What Are AnalystBased Market Timing Signals Saying SPDR S&P 500 Trust ETF (NYSEARCA SPY)

Post on: 29 Март, 2015 No Comment

There are numerous ways that analysts and investors attempt to time the market. The goal of market timing is to spot a market-wide move early enough and to ride the subsequent trend. Market timing is anything but easy since when is the right time to change sentiment? If you are too early, you’ll be sitting on the wrong side of the trade too many times to make any profit. If you are too late, you’ll end up being a contrarian indicator that buys near tops and sells at the market bottom.

My Style of Market Timing

I work at a tactical investing site that encourages investors to run their portfolios like a hedge fund. As such, market timing is not only desirableit is vital. The market timing technique they use has two major components:

- Total forecast earnings trend

- Price action confirmation

How exactly does the analyst-based market timing system work and how reliable has it been over the past 11 years?

Other S&P 500 Timing Systems

The S&P 500 (NYSEARCA:SPY ) is considered a bellwether for the economy. A lot of research and strategies have been built around common moving averages overlaid S&P 500 index prices (50 and 200 day) in addition to valuation strategies (FED and P/E models).

My personal belief is that, while long-term moving averages do provide some market timing ability, they are often too slow to pick up on a new up or down trend. The moving average is arbitrary based on what ‘everyone is watching’. The shorter the length of moving average you use, the more responsive it will be but with more frequent false signals. You thus have to balance between speed of signal with reliability.

Valuation systems are also useful in showing investor sentiment. Low share prices compared with high corporate earnings could be a result of investors feeling pessimistic about the likelihood of sustainable earnings growth, or it may be from perceived risk in some other area. Valuation gives you a snapshot of investor moodiness, but it often struggles to show where you are in the overall ongoing trend.

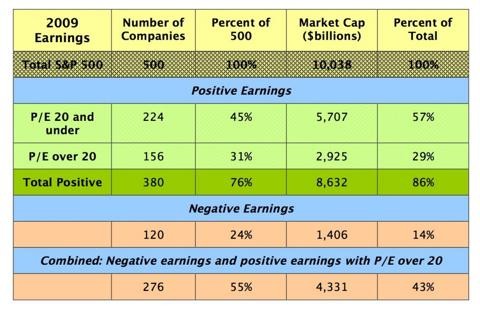

In addition to this, consider how valuation can be thrown a curve-ball during a nasty bear market. During the last crash, S&P 500 earnings fell so low that the earnings yield (inverse P/E ratio) fell well below average making the market look overvalued at the exact time investors needed to buy (see chart below). Valuation is a tricky game when both price and earnings are falling at the same time.

Chart compliments of Portfolio123 :

My Market Timing

The approach I use takes advantage of, not trailing earnings, but current-year forecast earnings of the S&P 500. Provided that the total forecast earnings (not valuation) trend is on the rise, the recommendation is to stay invested. Even though there will be profit-taking and minor pullbacks, the market should generally rise as total earnings are revised upward or riding on high momentum.

On the other hand, when forecast earnings are slashed — this causes investors to reassess the value of their company and prices often drop. Too many downgrades in future earnings and share prices could reach critical mass that turns into a meltdown. Again, when do you pull the trigger to bail or hedge?

I use a 3-week and a 15-week moving average on the S&P 500 forecast earnings for the current year. When the 3-week moving average falls below the 15 week — they look to the confirmation signal, which is the 100-day weighted moving average on the S&P 500 price chart. Having these two market timing factors combined greatly reduces the amount of false signals that just one would make. Also note that there is nothing overly special about the numbers chosen above — some choose to use 5 and 21-week moving averages and the more common 200-day moving average. There is no right or wrong, just how responsive you want your signal with the understanding that quicker signals come with periodic false alarms.

Chart below: 11-year performance of signals. Red line is equal-weighted holdings of S&P 500 including dividends with market timing and blue line is S&P 500 ETF without market timing, which also includes dividends.

Current Signal: Tipped to Bear

Over the weekend the above system tipped over the scale into bearish territory. Yesterday, the S&P 500 earnings were revised downward an additional 30 cents — which makes a stronger case for the timeliness of the signal.

While I am not implying that you trade solely on analyst forecasts or price moves in a commonly followed index, it is another signal worth considering in light of what is taking place in Spain and how the markets are reacting to this. When there is enough negative sentiment, momentum starts rolling down the hill. Once started, negativity is hard to stop.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Conduct in-depth research on SPY and 1,600+ other ETFs with SA’s ETF Hub