What Are Fixed Income Assets

Post on: 23 Май, 2015 No Comment

Asset

An asset is anything that an individual possesses that could be sold for a profit. Assets include physical property like houses and cars, as well as stamp collections, family heirlooms and furniture. More ephemeral financial property such as stocks, bonds, patent titles and any money owed to you are also considered assets. The opposite of an asset is a liability (credit card debt, mortgages, car loans and any other money you owe to someone else).

Bonds

Bonds are by far the most common type of fixed income asset. Bonds are a note of debt from a government entity or business. When you buy a bond, you pay a certain amount that the entity promises to pay back, along with annual or semi-annual interest. The U.S. Treasury issues bonds, which are possibly the safest investments on the market. State and local governments also issue bonds, which are tax-exempt, usually to raise money for infrastructure improvements. Businesses issue bonds as well as a way to raise money to grow the business; these bonds tend to be riskier than government bonds and thus offer higher interest rates.

Risk

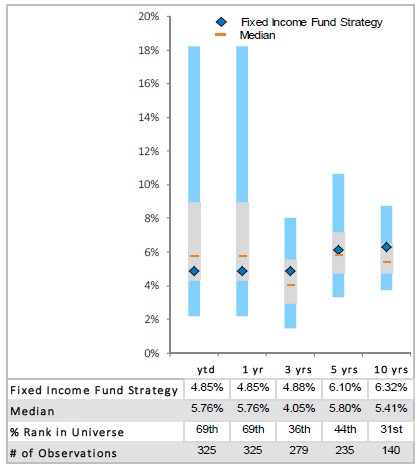

All investments involve a degree of risk. Generally, the higher the risk in a given investment, the higher the potential payoff. Investors manage risk by doing something called diversification, which means spreading money around into a lot of different businesses, industries and financial products. Investing in fixed-income assets is generally considered a low-risk investment (especially fixed-income asset funds), because you are practically guaranteed some money through regular payments and because bonds (excepting junk bonds, which are bonds offered by weak companies) are some of the safest financial products.

Other Securities

References

More Like This

What are the Four Bare Necessities of Life?

Effects of Fixed Assets on a Balance Sheet

You May Also Like

Fixed assets, also known as hard assets, include the long-term assets of a business that have a life expectancy of more than.

Certificates of deposit (CDs) are deposit investments in which the issuing institution pays a fixed rate of interest. The interest paid on.

While fixed- and variable-rate bonds have a dramatically different coupon structure, the underlying credit of the two financing forms are generally the.

For regular income, diversification and liquidity, fixed-income funds fit the bill. These mutual funds typically invest in mortgages, bonds or both. Primary.

Types of Fixed Income Securities. Investors seeking a safe stream of regular income can invest in fixed-income securities. These investments return a.

Conservative investors covet fixed-income products as a means to grow their savings above the rate of inflation. Fixed-income investments are generally associated.

Types of Fixed Income Products. Fixed-income products are investment vehicles based on fixed income investments. Fixed-income investments provide a fixed amount of.

Types of Fixed Income Investment. Fixed income investments are securities that pay investors a set rate of interest with a return of.

Exchange traded funds (ETFs) are investments companies organized similar to mutual funds, except ETF shares trade on the stock exchanges instead of.

A fixed income security is a financial obligation of an entity that promises to pay the security holder a fixed amount of.

Individual investors can relatively easy trade in bonds and mortgage-backed securities. U.S. Treasury bonds are the most popular and easily tradeable through.

List of Fixed-Income Securities. Fixed-income securities are a important part of any well-diversified portfolio. Many retirees invest heavily within this asset class.

In most areas of the country, inheritances aren't taxed. But as of this article's publication, eight states do impose inheritance taxes, so.