What Are The Advantages And Disadvantages Of Discounted Cash Flow Methods Such As Npv And Irr Free

Post on: 16 Март, 2015 No Comment

Search

Difference Advantage Disadvantage and Uses of Cash Flow Statement & Funds Flow Statement There are 3 basic financial statements that exist in the area of Financial Management. 1. Balance Sheet. 2. Income Statement. 3. Cash Flow Statement. The first two statements measure one aspect of performance.

1537 Words | 5 Pages

ANALYSIS FOR FINANCIAL MANAGEMENT 10TH Edition Robert C. Higgins Additional Problems Chapter 7 – Discounted Cash Flow Techniques page 247 A brief tutorial on Excel financial functions (problems to follow) You may find the following Excel, built-in financial functions helpful when.

discounted cash flow (DCF In finance, discounted cash flow (DCF) analysis is a method of valuing a project, company, or asset using the concepts of the time value of money. All future cash flows are estimated and discounted to give their present values (PVs) — the sum of all future cash flows . both incoming.

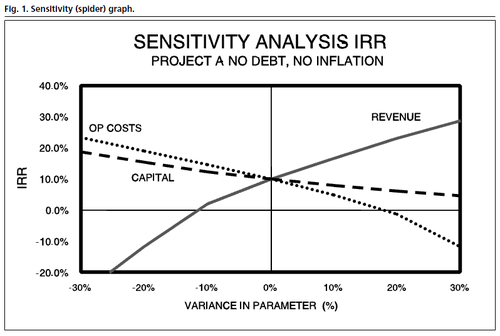

correlation between estimated future cash flows and the value of a firm exists (Copeland et al, 1994 ; Brealey and Myers. 2000; Jones, 1998 ). In their study of 51 highly leveraged transactions (HLTs). Kaplan and Ruback (1995) found that the valuations using the DCF methods are within 10%, on average, of.

actually reduce your cash balance- just paper expenses * Subtract Increase in WC b/c if a company needs more working capital to fund to run its business and to pay for items like A/R, then that drains cash flow . So if you need ore money to run the business, we have less cash overall * Subtract.

CHAPTER 4 DISCOUNTED CASH FLOW VALUATION Solutions to Questions and Problems 10. To find the future value with continuous compounding, we use the equation: FV = PVeRt a. b. c. d. FV = $1,000e.12(5) FV = $1,000e.10(3) FV = $1,000e.05(10) FV = $1,000e.07(8) = $1,822.12 = $1,349.86 = $1,648.72 = $1,750.

Asset Pricing Model (CAPM) Versus the Discounted Cash Flows Method Managerial Analysis/BUSN 602 Capital asset pricing model or CAPM is a financial model that measures the risk premium inherent in equity investments like common stocks while Discounted Cash Flow or DCF compares the cost of an investment.

APPLICATION OF DISCOUNTED CASH -FLOW BASED VALUATION METHODS Publication: Studia Universitatis Babes Bolyai – Oeconomica, LII, 2/2007 Author Name: Takács, András; Language: English Subject: Economy Issue: 2/2007 Page Range: 13-28 Summary: Valuation methods based on Discounted Cash -Flow (DCF) play a major.

MODELING THE DCF Modeling unlevered free cash flows Discounting to reflect stub year and mid-year adjustment Terminal value using growth in perpetuity approach Terminal value using exit multiple approach Calculating net debt Shares outstanding using the treasury stock method Modeling the weighted average cost.

What is a Negative Cash Flow . When a company spends more than it receives during a set period of time, typically a quarter, the company is said to have a negative cash flow . This is often viewed as an indicator of financial ill health by people who are assessing companies to determine whether or.

An empirical study of the discounted cash flow model Martin Edsinger1, Christian Stenberg2 June 2008 Master’s thesis in Accounting and Financial Management Stockholm School of Economics Abstract The purpose of this thesis is to compare the practical use of the DCF model with the theoretical recommendations.

collected to test their hypotheses, but the way and methods used differ from one sociological study to another. There are four general techniques, the case study, the experiment, the observational study and the survey. An experiment is a scientific method in which data are collected to be tested to prove.

had an ending share price of $104. Compute the percentage total return. The return of any asset is the increase in price, plus any dividends or cash flows . all divided by the initial price. The return of this stock is: R = [($104 – 92) + 1.45] / $92 R = 0.1462 or 14.62% Calculating Returns.

TUTORIAL 7 – Discounted Cash Flow Valuation I

In finance, the discounted cash flow (DCF) analysis is a method of valuing a project, company or asset using the concepts of time value of money (Wikipedia, 2004). Three inputs are required to use the DCF, also called dividend-yield-plus-growth-rate approach, include: the current stock price, the current.

Advantages of Cash flow * Cash flow is more “direct” as “profit” is highly dependent on accounting conventions and concepts/principles * Cash flow reporting satisfies the needs of all users better since cash flow is more direct with its messages. Some of the interested user parties are: *.

of cash flows . It is a standard method for using the time value of moneyto appraise long-term projects. Used for capital budgeting, and widely throughout economics, it measures the excess or shortfall of cash flows . in present value terms, once financing charges are met. The advantages of the NPV are.

When outsourcing done for the right reasons, it will actually help your company grow and save money. Here are the top advantages of outsourcing: • allows you to get the services of higher quality and/or cheaper; • improves the innovative opportunities of the company due to the interaction.

1. Disadvantage 1. It destroys your social life and interactions with humans if you do not maintain the balance. 2. It may effect to the destruction of your eye sight due to radiation. 3. It may cause pimples and wrinkles. 4. It may damage your studies and life. 5. Too much time in front.