What are the main advantages and disadvantages of a leveraged ETF

Post on: 9 Апрель, 2015 No Comment

As with any leveraged investment, your gains are multiplied but so are your losses if the index/market turns the other way. Thats why leveraged ETFs appear regularly on the best (and worst) performing lists in Canada and the United States. Here is a quick summary of the main pros and cons:

- Leveraged ETFs typically meet their investment goals on a daily basis. In other words, if the objective is to double the return of a certain index, the fund will likely produce that result on any given day.

- Like other ETFs, leveraged funds increase your exposure to different markets. You can use leveraged ETFs to speculate on the direction of oil and natural gas prices, gold and other metals, agricultural commodities, currencies and more.

- Management expense ratios of about 1.15 percent tend to be lower than actively managed mutual funds (which can run to more than 3 percent of the funds assets).

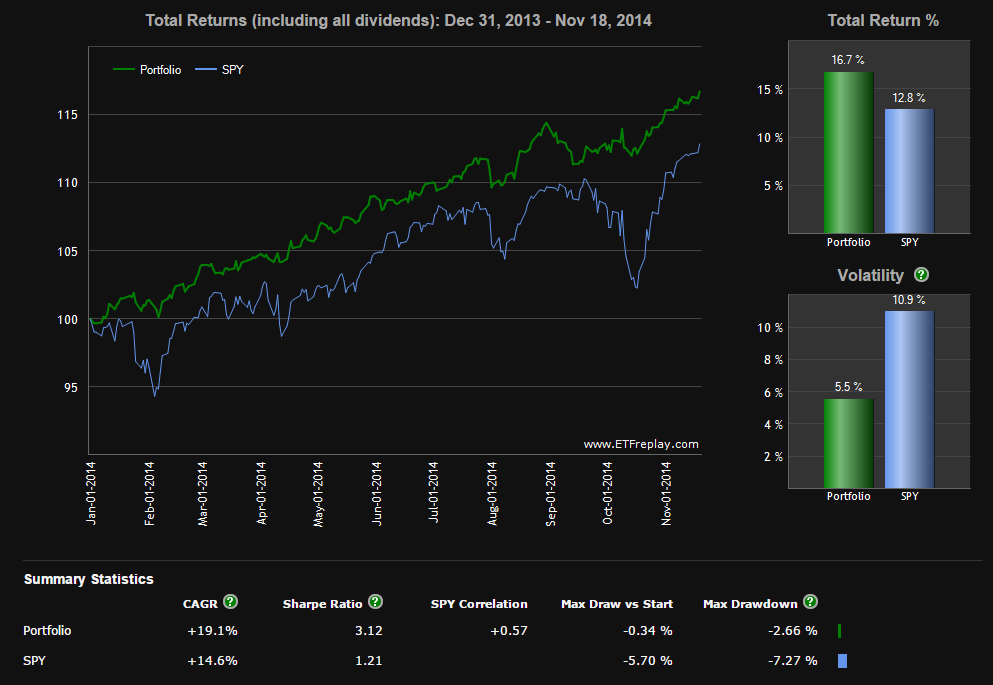

- Leveraged ETFs may be used to lower your portfolio volatility and market risk. This strategy involves short selling and is not recommended for the average investor

- You get the benefits of leverage to multiply your gains, but you cannot lose more than your entire investment. This is an advantage compared to short selling stocks, where you can possibly lose several times your original investment.

Cons

- For periods longer than a day, dont assume you will earn two times or minus two times the return of the underlying index. This is because the leveraged ETF rebalances every day. And, they are highly sensitive to market volatility. If returns vary widely from day to day, over time you will lose money even if the underlying index breaks even.

- Other factors including fees and transaction costs can also cause your return to deviate from the movements of the underlying index.

- Management expense ratios tend to be higher than other passive investments, including regular ETFs.

Warning

BetaPro, the only provider of leveraged ETFs in Canada, warns that a two-times leveraged ETF tracking an index that breaks even over a year, with 25 percent volatility, will lose 6.1 percent before fees. If the volatility of the index goes up to 50 percent, the leveraged ETF would lose 22.1 percent before fees