What Are REITs How do REITs Work REITs and Taxe I invest in REITs

Post on: 2 Апрель, 2015 No Comment

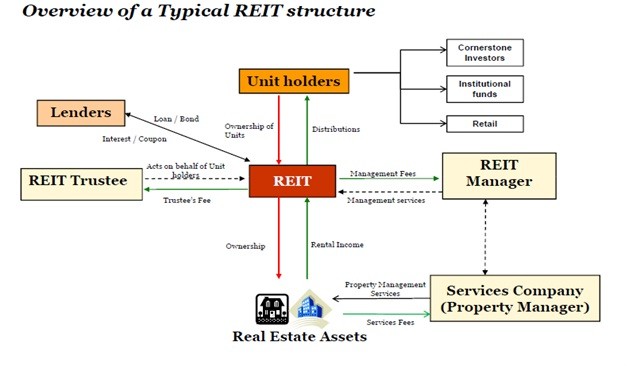

How do REITs Work?

REIT is an acronym for real estate investment trust. In a nutshell, a REIT is a corporation that is traded on the stock exchange and that is based on real estate investments. Some REITs may focus on one main genre of real estate, such as residential real estate, or retail real estate, while others are more diversified and may invest in all types of real estate. REITs enjoy special rules when it comes to paying tax. It is oftentimes a REIT that will provide the capital for large residential or commercial developments, ranging from apartment complexes to shopping centers.

Tax Status of REITs

In 1960, Congress created the current tax and legal framework for REITs in order to give smaller investors an opportunity to invest in large real estate deals. As long as a REIT pays out ninety percent or more of its taxable profit to REIT shareholders each year, it can avoid paying most federal or state tax. That tax burden is passed on to its shareholders. However, REITs cannot pass on any tax loss to its shareholders, even thought tax losses may cause the share price to decline.

Qualifying as a REIT

In order to qualify for REIT status, a corporation has to meet several stipulations. The REIT must be managed by a board of directors, and the REIT be made up of transferrable shares. At minimum, REITs must invest seventy-five percent of its assets in real estate. There are also specific rules that govern the concentration of REIT ownership, and the number of shareholders that the REIT is required to have.

Different Types of REITs

Most REITs invest in real estate equity, while others may also invest in mortgages. Among those equity REITS, some may be specialized in that they invest only in particular types of properties, or in certain areas of the country. For example, some REITS may invest only in apartment complexes, others may invest only in hospitals, or shopping malls, or hotels.

Why Invest in REITs?

For those who are looking to invest in real estate, there are several advantages to be reaped from REITs. For starters, REITs are traded like stocks, which means that the minimum cash outlay to get started investing is quite low. Because REITs have the same liquidity advantages of other types of stocks, investors can buy and sell shares in REITs whenever the market is open. Keep in mind, however, that REIT stocks are oftentimes independent from the stock market. After all, the stock market and real estate market do not always follow one another. For this reason, when the stock market is seeing a downturn, the real estate market might be experiencing growth. Further, since the variety of REITs is diverse, investors find it easy to adjust their portfolio allocations to their own specific goals. Moreover, due to staunch tax regulations that REITs must adhere to in order to maintain their status as a REIT, REITs tend to pay very profitable dividends. This makes REITs a smart choice for those who are looking to make an investment that provides them with an income stream.

Advice from the Pros on REITs

With the real estate market on uncertain terms, do financial planners still suggest investing in REITs? Yes! Since the price of real estate has never been lower, many financial planners suggest that there has never been a better time to buy. Buying now means getting more out of your investment in the long run, when the housing market corrects itself and the price of real estate, including commercial and residential properties, levels out.