What does an LP look for in a venture capital fund manager

Post on: 16 Март, 2015 No Comment

Sixth in a series of weekly posts by myself and Nicholas Lovell of Gamesbrief which answer the fifty questions you should ask before raising venture capital.  We expect the series to run for a year after which we will collate the posts into a book.  You can find the rationale behind the series here. and the list of questions here .  We welcome your comments on any and every aspect of what we are doing.

—————————————

‘LP’ is a generic term for an investor in a venture capital fund. Typically they are pension funds or insurance companies (otherwise known as ‘institutional investors’), but they can also be corporates, wealthy individuals or governments looking to stimulate the startup ecosystem.  LP is short for Limited Partner, a reference to the legal status of investors in venture capital funds – technically they are partners in the fund with limited rights and obligations.  I covered this in a little more detail when I answered the question Where do VCs get their money from?

A ‘venture capital fund manager’ or sometimes ‘venture capitalist’ is the team of people that decide which companies to invest in and then manage them to exit, they are often known as the ‘GP’ or ‘general partner’.  A GP can have multiple funds under management at any one time and they are compensated according to the terms of the GP agreement for each fund which determines the fees and profit share they receive.  I covered this in a little more detail when I answered the question What is venture capital?

Turning to the question du jour, the first thing that an LP looks for in a venture capital fund manager is track record.  In venture capital past success is a very good indicator of future success, unlike many other asset classes.  Entrepreneurs like to work with investors who have shown an ability to make money and hence VCs with a good track record stand a better than average chance of getting into the best deals and therefore making more money.  Additionally VCs who have had good success have typically built strong networks on the back of that success and are more able to help their companies with introductions to customers and partners.

The next thing an LP will look for is to see that the team has worked together before.  Ideally they have all worked together in the same manager and developed a good track record together.  Alternatively, if the individuals have worked together in past lives then that might be enough to get the LP comfortable.

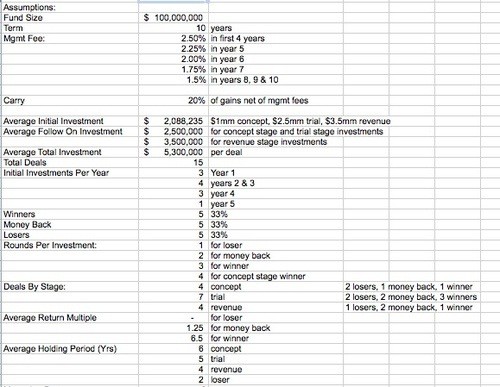

After that the LP will look to the fund structure/strategy – how many investments of what size and in which geographies and sectors the fund manager intends to make.  There are some basics that have to be got right – e.g. the team needs to be large enough to make the planned number of investments when taking into account their commitments to earlier funds, the fees need to be sufficient to cover the planned expenses of the manager.  Some other elements are more subjective and will appeal differently to different LPs – e.g. which sectors the GP intends to invest in (cleantech, internet etc.).

Finally, if the LP is comfortable on the three items above they will start to look to the terms of the venture fund of which the most important by far are the fees (typically 1.5-2.5% of funds under management) and the profit share or carried interest (typically 15-25% of profits, often after a basic return has been delivered).  LPs look through these percentages to see how much money the partners in the GP will get and as a result larger funds are usually nearer the bottom of the ranges given, whilst smaller funds are able to get nearer the top.  More successful funds are able to command higher fees and carry.

The first three items (track record, team history, strategy) are typically go or no-go gating items whereas the terms are more of a negotiation.