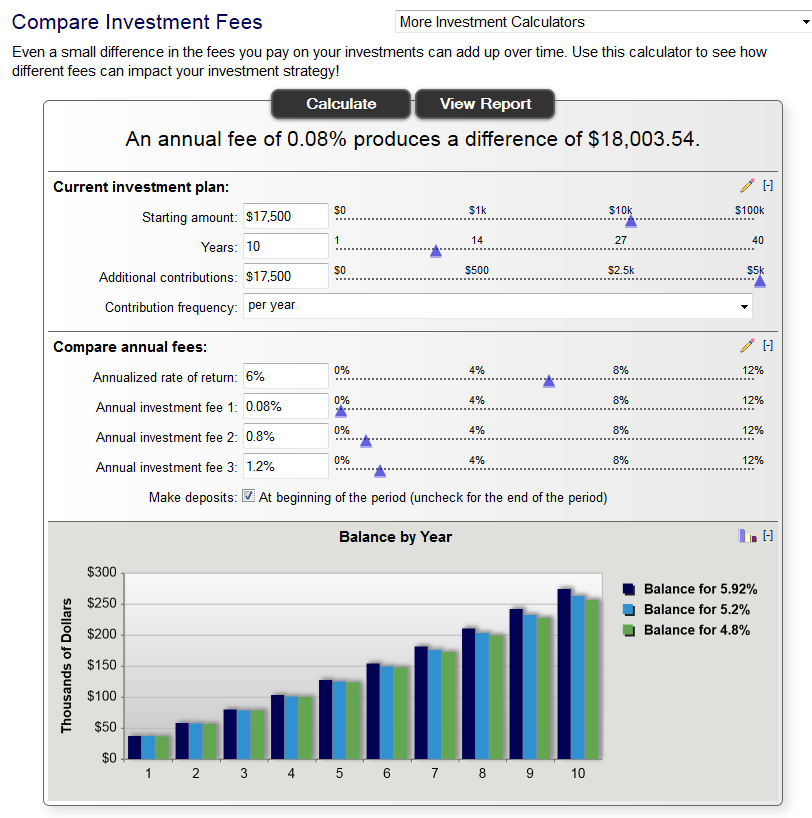

If you need help keeping track of your finances, try using Personal Capital to manage your budget and net worth. It can help you keep track of your income, expenses, and net worth, all in one place. Personal Capital is geared for investors and has many great tools. See my review of Personal Capital and how they helped me reduce what I’m paying in investment fees .