What are inverse ETFs

Post on: 14 Апрель, 2015 No Comment

The exchange traded fund (ETF) has exploded into the investment consciousness as the investment of the curious. Investors who are leaning towards the decision to use this investment want to explore their own investment know-how. They have found numerous opportunities with ETFs to stretch their risk boundaries. While many funds look to match or beat the benchmarked indexes, the inverse ETF, as the name suggests, seeks to do otherwise.

What does an inverse ETF do?

To review: an ETF is different than a mutual fund. ETFs are created in such a way that the investors don’t actually own the shares of the companies in the fund. The ETF instead sells shares of the fund without actually creating any change in the fund.

When an investor buys shares in a mutual fund, the fund must use the money to purchase additional shares of the securities in which it invests and conversely, when a shareholder sells her/his shares, the fund must divest some of the holdings to pay the departing shareholder. Because of the way an ETF is created, this does not occur in an ETF.

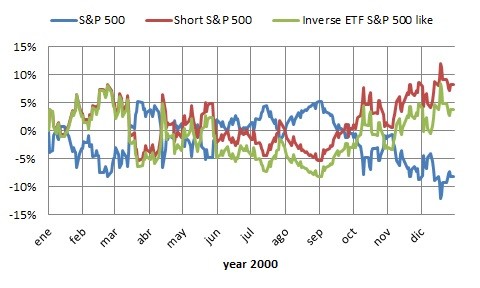

Is an inverse ETF similar to a shorted stock?

There are similarities in what this type of ETF attempts to do and a shorted stock. To short a stock, an investor bets against the security by borrowing stock at a certain price based on the belief that the stock’s price, for whatever reason, may be poised for a drop in price. The borrowed shares are sold and when the price falls, the investor buys the shares at the new lower price and pays back the borrowed stock while pocketing the difference in price.

How does an inverse ETF use derivatives or index swaps?

A swap of any kind is based on a contract. This contract has two sides and an institution, in this case a bank or financial institution, that holds the contract. These contracts are held with the assumption that when the stock price rises or falls, they can seek buyers who understand the risk. If the stocks fall in price, those institutions and the buyers of the swap on the other side of the contract will lose money. The inverse ETF uses this strategy essentially hoping to be on the right side of the swap.

When should an investor use an ETF?

Perhaps you believe that a market has had a good run and your traditional investments have profited because of it. Perhaps you believe that the market has had too good of a run and all your information points to a correction. Inverse ETFs can be used to place a bet on this downward movement creating what is known as a hedge. A hedge will protect what you have gained (and are about to lose a portion of the profits in a downward correction) by purchasing an investment that will profit against that movement. The goal is to stay fully invested with the worse case scenario as breaking more or less even. Some investors use these investments to simply bet on the movement with no intention of hedging current gains.