What if this bull market is actually just a very old bear

Post on: 7 Сентябрь, 2015 No Comment

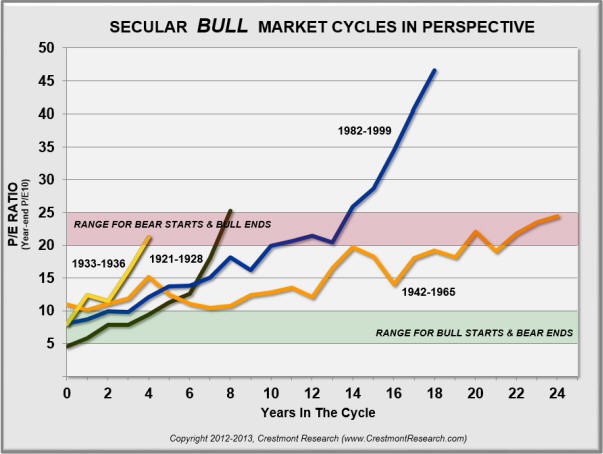

Equity markets in the U.S. have climbed a whopping 170% since bottoming in March 2009, but the impressive run still doesn’t signal a secular bull market, says the latest report from Crestmont Research, which analyzes equity cycles south of the border.

Instead, the rally that has stocks reaching all-time highs has all the signs of a cyclical bull within the secular bear market that began earlier this century.

“This secular bear began in 2000 and has lasted well more than a decade,” said Ed Easterling, Crestmont’s main principal. “The surges and falls are relatively consistent in both magnitude and duration to past secular bear market cycles. With valuation levels still relatively high, as measured by normalized P/E, this secular bear has quite a way to go.”

Secular cycles — both bull and bear — are long-term events lasting a decade or longer and are governed by market valuations that are either multiplying the effect of rising earnings or mitigating them.

Cyclical bulls and bears, meanwhile, are shorter-term market movements that occur within secular cycles.

Mr. Easterling said the S&P 500’s stellar 2013 is reflective of a cyclical bull inside a secular bear, noting gains have been made in 47% of the years within secular bears.

“2013 was the 8th best gain-year among 28 gain-years in secular bears since 1901, he said.

He thinks the cyclical bull currently in place may run further, but the decline in volatility last year may indicate that it is in the late stages and may eventually succumb to the next cyclical bear period.

“The typical secular bear market has multiple cyclical phases—and there will be more of these cycles before the current secular bear is over,” he said.

Of course, not everyone agrees with Mr. Easterling’s assessment.

“I think what started in March 2009 was the beginning of a secular bull market not just a cyclical bull,” Liz Ann Sonders, chief investment strategist at Charles Schwab, said during a panel discussion in late October.

But for those who side with Mr. Easterling, he recommends employing an investment portfolio that is structured to limit downside risk while participating in the upside.

“Market portfolios are outperformed by hedged portfolios in secular bear markets because of the disproportionate impact of losses in relation to the gains required to recover losses,” he said. “Most significantly, as the magnitude of the loss increases, the required recovery gain exponentially increases.”