What an AllETF Portfolio Does for You

Post on: 21 Июль, 2015 No Comment

ETF 101 News:

With over $2 trillion in assets under management, the U.S. exchange traded fund industry shows no signs of slowing as investors increasingly turn to the ETF investment vehicle for their portfolio needs.

ETFs offer low costs, transparency and greater liquidity and tax advantages than mutaul funds, writes Jon Stein, founder and CEO of Betterment, for CNBC. [Why Investors Should Stick to Passive, Index-Based ETFs ]

Since the majority of U.S.-listed ETFs passively track a benchmark index, ETFs are typically cheaper to run, compared to most actively managed mutual funds that have to pay a portfolio manager and analysts to meticulously research and select stocks. There are 1,651 U.S.-listed ETFs on the market with an average 0.59% expense ratio, according to XTF data.

Due to the way ETFs are structured, the investment vehicle provides greater transparency. ETFs disclose holdings on a daily basis and generally maintain a stable list of components that rarely experience large changes. In contrast, many mutual funds have high turnover rates and holdings are only reported four times a year, which leaves many investors wondering what they are actually holding. Furthermore, since active funds are operated by a manager, the fund can experience a so-called style drift where the portfolio manager could begin to overweight areas away from their core investment strategy.

ETFs are also considered a tax-efficient investment tool, compared to mutual funds. Specifically, ETFs typically show lower capital gain distributions due to their passive nature and innate creation/redemption process. In contrast, if a mutual fund investor wants to redeem shares, the fund has to sell internal holdings to finance the redemption and any capital gains would be distributed pro rata to all investors. [ETFs: Tax Efficient and Cheap Investment Vehicles ]

Unlike mutual funds, ETFs do not sell holdings in exchange for cash, which would trigger a taxable event. Instead, the ETFs undergo a creation and redemption process in which market makers, authorized participants or large institutional investors swap a basket of securities from the underlying benchmark index for ETF shares, or vice versa. [ETF ‘In-Kind’ Redemptions Help Limit Capital Gains ]

Investors may also trade ETFs throughout the trading day, similar to any other stock on an exchange. Due to the intraday trading, ETF shareholders also benefit from greater liquidity, which help diminish implicit costs and add to more accurate pricing.

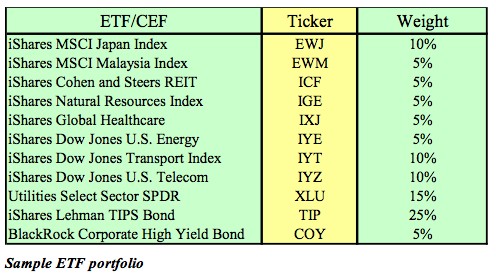

Even as ETFs are more cost-effective than mutual funds overall, investors should still evaluate each funds expense ratio, liquidity and the role it will play in a diversified portfolio, Stein said. There are other ways to invest successfully, of course, but relying on an all-ETF portfolio offers more potential to turn a small but consistent edge—reduced expenses—into a substantial increase in wealth over the long haul.

For more information on ETFs, visit our ETF 101 category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.