What Buffett Icahn and Loeb are Buying Wealth Manager

Post on: 8 Май, 2015 No Comment

- Commentary

By James Altucher

Have I told you that Warren Buffett works for me? Hes my intern. I dont really talk to him much. But once a quarter he reports to me in the form of a 13F filing with the SEC that tells me all of the stocks hes done due diligence on and then, having satisfied his thirst to find stocks that will make him a lot of money, he tells me which stocks hes actually went ahead and bought. Hes a very good employee for me. I dont have to pay him anything. and often I can buy the stocks he recommends at even lower prices than where he recommended them. I also know that he likes stocks for the long haul so its not as if hes recommending me to them one day an selling them the next. In the worlds of the Yahoo message board posters, hes not a pump-and-dump guy. Not only Buffett is working for me, but other long-term billionaires like Dan Loeb and Carl Icahn are my interns as well. They arent so bad. Dan once wrote me and asked me to call him Daniel. And after that he even de-friended me from Facebook. But thats ok. I dont hold it against him. He still does good work.

Buffett is definitely bullish on quantitative easing. Which is why his biggest addition to his holdings has been the 16mm additional shares he bought of Wells Fargo (WFC). which trades for less than 10x next years expected earnings. His only new holding is Bank of New York Mellon (BK) the oldest bank in the country, which he bought slightly more than 1mm shares of. And finally, he added to his position of JNJ. Buffett is a demographics investor more than hes a value investor. We can argue all we want about the pros and cons of healthcare but at the end of the day we know this: 76mm baby boomers are retiring in the next 10-20 years (the oldest baby boomers just turned 65). Healthcare is not something we can debate. Its a fact that the need for it will increase. JNJ is the biggest healthcare company and Warren Buffett is steadily adding to his position. Do you want to argue with him?

Getty Images Warren Buffett

Dan Loebs Third Point is one of the most successful hedge funds of the past decade. Loeb probably makes about a billion a year off the fees his fund generates. By his picks we can see that he is turning bearish and his picks are also good diversification from Buffetts. For one thing, his biggest new position is AAPL. And why not buy AAPL. They are replacing (in the hands of one company) the entire music industry, movie industry, phone industry, computer industry. 50mm ipads will be sold over the next year, and on each ipad, people will buy 100s of songs, movies, and dozens of apps. The ipad is taking over computing. Hes also been buying shares of buyout firm, KKR, which his backdoor way of buying into the private equity industry, which benefits the most from any boom because they will be able to exit their private positions. And finally. he has a new position in healthcare company, Carefusion (CFN). The company makes various patient monitoring equipment and respiratory care products two areas that definitely benefit from an aging population. The company is also going from trading at 35x this years earnings to 12x next years earnings. If they continue at that pace (which they should) they could go up 200% from these levels. Another brand new holding is Potash, POT. Hey, with the world population increasing, we have to feed the new people, right? POTs products are in demand, the more people we need to feed.

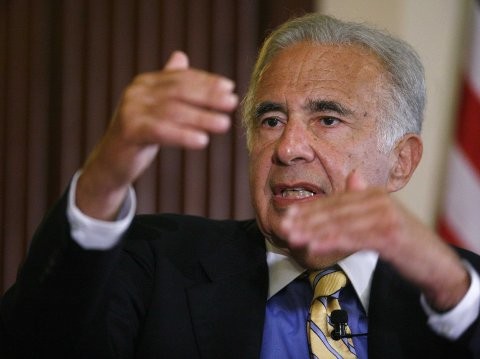

Carl Icahn, normally an activist investor, has been buying up shares of brand new position Mattel, the maker of Barbie, Polly Pocket, and other toys for kids. Mattel has recently announced they will be buying back shares and increasing their dividend, both signs that they view the coming year as a positive one. If the economy is turning around, and the country is rebuilding, then there probably isnt a better bet than one of Icahns newest positions, Commercial Metals (CMC) which recycles steel. CMC trades for just 7 times next years earnings.

Investing is very hard. In order to properly have an edge you need to know the CEOs, you need to know the customers, have a sense of the demographics, and understand when the assets of a company are real and represent cheap value. In other words, sitting at home, its too difficult to find the right companies. But thats why Im letting you use the hard efforts of my three interns: Warren Buffett, Danny Loeb, and Carl Icahn. These guys have done good work for me, for years, have made me money, and I dont have to pay them a dime. And neither do you.