What Does a Diversified Investment Portfolio Look Like Crackerjack Greenback

Post on: 5 Май, 2015 No Comment

What Does a Diversified Investment Portfolio Look Like?

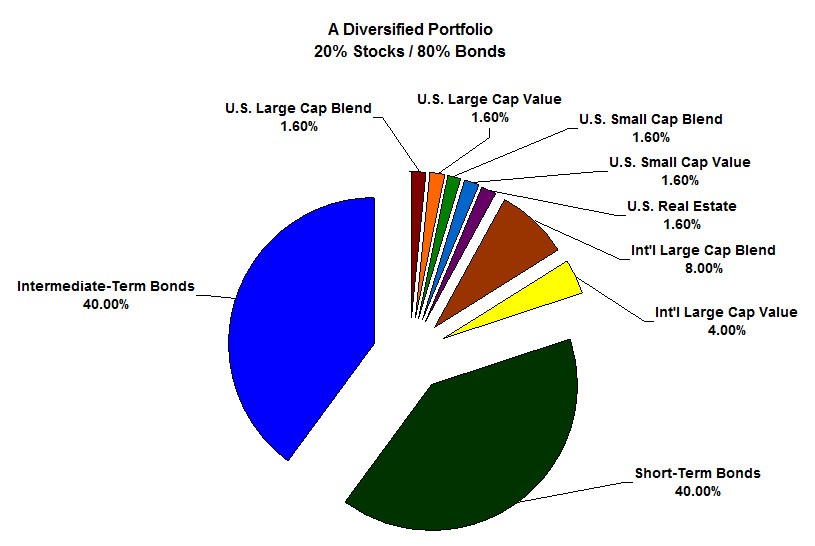

I often talk about a low-cost, tax-efficient, diversified portfolio as one of the keys to investment success. So what does such a portfolio look like? Heres an example of a diversified portfolio with an overall allocation of 70% in stocks and 30% in bonds:

Youll probably have a few questions about the logic of this portfolio. Ive put the answers to the questions I could think of below. If you have some questions I didnt answer, leave them in the comments and Ill answer them as soon as I can.

Why So Little in U.S. Stocks?

Why So Much in International Stocks?

Most investment advisers recommend a large portion of your portfolio be allocated to U.S. companies. Why is this? As far as I can tell, its because they have more faith in American companies. The truth is that American companies only make up about 40% of the total world stock market. If you put 80% or more of the stock portion of your portfolio in American companies, youre basically putting all your eggs in one basket.

By diversifying into foreign countries, you mitigate the risk that any one countrys dilemmas will adversely affect the value of your portfolio. Even though foreign stocks tend to move like U.S. stocks in hard times (like right now), they will move quite differently in the long run. This reduces your volatility (risk) and increases your return. (Though I cant guarantee that, obviously.)

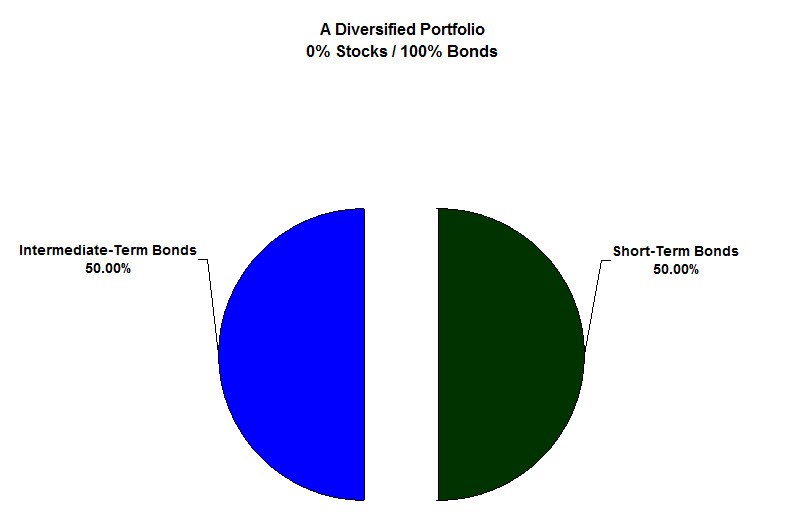

All of these questions can be answered fairly simply. The bond portion of a portfolio should be there to serve as a safety net. Its designed to offset the risk youre taking on by investing in stocks. You shouldnt use the bond portion of your portfolio to seek extremely high returns, so that rules out High-Yield Bonds. Long-Term Bonds give you slightly higher returns than Intermediate or Short-Term Bonds, but they do so at much higher risk. Its actually so much more risk that it doesnt make sense to invest in Long-Term Bonds for the safer portion of your portfolio.

Global/Foreign Bonds are not separated because they are included in the investment choices I detail below. The two funds I am recommending for the Bond portion of the portfolio both invest in U.S. and international bonds, so youll get a mix of both.

So How Can I Invest in a Diversified Portfolio Like This?

So which Vanguard funds should you use to replicate the diversified portfolio shown above? Heres the list (starting at the top of the pie chart going around clockwise):